Quite the uneventful week in the credit markets UNTIL Friday. The US yields are trying to test the highs of the yield ranges but there is no significant catalyst to contribute for a break to the upside yet. Powell confirmed a hawking stance and said price stability will take ‘some time’ and will require bringing ‘some pain to households and businesses’. The first does of pain was delivered to equity longs. $SPX finished the day at -3.37%, quite the move for a broad based index.

Despite the large equity moves on Friday US yields remained relatively calm with the most notable moves happening in the 2 year and 30 year. The 2 year yields almost broke the 3.45% high while the 30 year yields moved to the downside causing further flattening in the 30y-2y curve and 10y-2y curve.

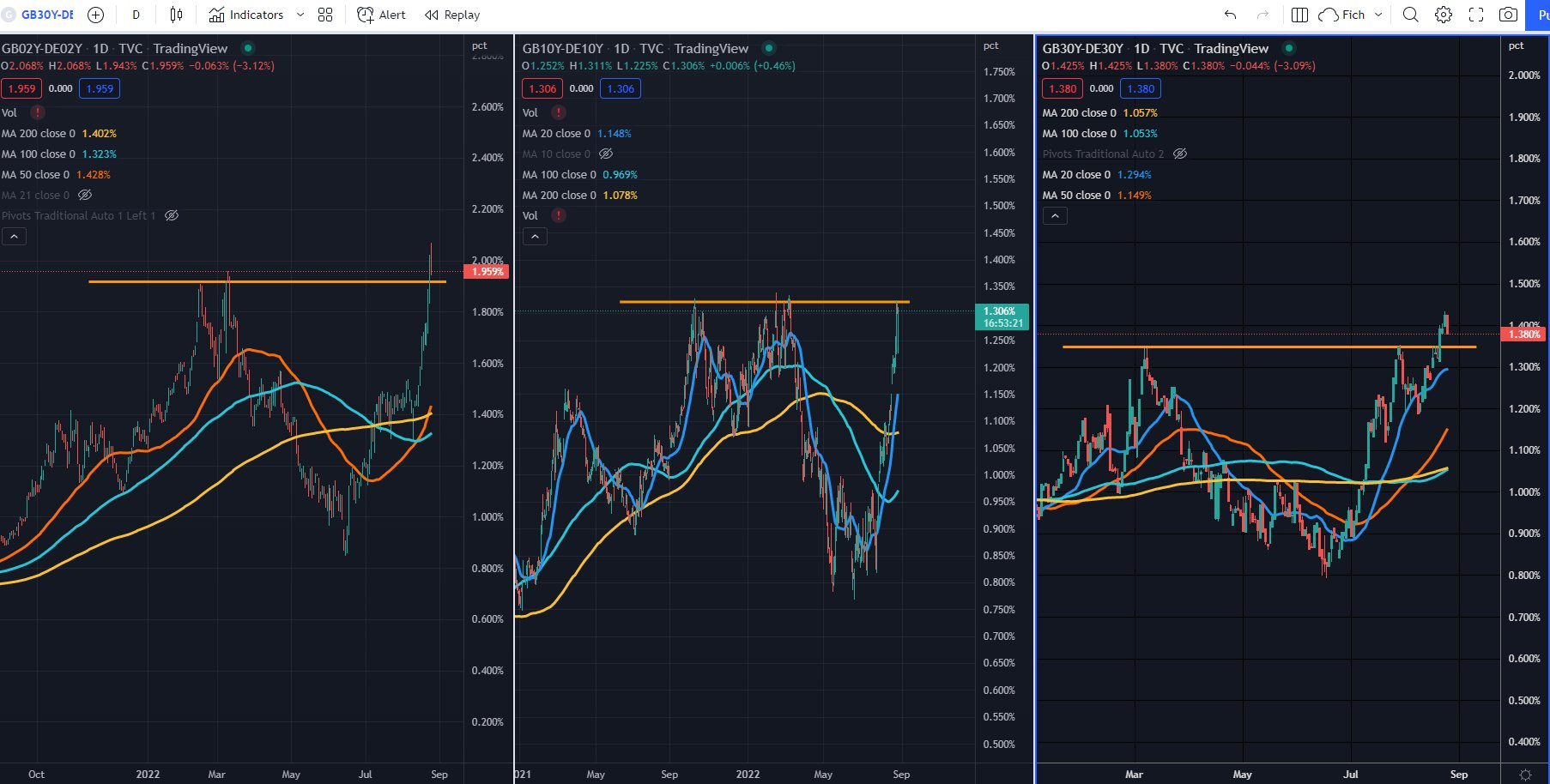

In Europe we saw a pick up in primary activity with a bunch of new IG deals hitting the market and performing better than expected. One could argue it is the lack of supply there that is pushing demand up. All of this happening while the European electricity and gas markets saw new highs during the week. It can be argued that the energy crisis in Europe turns out to be a non-event for the markets (not so much for household) as there is no fear related to any of the scary headlines hitting the newswires. A counter argument to that theory is complacency and EU traders being on holiday but I tend to think a crisis of that scale should have already impacted negatively markets. What I noticed is that the market is significantly more afraid of more aggressive hiking caused by higher inflation, something that was briefly considered last week with the release of UK GDP