The highlight of the past week was the CPI print on Wednesday. We had finally witnessed m/m CPI and core CPI slowing down. Many expected that given the large drop in commodities in the month of July. The market really liked the number and the idea that we are seeing a slow down in inflation but if you look under the hood the bond market didn’t react as cheerfully as the equity market. Yields across the curve didn’t go down but either ended the week flat or up. The long-end was most affected but yet nothing of significance really happened. As bond cash prices overshot their benchmarks I will be looking for pair trades that make sense from a valuation point. This is necessary because I am not eager to buy cash bonds or ETFs at the current prices. I am of the opinion we are at a short-term peak or very close to one and we will get a down leg soon, albeit not to the lows. What I am waiting for is a higher low in the cash market where cash bonds will show relative strength compared to their benchmarks. At this moment I will be happy to explore going long again (as we were in late June to end of July)

US10Y-US02Y still deeply inverted sitting at -0.416%. Is this time going to be different or are we going to get a severe recession/market sell off? It takes time for this signal to play out but given the current equity indices performance I have my doubts. Time will tell.

CDX High Yield Index broke through the first support level and is now looking for the 400 level. What I will keep an eye on is the price action of the 400 level compared to $SPX. Strong $SPX but CDX High Yield index level holds, I am cautious that insurance traders are not confident the rally will last any longer.

IT10Y yield consolidating around 3%. It looks like there is a decent case to short the IT10Y bonds

The week ahead is very light on data however it is an OPEX week. Lately we have weakness in the indices on OPEX weeks.

I would argue August is not the time to go big in any trade. I prefer to wait for any additional over extension in the cash market until things are unsustainable and then short. If August keeps up this pace I am pretty sure we get a lot of inflows at the end of the month/beginning of next month, at which point ETFs/Funds will be buying at ridiculous prices.

FIXED INCOME ETFS:

SRLN - I honestly can’t find a reason for this ETF to be at this level. I am short and will keep adding to the short position. The ETF is up 5% from the bottom (A very big move for this low volatility ETF) without a meaningful correction. I am looking for a down move to $42.75-$43.00.

HYGH - This ETF shows you the credit spreads of HY issues. (rates hedged ETF).I think high yield overshot last week on the positive market action and it is poised for a pullback. To illustrate my point better I have plotted it against IG’s credit spreads ETF - LQDH.

EMB - 10% off the lows and tagging the 100d SMA. Given my short-term approach I would not be a buyer at these levels as I think a pullback is imminent. Worse case a consolidation at current levels.

COMMUNITY MEMBERS QUESTIONS:

What is the performance of new IG issues like: How do I approach the market? I personally apply a more broad based approach where I split IG issues into two rating segments, above (S&P) A- and below (S&P) A-. I generally avoid anything below A- in the corporate bond market. I am of the opinion that anything BBB+ and below requires a lot more individual approach and you have to consider factors like potential tightening, market volatility (yes, the equity markets volatility affect them to a great extend) , how much supply was offered to the market by same sector companies, recent performance of issues from same sector competitors, bid to cover and many more.

Lets go to last week’s issues.

