Starting last week, we decided to combine the Equity and Credit market reviews in one piece.

We have done so in order to decrease the amount of e-mails you receive from us as we understand how spammy the world of Substack has gotten. Plus, we hope those of you who have been strictly focused on reading one of the reviews to accidentally find value in the other as well.

We are constantly trying to improve the way we write and lay out our thoughts in markets. Hope you like it and don’t hesitate to tell us what you think.

WEEKLY CREDIT REVIEW

I am beginning to think that the fixed income markets are trying to tell us that volatility is about to drop. It makes an impression how weak retail numbers or the continuous cries from central bank members that rates will be higher for longer are not taken seriously by market participants anymore. If you don’t believe me, look at the DAX, iTraxx XO or CDX HY charts.

Leaving emotions aside and looking at what the charts are telling us will give us a better indication of what to expect. Unfortunately, what I see is more of a nothing burger rather than action. So the big question that lies ahead of us is:

ARE WE ABOUT TO SWITCH TO CARRY TRADING FROM CAPITAL APPRECIATION TRADING?

This was first suggested by @em_credit_fund on Twitter and the idea stuck with me. He has a point.

The move index is down, terminal rate and FFR expectations have not changed since end of Nov’22 and credit spreads and CDS indices are tightening rapidly. There isn’t really anything telling me right now that we are in for a rough ride. Only argument might be that we went too far, too quick but that cannot lead to anything more than a technical pullback or a consolidation at current levels. What we’ve seen last week was consolidation at the highs. I am beginning to lean on the buy the dip in credit. Shorting may no longer be the name of the game. Of course in a more general sense. In reality there is always an overvalued corporate or sovereign bond here and there. My view is that we won’t see a repeat of 2022 this year. Volatility will certainly be significantly lower than what we got used to.

This brings my second point for the week:

HOW DO WE FIGURE OUT IF THE NARRATIVE HAD CHANGED?

In my world of proprietary trading, this is not achieved by some sophisticated analysis with macro charts. We do it the old fashioned way. If we are short, and bad news are not affecting my short positions in a profitable way, while a good up day in the markets ends up in a oversized loss in my portfolio, I have a clue that sentiment is now different. Price action is telling me that bad news is no longer viewed as bad news. It is either irrelevant or priced in.

Now, I want to emphasize that I am not suggesting we see a monster rally or that the market will NOT have big down days. The world of trading is not black and white. What I am positioning for is less volatility compared to 2023, buying the dips in credit and focusing more on picking longs, rather than focusing on a repeat of 2022. It will be more of a individual credit instruments’ market.

I will show you what I mean in the charts review:

MOVE INDEX:

Right at the Nov’22 lows and very close to the Aug’22 lows prior to Powell’s Jackson Hole speech. We may certainly move higher but the odds of breaking the highs are slim in my opinion. The worst of this hiking cycle is behind us. Even if we get a higher inflation print here and there, I don’t believe the FED will change course and keep hiking forever.

CDX HIGH YIELD INDEX:

I can’t help it but notice the lack of direction and general reluctance to move higher. With the current publicly available information, I don’t see a retest of the highs in this index at least in the first 2 quarters. At a later stage, if inflation picks up due to higher commodity prices, then we may move higher, but that is yet to be seen and largely unpredictable variable.