and German PPI and reinforced by Powell’s speech on Friday. Speaking of the UK we saw the 2Y yield trying to go for the 3% handle but couldn’t so far. The UK10Y and UK30Y yields are fighting for their life to stay in their respective ranges. Breakout out to the upside decisively may spill over to continental Europe. If you are of the opinion the move in the UK is overdone you could try any of the yield differential trades between the UK and Germany. Going for the 2Y or 10Y differential seems like a good bet. Alternatively you could buy 10Y or 30Y Gilts.

What made a big impression on Friday is the lack of real selling in any of the fixed income ETFs. Their daily ranges were tighter than the general indices suggesting the move comes from large cap stocks rather than the broader market. CDX High Yield and iTraxx XO confirmed that by moving relatively modest compared to SPX’s move.

However, given Friday’s large equity moves I wouldn’t be surprised at all to see a re-test of the highs in both CDX HY and iTraxx XO very soon.

FIXED INCOME ETFS:

$HYG - HYG is still within the important technical level despite the very slight close below the level. I would count that as a hold. However I wouldn’t entertain the thought for going long or short right now as we need more time to decipher the price action. What if Monday is an up day - meaning we have held the level. I prefer to stay on the sidelines and wait for confirmation. I am of the opinion that a good technical level is just one part of the picture, supportive price action and figuring out a way to construct a trade with skewed in your favor reward to risk ratio are the other parts of the puzzle making for a excellent trade.

