Bears waking up from hibernation

Equity and credit markets reviews 2/27/2023 - 3/03/2023

We have decided to combine the Equity and Credit market reviews in one piece.

We have done so in order to decrease the amount of e-mails you receive from us as we understand how spammy the world of Substack has gotten. Plus, we hope those of you who have been strictly focused on reading one of the reviews to accidentally find value in the other as well.

We are constantly trying to improve the way we write and lay out our thoughts in markets. Hope you like it and don’t hesitate to tell us what you think.

CREDIT MARKET REVIEW

We are finally seeing the market waking up to the rise in inflation expectations and the subsequent jump in terminal rate expectations. There is certainly more waking up to do but as we already know, nothing goes up or down in a straight line. SPX is trading from one technical level to another which makes me feel like we are experiencing a simple technical pullback so far. To top things off, each level is used as a reason to bounce from. My point of view is reinforced by the evident underperformance in the VIX futures. If there was any fear the VIX would have sky rocketed. However that is not happening.

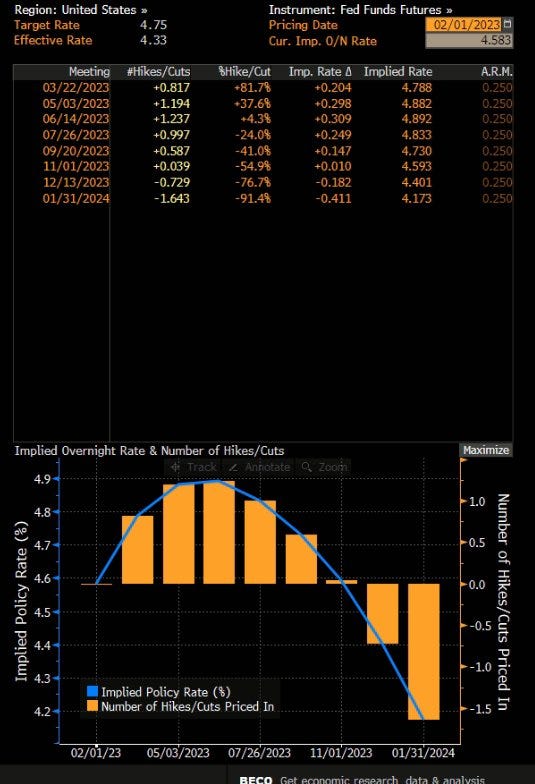

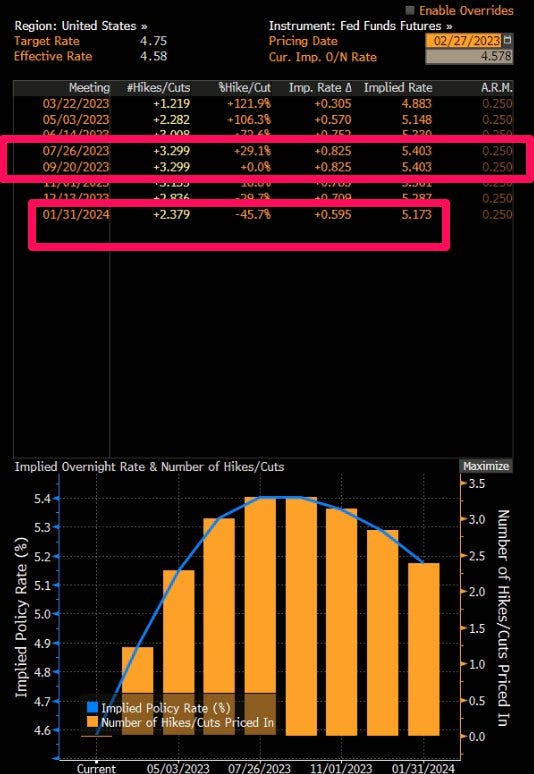

At the same time the terminal rate expectations went up again, now pricing 5.25%-5.5% range in FFR. This is coupled with rates being priced higher for longer. Jan’24 FFR expectations are now sitting in the 5%-5.25% range or just 1 cut, a cut coming now from the 5.50% region. Let me remind you that at the beginning of February’23, the expectations were for a maximum terminal rate of 4.75%-5% and Jan’24 rates to be at 4%-4.25%. Not only were the expectations for terminal rates 50 to 75bps lower, but the Jan’24 expectations were for 3 rate cuts and finding a floor at the 4.25% region. A whopping 100bps difference in less than a month. And what does the equity market tells us? The message is straight forward and simple -“I DON’T CARE"

So by now it is getting more and more clear. The market is not so concerned about the higher rates at the moment, at least not yet. That puts all bears into a vulnerable position. What if the next data point that comes along suggests lower inflation. What would such data do to the equity and bond markets if negative data couldn’t bring it down further to test the lows? My bet is we get another squeeze higher. And this is coming from a person that has his whole portfolio tilted to the short side. I am not even talking my book here. This, of course, is a short-term view and what seems more likely to be the next move. I certainly believe that eventually the equity and bond markets will wake up to the reality of higher rates (If they remain that high) with economic data finally reacting to the higher rates. Until then I try to protect my short-tilted portfolio.

