The highlight of last week were the higher than expected CPI in the UK and higher than expected PPI print in Germany. They were more than enough to reignite the conversation of how sticky inflation is, especially in Europe, and whether we are past peak inflation. I am not qualified enough to talk about how macro economic factors will affect inflation levels. There are multiple Twitter/Substack accounts doing a very good job on that topic.

These ‘unexpected’ numbers took the UK 2 year yield to 2.55% a new 12 year high. Looks like the UK is front running the rest of Europe and showing them what it is to be expected.

In continental Europe the German 2 year bonds are headed towards the 1.2% high. Last week, you couldn’t have gone wrong shorting any of the European sovereign bonds. It was a bloodbath across all of Europe.

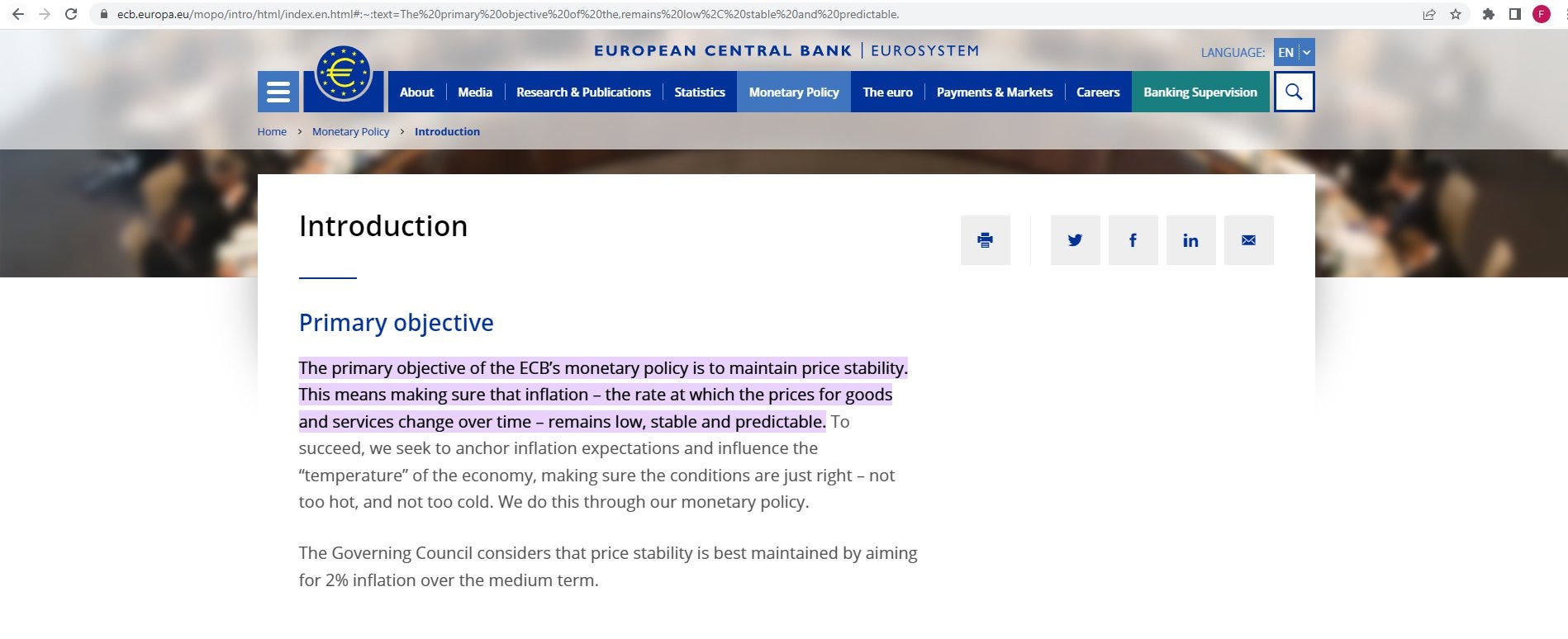

Given the strong economic activity it will be timely to remind ourselves what the primary objective of the ECB is. At some point they should start adhering to their mandate. I would argue the biggest risk for Europe now is not just sky high energy prices and electricity prices but the ECB killing the economy by communicating with the market significantly more hikes than expected.

This has been a narrative discussed extensively this year on Twitter by many professionals. I fully subscribe to that narrative and think there is no way out of it but I also believe it is virtually impossible to time the moment to short. With the current economic prints coming from the UK and Germany we are getting the signals inflation in Europe will not only be sticky but it is not done with its move to the upside and we get that information in the months where inflation was supposed to slow down.