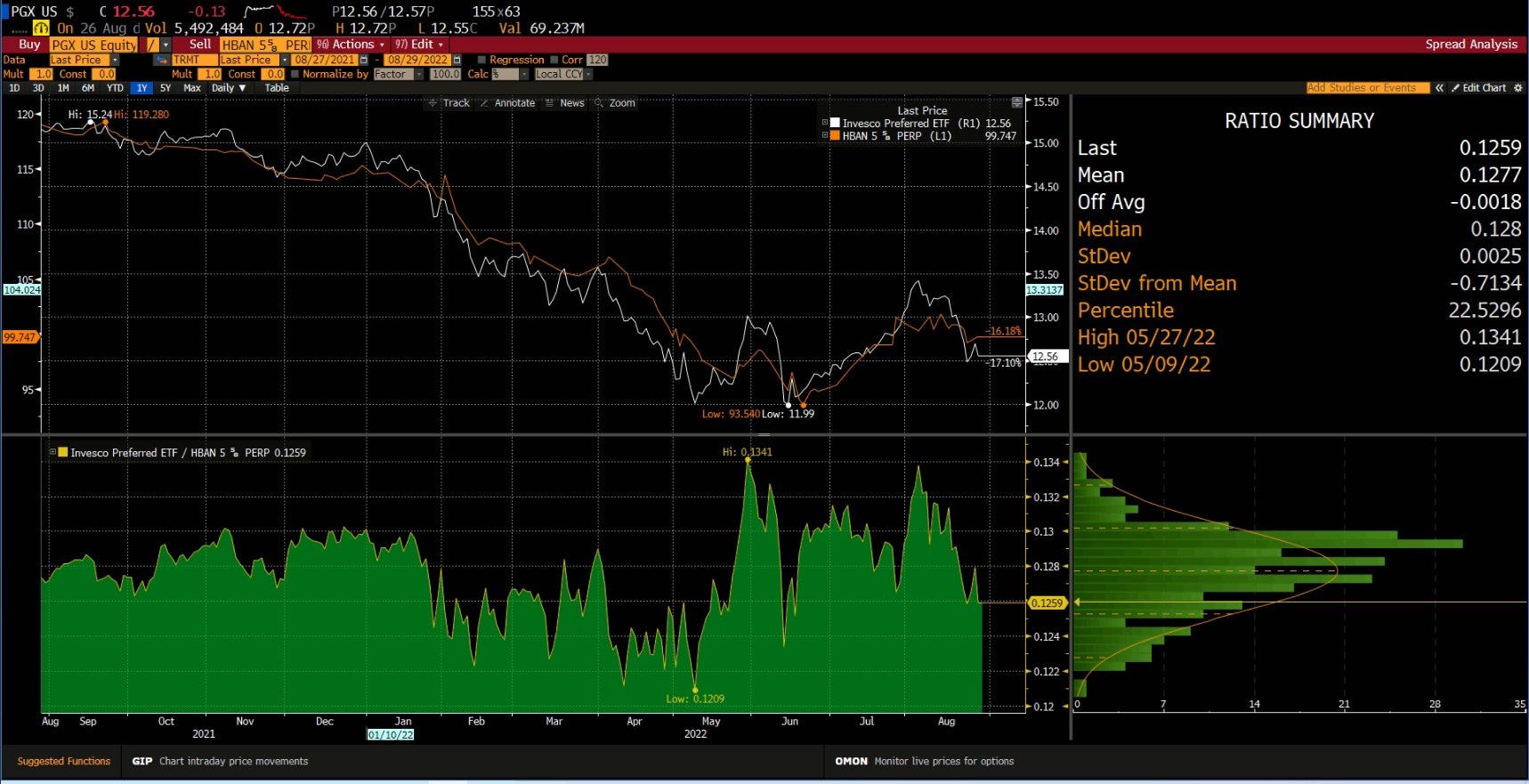

PGX 0.00%↑ - I flagged PGX during the week when it was trying to hold the cluster of 50d SMA and 100d SMA. That level was very quickly busted and now it serves as resistance. Seems impossible to determine the potential direction of PGX's next move. Best to stay on the sidelines until the direction resolves.

$EMB - Closed at the first possible support level but that doesn’t mean it will hold it. Given the substantial equity sell off and another attempt by the US Dollar ($DXY) to break the highs I wouldn’t be a buyer until we see several days of consolidation and the Dollar holding the highs. As of right now things are not looking bright for Emerging Markets debt and I would stay away from it.

POTENTIAL TRADES:

European High Yield Cash OAS Spread - They are still lagging the move of iTraxx XO and with a continuation in the sell off and further advance of XO we will have an excellent short opportunity. The actual spread between iTraxx and EU HY Cash OAS spreads is at levels not seen since the EU sovereign debt crisis and just shy of the highs. Friends on Twitter reported inaccurate screen prices in the cash market and I think they are right as the bids and offers widen significantly when the market is in risk off mode. Nevertheless if anyone looks hard enough , he/she will find a good High Yield bond to short.