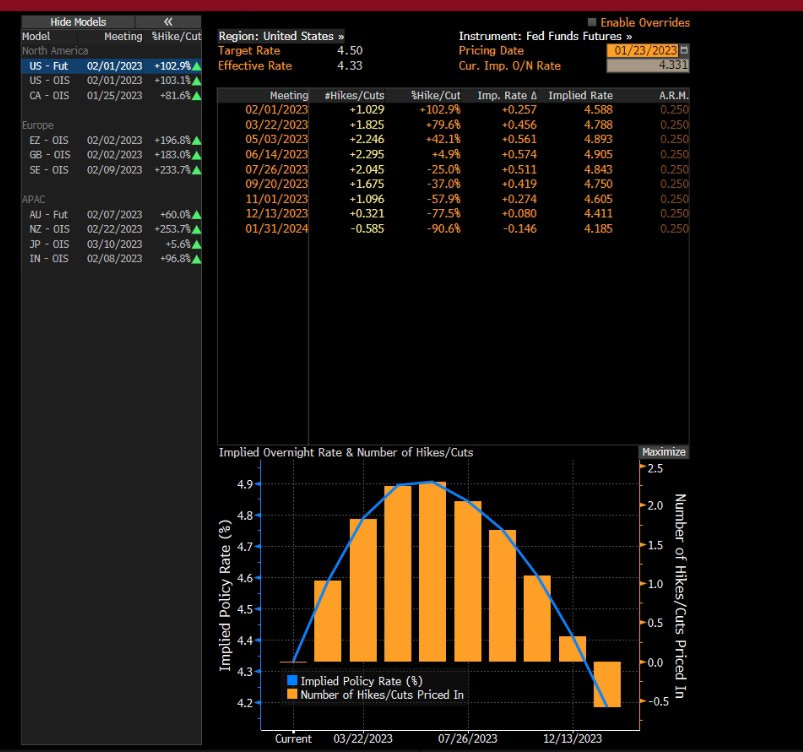

TERMINAL RATE:

In the US, the terminal rate, as priced by the FFR futures are still pointing to a range between 4.75% and 5%. Nothing changed there.

HIGHER FOR LONGER?

Using the same metrics (FFR futures), we are seeing that higher for longer is losing ground, mostly thanks to weaker economic data. Dec’23 is currently priced at around 4.50%ish , while Jan’24 is priced at 4.25%. Again, full 75bps cut same time next year. I wonder if data keeps deteriorating, would we see lower rates? With so many people banging for higher for longer, this seems like the counter trend trade.

An important take away from this data is the fact that 2 months we have not move away from this 25bps range in FFR expectations in the year end, regardless of the data coming out. My theory hasn’t changed, the worst is priced in, we need new information to get out of this range.

PFF - Looks like we are in for a slow grind higher or consolidation here. Again there is no reason for outsized move to the downside at the current moment. I would prefer to be short but without a catalyst, this trade feels like a death by thousand cuts.

CURRENT TRADES:

ATH-E vs PGX - currently not performing as intended but holding onto it. I think the exchange traded preferred needs more time to adjust. Loss is still at very acceptable levels.

POTENTIAL TRADES:

My portfolio is giving me the signs that I am not positioned correctly and should re-evaluate. I will hold on to the current credit trades, which are not many and avoid getting into new ones.

To consider new trades I would prefer to see 2 things:

A technical pullback in credit ETFs and instruments. The goal is to get better risk-adjusted entries. Right now I feel like I am buying at the top

If we credit instruments consolidate at current levels but g-bonds continue their march higher. That would mean the consolidation’s levels will be my reference point for a new trade. Not what I want but have to be happy with whatever the market gives us.

In terms of short-positions, I would still point to PFF and PGX as over-extended ETFs due for a technical pull back and if a short-opportunity arises, I will go for them, alongside with a short-position in HYG. Note, that I am talking about the ETFs, not credit instruments. That is because I want to be quickly in and out , with minimal slippage and exceptional liquidity.

CONCLUSION:

I have always found the toughest period for trading to be the switch in market dynamics. I am still wearing the bearish glasses from 2022 but price action and my PnL are telling me that I should take them off. My sense is we move to a range bound market with one data release swinging us to the high of the range, another data to the low of the range. At these moments it will look like we are about to break from the ranges but that will be the time to fade it. Anyone wearing the 2022 bearish glasses will be chopped to thousand pieces, usually shorting at the bottom of the range.

If you are really convinced the market will drop you need to watch for the potential for higher rates and actually FFR futures confirming that OR look out for deep recession fears. Right now we have neither, hence my logic that we will be in a range-bound market.

Most news you read out there is too generic, written by someone who has never invested or managed money or is just plain bad. GRIT Capital was founded by former $100MM portfolio manager Genevieve Roch-Decter who is on a mission to democratize access to stock market insights to the masses! Subscribe for free!

WEEKLY EQUITY REVIEW

General market overview: You remember that I told you last week about the end of beginning of year inflows and how the market was supposed to downtick as some profit taking will too take some place? Well, that happened. Did I make a buck on the move? No, I did not. Although a solid 2+% at some point in the SPX, my picks were structured as OTM put spreads and they needed a day or two more than that. Unfortunately, Friday killed all hopes. But every painful story has a moral.