As for the USA bond markets I think we will be in a large range for some time , likely until October when we start getting in September inflation numbers. Should we see an uptick in any activity pointing to potentially higher inflation numbers we will likely break the highs. US02Y, US10Y and US30Y yield will very likely stay in their respective ranges for the time being.

The 10Y-2Y yield curve is still inverted but eased off the lows and is not at -0.26%

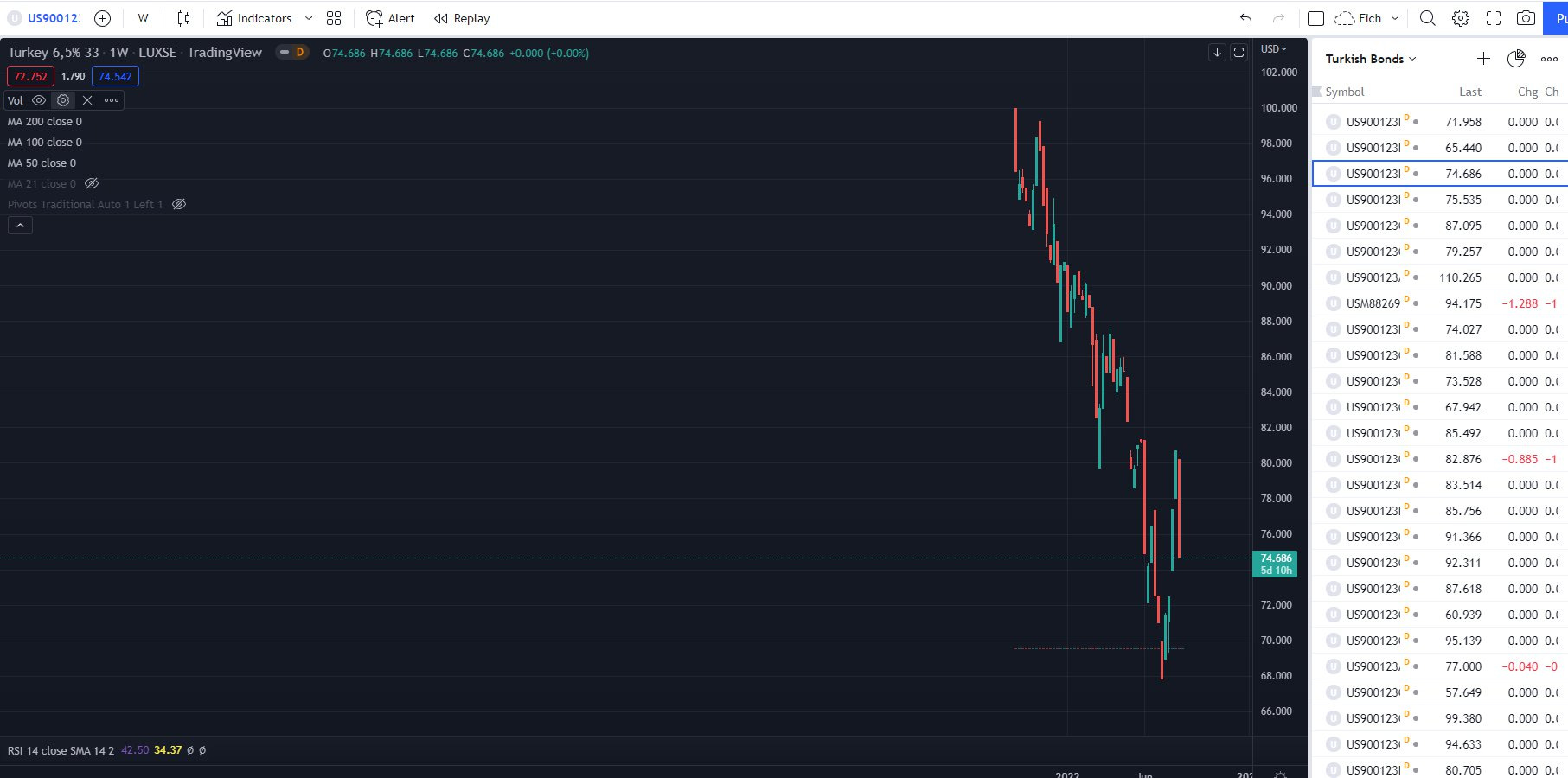

The Turkish Central Bank unexpectedly lowered its benchmark rate by 100bps to 13% taking down the cash bond market significantly for the week. One of the reasons behind $EMB’s poor performance this week.

iTraxx Crossover held the support levels. I am not so sure if we re-test the 600-625 highs in August but I think at some point in the Autumn (late September-October) we will be there. Europe is obviously in a significantly worse situation given the energy and electricity prices. The actual trade was down at the support levels where at least a consolidation was expected given the very sharp rally of the lows in the cash market and European sovereign bonds. We recommended reducing long exposure when we were at the lows.