What are the ETFs telling us:

PFF:

Very strong on a relative basis, still outperforming significantly LQD (Investment grade bonds) and HYG (High yield bonds). I keep wondering why this may be the case as the outperformance remains very stubborn. Should something does not make sense for a longer period of time, I start asking myself questions. There is likely something that I am missing. It turns out I was. You see, one of the benefits of trading on a trading floor is that you have access to many very clever and talented traders to talk trading with. Recently, one of our traders chatted me up about my frustration with PFF’s outperformance and asked me a simple question- “Hey, did you noticed PFF’s dividend payments are going up and the effective yield is now up, compared to ‘22”. It turns out I had neglected this ‘minor’ detail. Should the dividend remain at current levels, there will be no reason for PFF to drop, unless the rest of the credit markets drop. Therefore the outperformance is there for a reason. If we assume the new dividend to be in the $0.17c region , we would see a current yield of ($0.17*12)/32.56 = ~6.26%. Comparing that to LQD’s assumed dividend of $0.34c and a current yield of ($0.34*12)/105.85 = 3.7%, the yield differentiation is approximately 2.55% or 255bps. From personal experience, I’ve noticed that preferreds trade at roughly 180 to 270 bps spread to IG bonds composite, which means we are pretty much aligned.

One thing I should note. There is a turnover in constituents in each of the ETFs. There is also reinvestment of free cash. Both of these activities assume that new/free capital will be used to buy new issues or existing issues at higher YTC/YTM and higher CY. This means that LQD’s monthly dividend payment will go up as well as PFF’s. I assume this process takes longer in LQD due to the much wider universe of constituents. LQD has +2583 holdings whereas PFF has 491.

Additional note - In the above current yield calculations of PFF and LQD, I had used the last 4 months of dividend payments of both ETFs and assumed they will remain in this range until the end of ‘23. I have also excluded the ETF’s expense fees. This is the reason you will see different numbers if you go to their official websites.

LQD - https://www.ishares.com/us/products/239566/ishares-iboxx-investment-grade-corporate-bond-etf

PFF - https://www.ishares.com/us/products/239826/ishares-us-preferred-stock-etf

LQD - From the simple technical point of view, we are re-testing the Dec’22 lows , coupled with the 100D SMA. This without context doesn’t mean much so we need to plug in what rates are doing. As LQD has a 8.43 years effective duration, I will focus on the 10 year yields. I would reckon we are re-testing the 4% level, however it is very tough to figure out if this will serve as a level of interest due to the messy nature along the curve. The short-end made new highs. 5 year and 10 year are on their ways but not there yet and the long-end is in a world of its own. One can use the 4% level as a starting point but to me personally it does not mean anything currently. Therefore the current technical level of the double bottom and 100d SMA tag is meaningless. Not good enough for me to put money at risk = I stay on the sidelines.

EMB - I feel the same way as with LQD. Nothing in particular to tell me which way we likely go. Just an observer so far.

MUB - As discussed last week, my expectation is to trade between to 200d and 100d SMAs, based purely on technical trading. Credit spreads expansion in the short-end muni bonds had stalled. If you have a reason to believe that rates will pullback from current levels, there is a case for muni credit spreads to tighten and use the current technical level as a launchpad for a short-term long position (1-2 weeks). I am an observer of this level but would trade it only if I see credit spread tightening. This will be my trigger.

POTENTIAL TRADES:

This week I have no trade ideas that are good enough to be added to the portfolio.