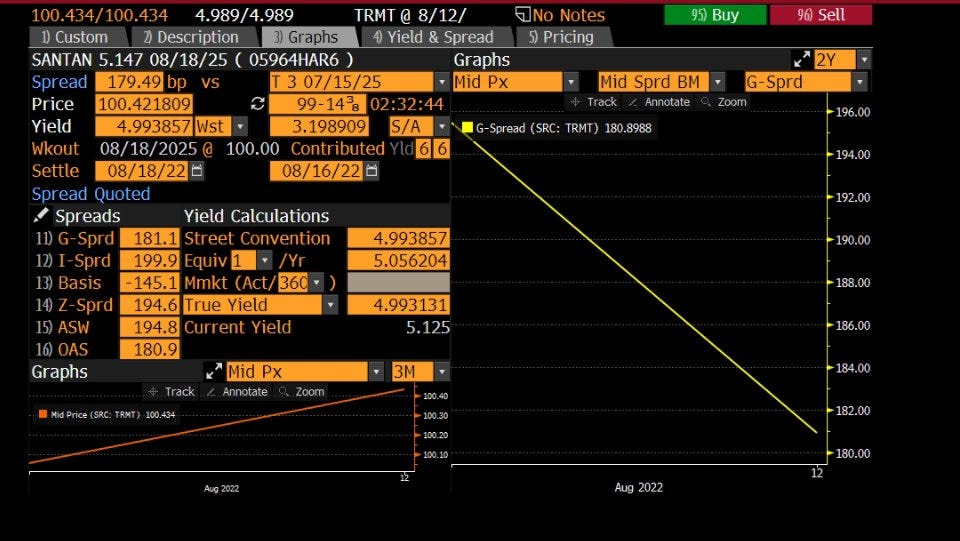

SAN 3yr - Came in very cheap at 195. A day after the issue it was trading at 179.5 according to BBG.

SAN 5yr - Issued at 230, was trading around 223 at T+1. This one was priced too tight in my opinion.

NRUC 10Y Sustainable - Issued at 140, traded at 129 a few days later.

TXN - TXN book was outrageously big, allocation was difficult to come by. 10Y came in at 90, last print at 81.5 according to BBG.

TXN 30Y priced at 110, currently trading at 100ish according to BBG.

One should keep in mind that the market was very helpful to all of the new issues as CDS indices were dropping like stones, traders were happy to take on risk. This week I am not sure what the market will be like but would be a lot more cautious.

CURRENT POSITIONS:

Short PSA-L, PSA-I and SCHW-J. - Currently winners.

Short SRLN - Currently a loser.

CS 7.25 perpetual vs CS 6.25 perpetual - This trade is currently a loser and will try to get out. This level of widening does not make sense to me but we are not here to make sense of the markets but rather make money. Therefore I will be looking for liquidity to get out in the coming days.

I am out of all BDCs and Yankee bank perpetuals as I don’t see a reason to be long at these levels anymore. I am not good at holding positions for long periods of time.

POTENTIAL POSITIONS:

LQDH vs HYGH. I would do it via futures instead of the ETF as the ETFs are illiquid, hard to find borrow and borrow is expensive. My trade will be rates hedged IBIG futures longs vs rates hedged IBHY futures.

Looking for any EUR denominated debt that overshot to the upside. I am of the opinion that inflation will be a lot more persistent in the EU and the ECB will have to be more aggressive than the market prices. This trade will likely play out in Sept/Oct.

Keeping my powder for the end of the month potential inflows to all subsets of the credit markets. Given the strong performance in credit in the past 45 days I would argue there is a strong case for further inflows. This will move cash credit products to very unreasonable levels.

RISK FACTORS:

OPEX (click on the link for reference to BBG article) week volatility - Can’t really say it is a major risk factor but it is a source of volatility. OPEX weeks are famous for providing many false signals getting people long or short for no apparent reason. Additionally, this year OPEX weeks are having a negative bias as per BBG’s article.

If one is net short the costs of holding the short positions in a slow month can add up. That is why I am persistently mentioning to identify over extended products where the potential profit will be quick to realize or pair trades where your carry will be very low.

CONCLUSION:

Beginning of last week I shifted my sentiment to short. This week the feeling really strengthened exponentially. I cannot see a reasonable argument to be long at these levels (if you are a short-term swing trader , 1 week to 1 month). Before considering any long positions I would like to see a pullback that is met with bidding and each chart must form a higher low. As of right now we are far from this moment. In order to avoid as much as possible the lack of activity in August I would be mostly waiting for excessive moves to the upside and pair trades that are extended beyond 2.5-3 Z-score. I would like to point out that I am not preaching for a doomsday scenario as I sincerely have no idea where we test the lows or not however I am confident that we overshot to the upside and short-term we are very overbought.