2023 unexpectedly starts with a Bullish tone

Weekly credit review 09.01-13.01

What my expectations were for the start of 2023 and what happened in reality couldn’t be further from each other. I was convinced that the higher terminal rate in Europe would wreak havoc in both the equity and bond markets. Turns out I couldn’t be more wrong. Luckily the trading gods were on my side and Romania and Hungary issued new paper which helped with making a profit in my widening g-spread trades. I closed them.

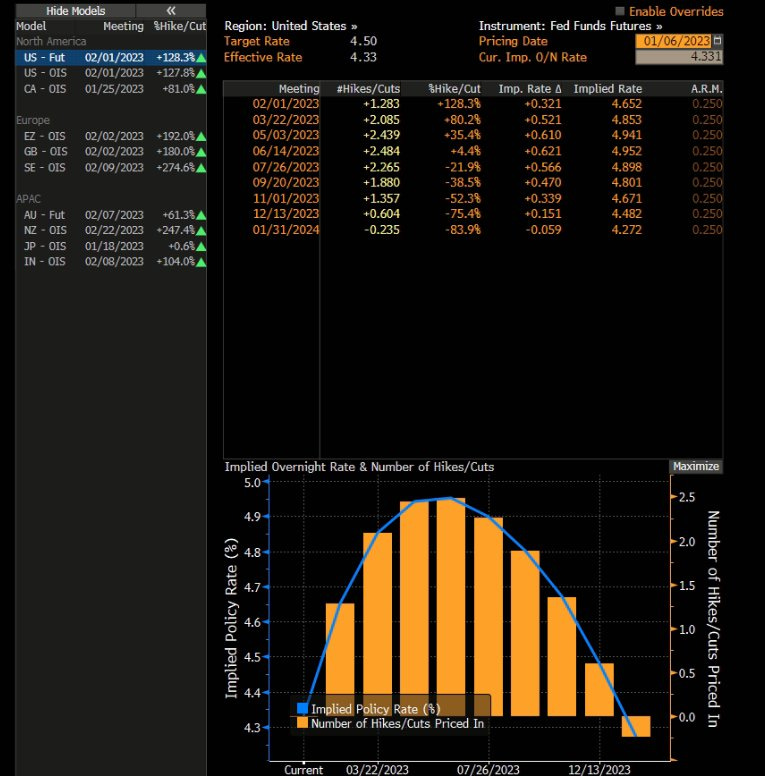

In the first week of Jan’23 we saw the terminal rate expectation in Europe drop to 3.30%ish , which may have fueled the rally in equities. In the States, the terminal still remains in the 4.75%-5% region but the higher for longer is losing momentum, at least in the last week.

As of right now I am mostly sitting on the sidelines as most of my credit exposure is taken down to a minimum after the 1st week. I have no clue as to the next direction and am looking through as many charts as I could to get a hint as to what may come. As of right now, there is evidence saying that we may have seen the worse in yields for this hiking cycle. That doesn’t make me a buyer right now unless I find something very undervalued that is hedgeable.