CURRENT TRADES:

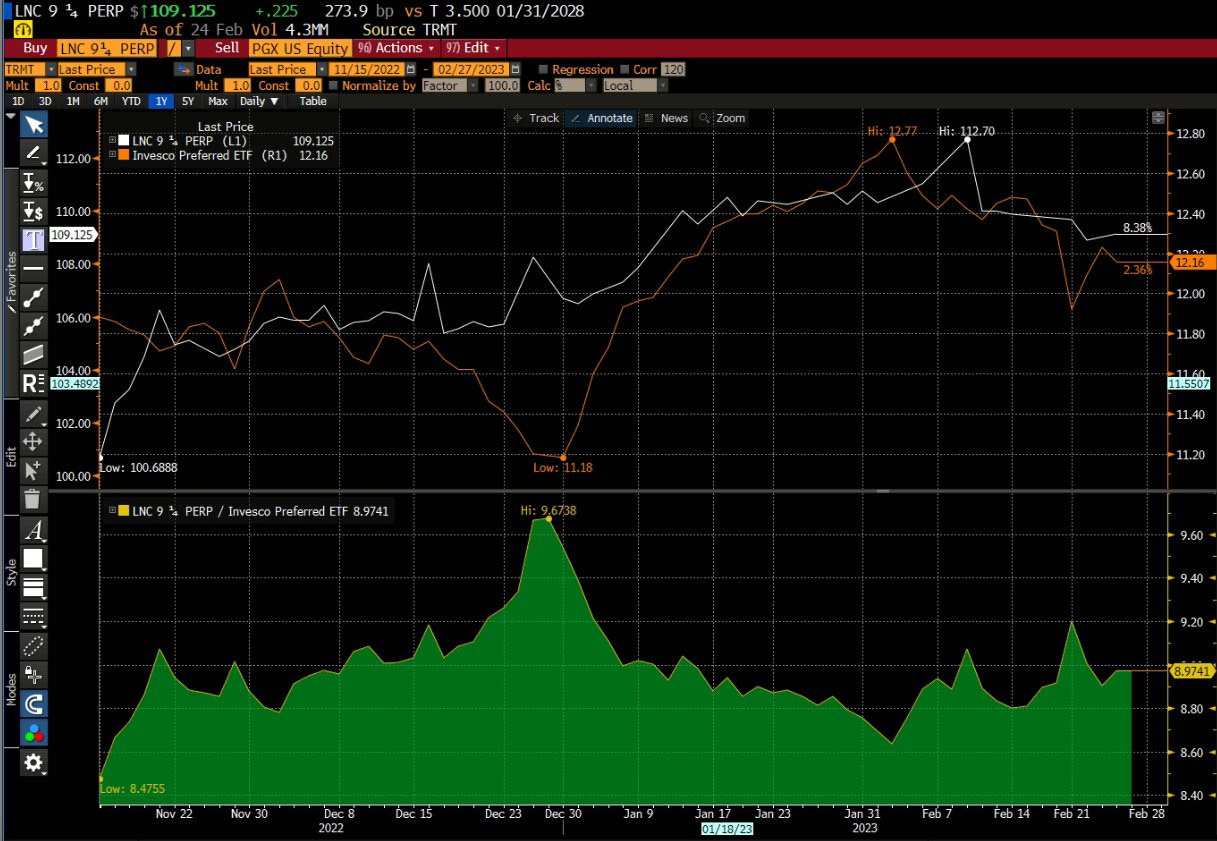

LNC 9.25 perp vs PGX - The trade had been performing well given the purpose of carry collection. We collect the 9.25% while paying significantly less for the short in PGX. So far I am happy with the trade and will keep it that way. We are slightly in the money on a capital appreciation basis coming from the pair construction.

As usual, if you are interested in looking at the performance of the full portfolio and finding out in real time the additions/deletions of the portfolio, you will find value in subscribing to our private Substack/Twitter. Starting from the 1st of March’23, the price jumps from €29.99 to €59.99 per month.

CONCLUSION:

I hate to say it but so far all I see is credit markets not being bothered by the jump in rates, jump in terminal and jump in higher for longer expectations. There is a lot of bearishness and rightfully so. I am also leaning bearish given what the bond markets are pricing. In addition the MOVE index began its ascend. This leaves me a bit puzzled as charts are screaming at me to short anything I can get my hands on while at the same time price action tells me to hold on. As I value price action more, I would stick to it and use this week to offload some of my short exposure and wait for clearer signals. You know the good old saying: “nothing like price to change sentiment”

FRIENDS OF HOTF

It is incredible difficult for those who are just starting to filter through the noise in fintwit. Thus, we have decided to include in this section people we follow closely as we believe they are from the few that know what they are doing.

Before moving onto the next part I want to give fx:macro’s newsletter a shout out. He is the very best in summarizing central bank’s activities and the most important macro events in the coming week. There is so much going on in the central banking world at any given moment that getting up to date without his publication will be impossible. Highly recommended.