The state of the European bond markets could also be captured in the spread between iTraxx Crossover - iTraxx Europe (EUR HY - EUR CDS indices). The drop in the spread was very shallow suggesting we are not over with with the stress in EUR cash markets. We are seeing higher lows in each chart suggesting a higher likelihood of breakout to the upside. This time around we have all the reasons supporting this move. My current sentiment in European bonds is to look for any counter trend moves (cash market going up, yields down) and re-short any bonds/indices that overshot.

CDX High Yield - As we are short-term traders and the time frame of the reviews are weekly I wouldn’t emphasize as much on the longer term in this case. I will be looking for 500-525 level first where I will use it to get out of my SRLN and HYG shorts. It is too early thinking about cash long positions at the moment. We need to see the SPX gap filled first and a re-test of the 500 level in the CDX High Yield - CDX Investment Grade indices. Now is the time to hold our short positions which we emphasized on in the past 10 days.

FIXED INCOME ETFS:

HYG - First reasonable level where I may consider taking off my short positions is at $76. It coincides with the 50d SMA. If I am to explore longs (which I am not at the moment) I would never buy a level directly just because I see a few lines on a chart. I would need to see several days of price action on a given level before determining whether the level is tradable or not. The lines on a chart are simply to identify possible areas where multiple market participants may get involved but I NEVER know if they will get involved before I see the price action respecting the said level for a few days. (the longer the better).

SRLN - I am looking for the $42.50 level to offload my favorite short position. Unfortunately it has been acting strong relative to HYG and the general market. That is a warning sign to me that this position may not work or may not be worth paying the borrow fee. As I said multiple times, price action and relative performance is quite important to me and I put a lot of weight on that particular factor when determining what to do with any of my positions.

EMB - I am NOT a buyer of EMB nor EM IG or HY debt and will stay away until I see a lengthy re-test of the lows with outperformance on a relative basis to the US Dollar and SPX. There are plenty of macro factors affecting negatively Emerging Markets debt (USD denominated) and I don’t want to stand in the way of the trend. I am sure there may be plenty of opportunities for the professionals focusing on the secondary cash market but trading the EM debt cash markets is not my primary focus. I follow the levels and current sentiment on the major ETFs/Indices as at times I trade new EM IG issues. The secondary is not something I follow closely.

CURRENT POSITIONS:

25% left from my initial shorts in PSA-L and PSA-I and SCHW-J preferred stocks.

HYG short position

SRLN short position

Short 2 year German bonds

PNC 6.2 perpetual long vs PGX short

CS 7.25 perp vs CS 6.25 perp - This one is not working out and I will make sure I sell it this week.

POTENTIAL POSITIONS:

As of this morning I don’t see any new positions that I want to take as the train had already left the station and any new shorts at the current levels feels like chasing and I don’t like to chase. I am short and will remain short until we close the gap in SPX at 4150 or we breach the highs above 4300.

RISK FACTORS: Tuesday will be an important day for Europe. All eyes will be on the German/French and UK data looking for signs of where inflation is heading. Any strong prints will simply emphasize the inflation narrative and we may get to the iTraxx Crossover highs significantly sooner than I anticipate. On Thursday and Friday we will be looking for sign on inflation expectations in the US but this will be combined with Jackson Hole’s symposium which may give hints to the expected behavior of the FED in the coming months. An eventful week to say the least.

CONCLUSION:

I would like to point out a few important facts about the trading style used on our trading floor. We are short-term swing focused traders. That means we rarely do trades longer than a few weeks. We would consider current narrative in the markets and what macro theme may be playing out but focusing on macro is not our forte. Our bread and butter is identifying important levels by using technical analysis and price action techniques to determine whether a level is being considered by multiple market participants. Then we would consider the best risk to reward trade construction to represent a trade. It can often be long one product/short another , it can be an options trade or in some cases an outright directional bet using the underlying instrument. In the fixed income cash market world we focus mostly on primary issues and relative value (pairs trading or vs benchmark ETF) and in the indices and sovereign bonds we use technical analysis + price action to identify key levels.

As we were loud proponents of reducing or selling in full any long exposure and going short in the past 2 weeks it is difficult to find any new short opportunities that provide the excellent risk to reward levels that we like to trade. This week will be used to navigate our existing short exposure and looking for new opportunities on the short side but I don’t have any hopes on finding good short opportunities. You can follow us on Twitter for any real-time trade suggestions or if you want to engage with us via DMs.