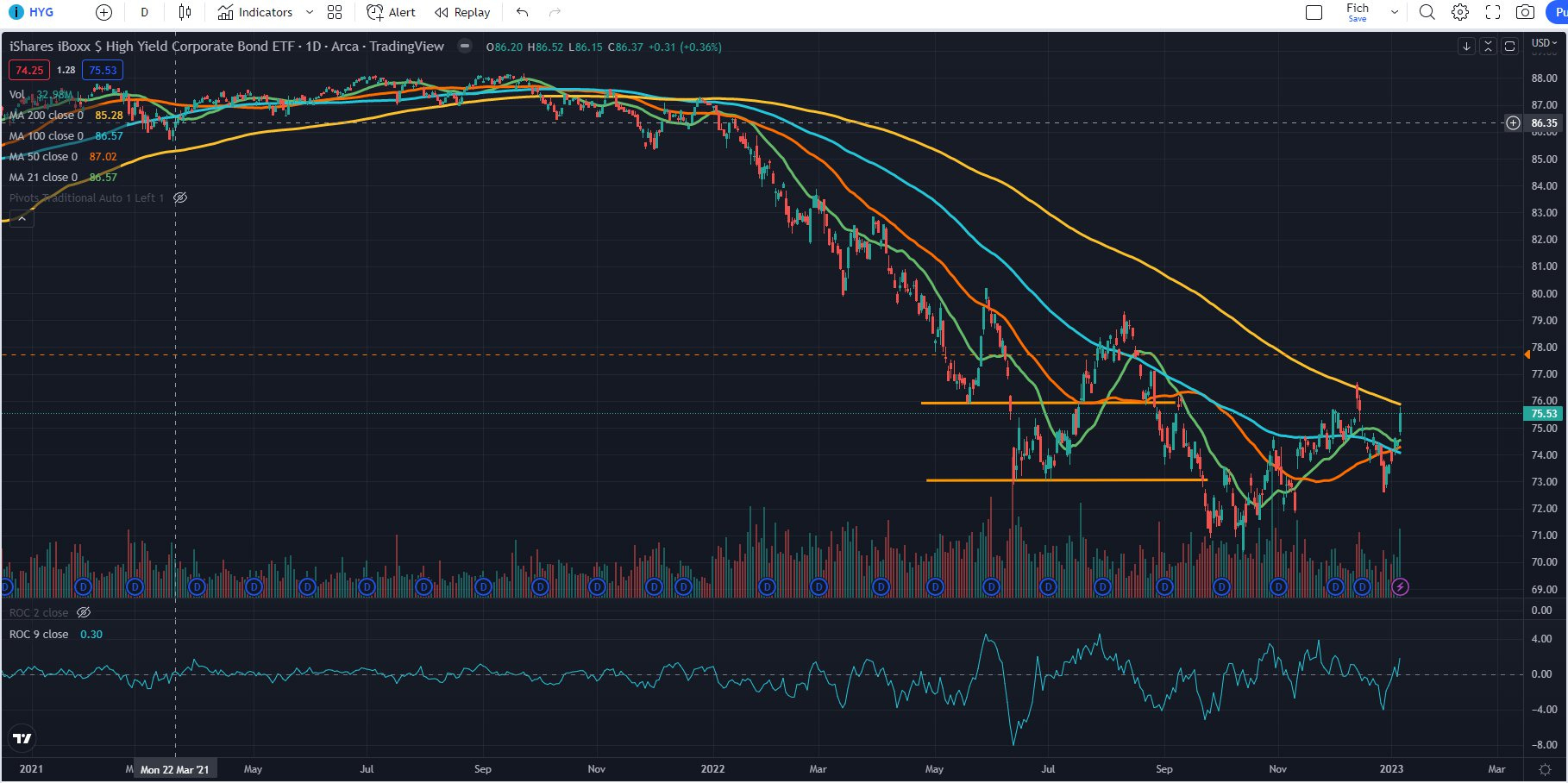

My eyes are now on potential pair trades with very extended charts caused by the exuberance in ETFs like PFF and HYG. I am already seeing some great divergences in some perpetual preferreds vs VRP and PFF.

Let us start with some of the important charts:

iTraxx XO says credit spreads should be tightening, fear is getting out of the system. As to the reasoning, I have no clue except for the very bare minimum of “the equity markets are showing strength” and the drop in expected terminal rate in helping. We are now trying to break below the Mar’22/Apr’22 highs and if we do so it will look like nothing happened in 2022. Weird, isn’t it?