EQUITY MARKET REVIEW

General overview: At some point last week we had VIX at 22.5. Sounds funny how this is somewhat of a happening, but can’t say it did not get me a bit excited. After all, no volatility / steady grind upwards is traders’ kryptonite and we are no different. Anyway, to a lot of us behind the screens, buying at 4200 a couple of weeks ago looked ridiculous. Now, after what I see as a healthy pullback of 4-5% from those recent highs, buying looks much more tempting.

On one hand, technicals look much better. SPX is now at the 50% retracement of the low-high range since the beginning of the year. Luckily, this coincides with it being right on the sma200 on the daily timeframe and good support in the 3900 - 3950 range. What is more, the sma100d is not far to the downside either so it could play last defense and a neat trandline from the lows is pretty much kissing the current price from below too.

On the other hand, we had rates ripping higher again all over the curve. The trend has no sign of backing down and it kind of feels like this:

US20Y is playing with resistance at 4.15 which could be read both ways. It could be a good spot to fade (not directly though) some of the recent move up. A retrace here should be fuel for some risk-on narrative just when SPX is at a good spot to be picked up.

However, I would not bet that the level would hold for long, meaning anything other than a quick scalp would be hard. I find it positive that on Friday, when PCE surprised everyone, the level managed to hold all the while equities and gold sold off while the dollar accelerated to the upside and the Eurodollar futures continued to get pounded.

Another thing is also worth noting. In Europe, where investors seem to think that trees can grow to the skies, there was a nasty German GDP surprise which finally got the EWG punched hard. The Europe as a hideout place theme is long due for a pullback and I can’t say it would be bullish for US equities if it comes from a global economy scare point of view.

Sector overview and potential ideas - Similar to the SPX last week, almost all sectors ticked down and are now at levels that do not look bad on the long side.

Out of all sectors that had gained nicely since the beginning of the year, to me it seems that it is financials (XLF) that stand out in terms of defending their performance. Just pointing out the ETF is now at a neat spot on the daily and the ever increasing yield curve inversion does not seem to hurt them as nearly as expected.

On a different note, it is hard to miss how much some of the mega caps are beaten down. My gut tells me that GOOG, MSFT and AMZN might be some of the worst performing tech stocks on a volatility adjusted basis since the beginning of the year. AAPL has pulled back meaningfully too and is sitting on the sma200d. At the other spectrum are TSLA and NVDA, which are probably the most overvalued stocks right now but even they do not make me discard the idea of picking up megas on the long side and placing a hedge. I stumbled upon the nice level on which the MGK vs QQQ is and the difference within the holdings does look appealing (less NVDA and TSLA in MGK). I am discussing this idea in a write-up on pair trading with ETFs that will come out later this week. One thing that I do not like about it is that there is a downward drift of the ratio which I cannot explain too well and this makes me look for alternative ways of putting on the trade.

Lastly, I think fading the dollar when DXY reaches 105.5-105.7 makes sense. I am hoping that the acceleration from Friday continues this week as I would be more comfortable shorting into what would be an extended move to the upside. I also like the fact that rates, Eurodollar futures and SPX have all contributed to some cooling off of the FOMO that there seemed to be. Placing a short in this area would nicely be backed by the sma100d and would also give me a clear stop above the sma200d.

Current positions - I am long USMV and short SPY (1/3 risk). I am also short TSLA (full risk)

I have taken profits twice already on the USMV / SPY ratio trade and I am keeping the rest for now.

Earlier last week I felt the need to increase the short exposure of the equity portfolio and given how TSLA bears have snatched defeat out of the jaws of victory (i.e. they lost hope, positioning should be good for an entry), I placed a long put fly 190 - 150 - 130 for the end of March. So far the trade has not done pretty much anything. Got my stop above the sma200d.

Conclusion: Last week we advocated for a stop to the FOMO inducing long equities narrative, explaining how the risk-to-reward was poor. Fast forward to today, things look much brighter after the drop and PCE out of the way. Technicals are well aligned for the bulls but traders should be swift here to change their minds if rates and the Eurodollar continue in their directions.

Great reviews! Thanks for the update on $PFF, a good reminder that it’s worth digging deeper! And thanks for the shout-out!

It isn't that the market doesn't CARE, it's that the market doesn't BELEIVE it! And why should they. This market is a purely technical market. Every pull back sets up for the next rally. This will continue until it doesn't.

a