The good part of it is that it certified we are in an extremely choppy place and waiting for the market to show a direction (or clearly overshoot long or short) is the right thing to do. Equities have been in extreme choppiness with almost nothing besides a couple of sectors and individual equities making a decent move since November.

This meat grinder has cost traders dearly and I have had my fair share too. We finished the week just where we started it - at the sma200d and the trend line everyone tells you about. I realize the pain trade higher and probably this is where we are going following Friday’s price action. However, I am not willing to participate for this part of the move as I see it as bad risk-to-reward proposition. Where are we heading to? A hundred points above is 4100 which appears to be a solid resistance. And as far as catalysts I am not really sure what would take us there, given my stance that the FED will keep its word and not cut. It just makes sense not to cut when everything is doing fine so far (by everything I mean both credit and equity markets).

The week has not provided us with much in terms of US rates moves. No need to overanalyze here but I do like where the long end is sitting. 20Y rates are at a key level and jumped off sma200d on Friday. If the stock market is getting those soft landing vibes (which given how narratives change could quickly be growth back to normal) and the FED is not cutting, I see no reason for rates to fall indefinitely. I have no idea where demand will eventually get them to, but my general expectation is that either equities fall with falling rates as safe haven gets bid or rates raise and…put a lid on equities. You see that both of those have limited upside for equities and this is why I believe the better risk-to-reward would eventually be to be short.

Sector overview and potential trades: Last week the stand outs in terms of weakness were the defensive sectors. I was surprised to see individual equities such as KHC and CAG fall 4-6% on no news.

As noted, valuations for consumer staples are too high, but the market apparently started realizing this last week. The switch from defensives to other sectors has been noted in utilities (XLU) and healthcare too (XLV). All the three sectors have poorly looking charts as of the moment.

Another thing I noted is that the industrials are sitting at near 2m lows. They were one of the strongest sectors coming off the bottom and while this might be the pause they were due for, I think it is worth keeping an eye on. Constituents such as DE & CAT have seen some profit taking while the NOC, LMT, RTX crowd has suffered from spending cuts talk. Overall an underperforming start of the year.

In other news, dollar has been impressing everyone with how weak it has traded. I do like to think that everyone has given up on the dollar, but I do not see why a dead cat bounce would not happen. I like that all the major pairs JPYUSD, EURUSD, GBPUSD are at nice resistance levels (some less than others) all the while DXY is at good support.

After Lagarde’s talk last week, which sent the DAX lower, I noted that the EURUSD failed to make a new high and thought that the right time has come. Fortunately, had not entered as I see today the EURUSD is higher. But this is on my watchlist.

In a similar note, if the rates happen to continue Friday’s price action and the dollar seems to get a bid, I believe some short term pullback in gold makes sense. The range 1925 - 1950 seems like a tough nut to crack when entered in already overbought condition.

Current positions: I have 1/3 of my Z short left, which I am in the process of unwinding.

Yes, the shorts did not work despite that at some moment I got the technical pullback I was looking for. Even though they were with short expirations, the delta and gamma had not provided enough profit for the trades to be worth to take profit and Friday killed all hopes, so I started taking them off.

Conclusion: We have entered a new low volatility regime with tighter ranges and greater choppiness. The market has not got anywhere during the last 2 months and that has disappointed many of us. It is the right time to take fewer directional trades, wait for very big extensions and aim for highest delta as the market gets two days in a direction, pauses, and then reverses more often than usual. Note that, higher delta means also higher risk to get stopped out. 2023 is already saying traders need to adjust.

Most news you read out there is too generic, written by someone who has never invested or managed money or is just plain bad. GRIT Capital was founded by former $100MM portfolio manager Genevieve Roch-Decter who is on a mission to democratize access to stock market insights to the masses! Subscribe for free!

Nice detailed post. I don’t know much about the credit market so appreciate your insights there. On the equity side, kinda unbelievable that VIX is as low as it is already. Wonder if folks look back to how quick the last major pullback recovered in 2020 and didn’t want to bid up vol even as equity markets quickly recovered in the second half.

great, thank you!