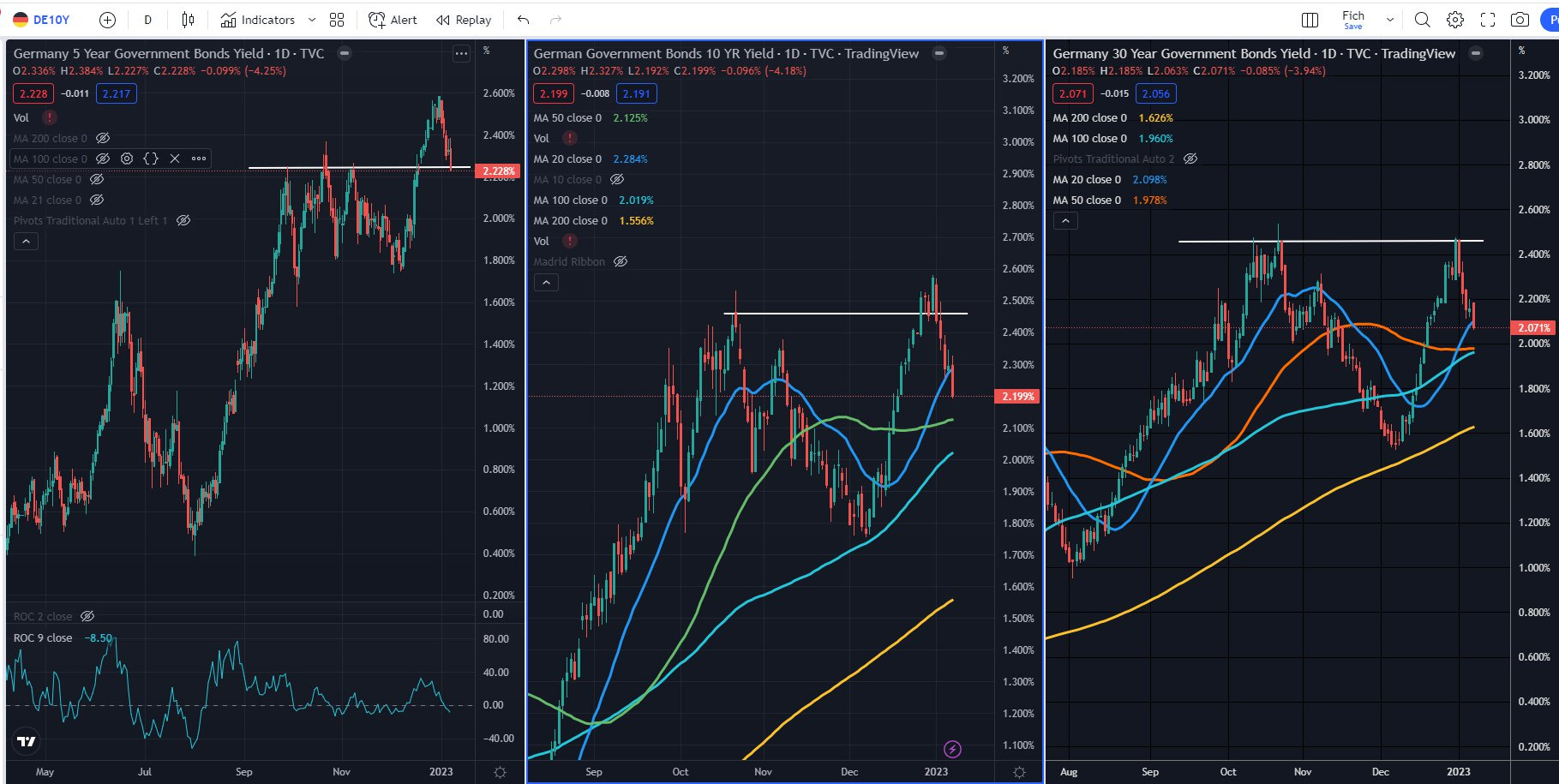

European Yields

The German 5Y , 10Y did break to new highs while the 30Y tested the highs and failed. Now the big question is whether they make a higher low and try again for the highs or this was the high in European yields? The question I wish I had an answer to. It is likely we’ve seen the hikes for this hiking cycle, especially if recession is on the horizon.

I am sure anyone trying to issue new paper is happy with how the year started. We are in a favorable environment for new issuance and that was proven by the large influx of new primary deals last week.

Another chart showing the relative calmness of the markets is the German 2 Y yield - Italian 2 Y yield spread. It is currently at -0.5%.

What can change my mind?

If German yields make a higher low and keep pushing higher. This will be the time to re-engage in short positions. As of right now I don’t want to fight the price action. Prefer to stay clueless and look for signs rather than pretend to be smart.

HOWS THE USA LOOKING:

CDX High Yield CDS index looking similar to iTraxx XO. With a calm market we will certainly go for the 400 level.