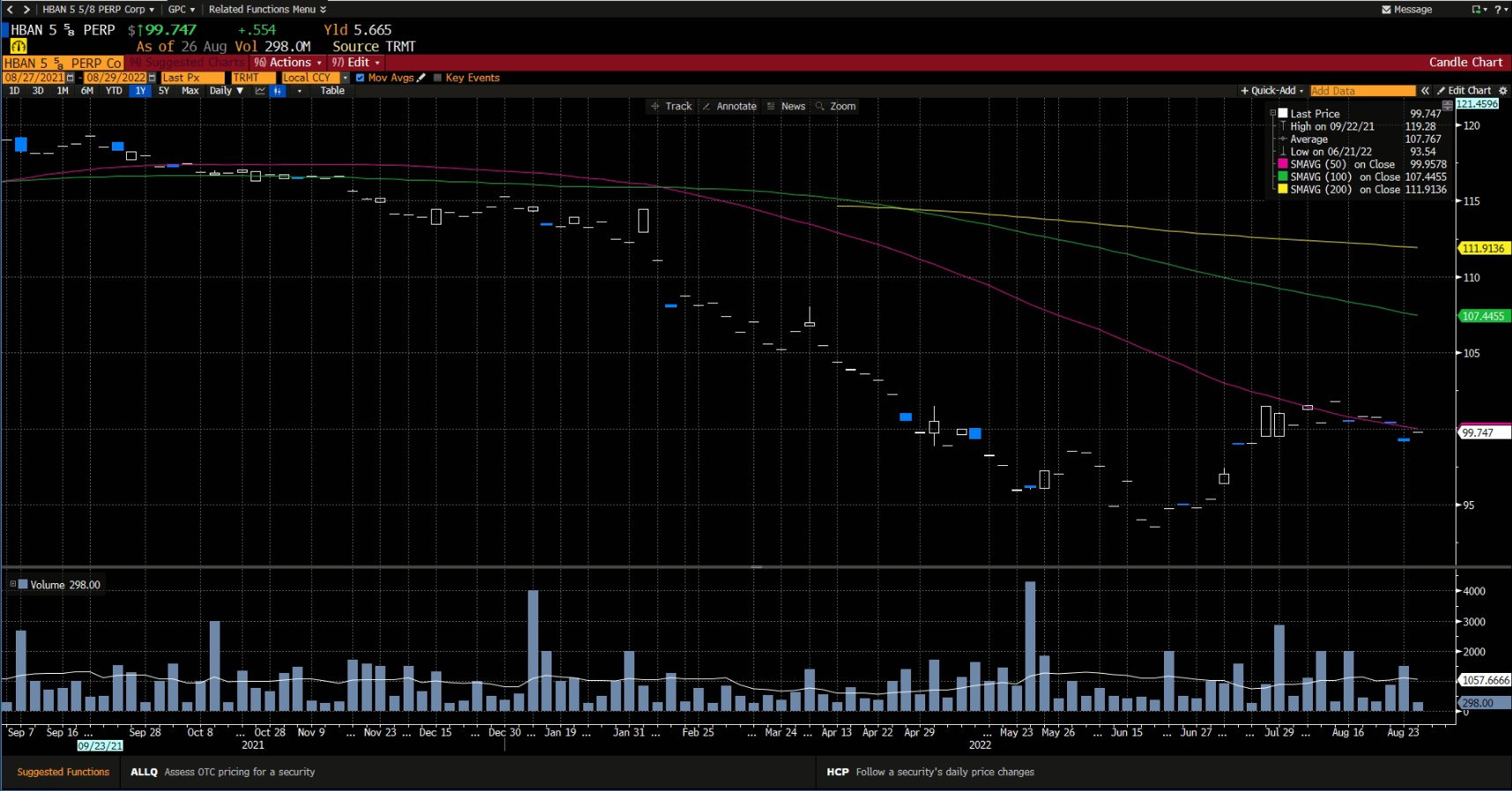

2. What I can suggest IF we have left tail event in bonds is to look for my beloved cash perpetual preferred stocks (OTC - $1000 par) to short as they are almost always too slow to react to both positive and negative events. One can even go as far as buying PGX and shorting the perpetuals. Some of the most overvalued I found were the JPM 6.1 perp and HBAN 5 5/8 perp. Both were flagged by our scanners as perpetuals relatively overvalued compared to PGX.

3. UK - DE yield differential trade. I think the UK10Y vs DE10Y appears to have the best chart and very significant level. You should keep in mind that on top of the regular risk of this chart breaking out to the upside you are also carrying currency risk as the UK Gilts are priced in GBP while the DE bunds are priced in EUR. You should look for an entry should the differential moves back up to 1.30%ish.

CURRENT TRADES:

NONE - This happens very rarely to me but I prefer to stay in cash than be in mediocre trades with poor reward to risk. I am in capital preservation mode after the very good past two months. No need to push things when the odds are not in our favor.

CONCLUSION:

As I was very light in exposure coming into the week and even lighter at the end of the week I am not burdened by any losing positions. At the same time I don’t see any skewed trades with good reward to risk ratio and will stay away from entering any until I find something worth taking the risk on. The best bet right now is shorting the Perpetuals but I wouldn’t bet the house and they are not in my portfolio yet. I don’t want to come up with abstract trades which I am not sure about. It is significantly better to say nothing than point out the community to trade ideas not worth taking the risk. Cash is also a position.