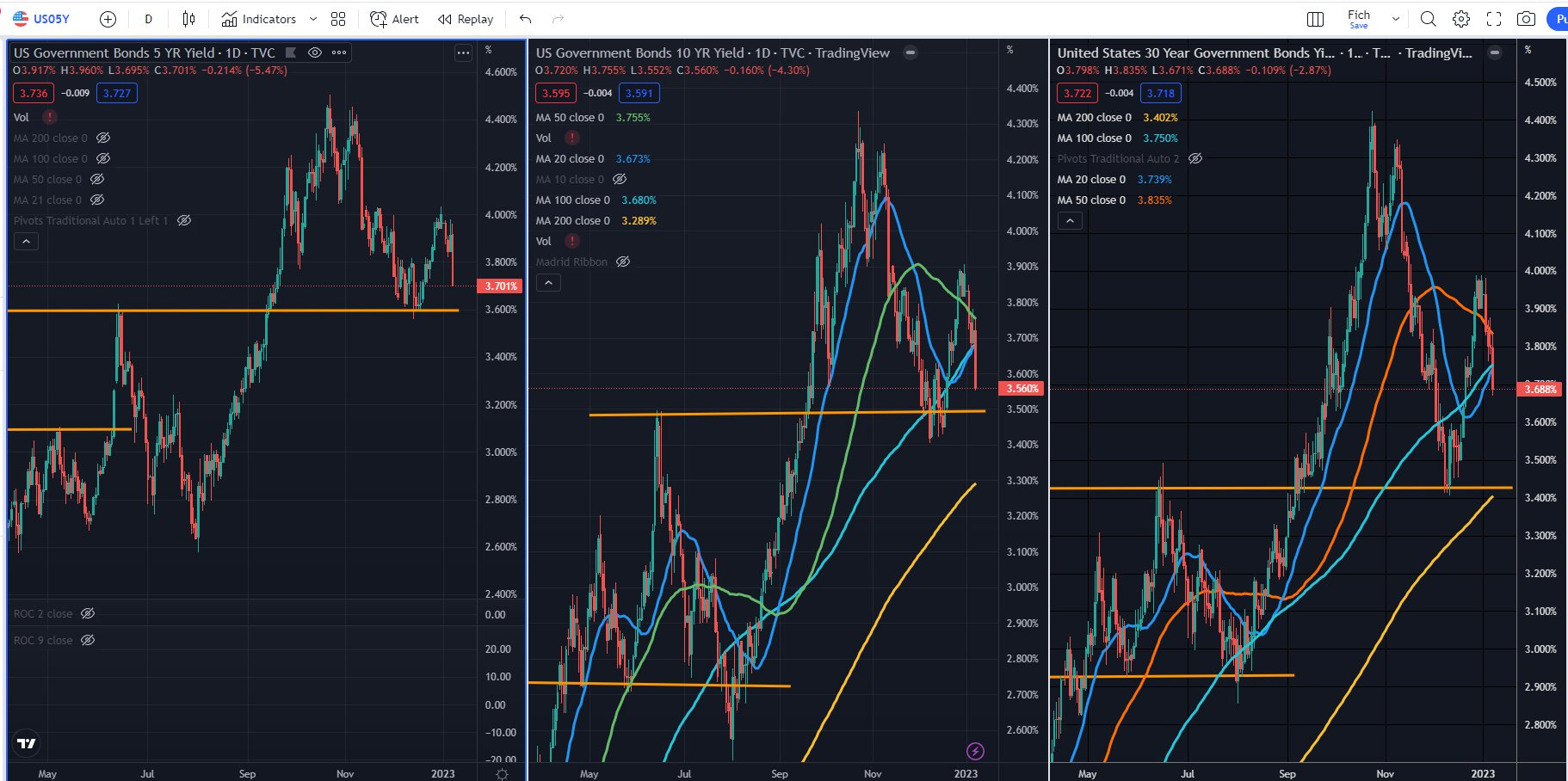

US Yields are again trying for the big support at the Aug’22 level. If we test that level again the chance of breaking it to the downside increase significantly.

Some of the important ETFs:

PFF - We are currently testing the $32 level which proved important in Dec’22. There is certainly a lot more room to grow, should the market keep rallying. I would certainly not initiate a long in PFF at this level but rather look for undervalued preferred stocks and if necessary hedge them with PFF, essentially trading the spread between the two.

LQD - Has not yet tested the 200d but likely it will do so in the next few days. From there it will be a wait and see.

HYG - Right at the 200d SMA. It will likely hoover around this levels before taking the decision which way to swing. I am clueless as to where it may go.

POTENTIAL TRADES:

MTB 5.125% vs VRP (cheaper vs FPE as borrow is lower)

This is a classic case of the discrepancies between OTC products and exchange traded products. Obviously exchange traded products are significantly more quicker to price in new information whereas OTC products need some time. This is where the opportunity lies.

As I am already in this trade and losing money, I will be adding to it next week without shorting the hedge. I will keep the optionality to do so should the market tell me it wants to head south again. Until then it will be long only.

CURRENT TRADES:

GP 7.25 28s vs IBIGG23 (LQD futs) - I am looking to hold this one as I have a decenet positive carry on this position and I am earning money every day just for holding it.

CONCLUSION:

Looking at the charts and thinking about where we are in the hiking cycle I suspect that we might have seen the highs in yields, both in Europe and in the States for this hiking cycle. This of course doesn’t mean the equity markets or cash bonds don’t drop any further. This could easily happen in a severe recession scenario leading to wider credit spreads. It means that government bonds would likely not test the highs for the time being. In 2023 we will continue trading from one economic data release to another until inflation is no longer a narrative. When that happens I don’t know but surely it will eventually happen. Until then, we will all be inflation and unemployment specialists :)