The obvious attention grabber last week was the CPI print. We all expected a gloom and doom scenario on that day but little did we know that this was the perfect setup for a short-squeeze. To make things worse, on Friday we gave back half of the move forcing everyone to spend the weekend scratching their heads. I am not going to pretend like I know what happened or come up with a clever reasoning. I was caught off guard by the move, incurred losses, got out of my trades and moved on. I thought, maybe, when I get some rest this weekend I will figure it out and post something clever on Twitter about it. Nothing really comes to mind , nada, however what I have managed to achieve this weekend is to get a good rest and not be anxious about what Monday will bring. I couldn’t care less if we are up 2% or down -5%. You see, in trading all you have to care about is your PnL, not whether your theory is right or wrong. I like to cut losers as quick as possible when wrong, and ride the winners as much as I can. Okay, that might be far fetched as I always cut the winners too quick, but the one thing I do right is cut those losers.

So what changed after the CPI report? Let us look at some facts:

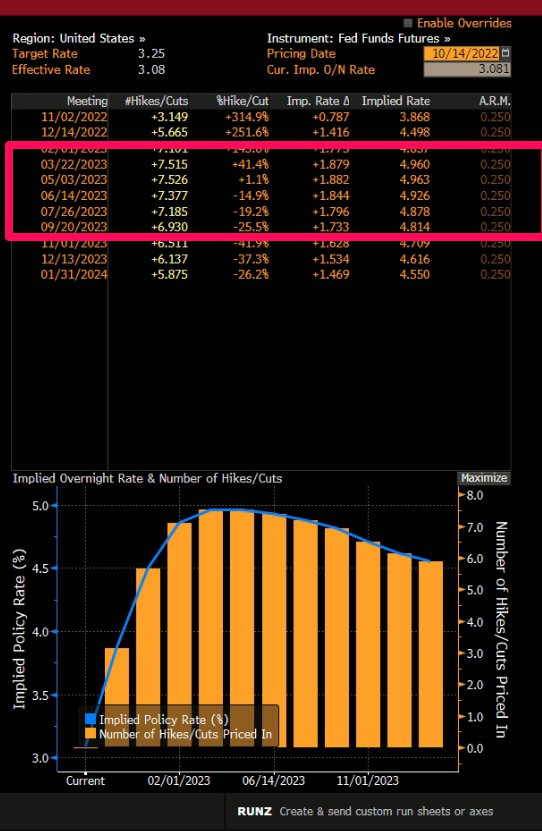

Fed Funds Futures now pricing 5% rates in the spring of ‘23. We were between 4.5% and 4.75% before the report. I am thinking we are getting close to a pause as the FED needs time to asses what are the consequences of the hikes. We need at least 6-9 months to see the first effects of the hikes. We are not even close to seeing the effects yet as the large chunk of the latest hikes happened in Jun’22, Jul’22 and Sep’22. Therefore if we expect to reach peak rates in June’23, we should be on the looking for the full spectrum of effects to hit the economy in the end of ‘23 at the earliest.

2. FED’s Daly hinting they are likely pausing in the 4.5% - 5% range. This only serves as confirmation bias to me prior point.

CDX High Yield Index and iTraxx Crossover index (I am referring to the total return indices, not the CDSs) did not make new lows at the time making them relatively stronger, but should be noted that the iTraxx index is making consecutive lower highs.

Given the above mentioned arguments I am thinking that sooner, rather than later we will see a bottom in the 1 year and 2 year bonds, a.k.a short-term top in yields in the front-end of the curve.

POTENTIAL TRADES:

For people who are happy to sit out the volatility yielding 7%+ I can recommend a few trades - PNC-P and GS 5% perp.

PNC-P is already callable and will likely be called at first opportunity, most probably after the earnings blackout period expires but if PNC decides to re-finance and call this preferred you will not lose anything. Call events happen at par + accrued dividend and until the actual call occurs you will be generating juicy 8%+ yield.

GS 5% perpetual

If one is looking to add convexity and wants to dip his/her toes in EUR/GBP denominated debt I can show you the RAGB 0.85% (Republic of Austria) 100 year bond or UKT 0.5% 61s. Quite the potential moves there if you are of the opinion we are close to a pause. High risk, even higher reward in this one. Watch your size.

CURRENT TRADES:

NONE

RISK FACTORS:

This week is very light on important economic data which will likely lead to lower volatility. I guess it will be welcome, especially after the last 2 very busy weeks.

CONCLUSION:

The more I think about any potential new trades, the more I reach the conclusion that we are in the situation where you either sit out a potential volatility by parking cash in callable floating rate instruments, such as preferred stocks or perpetual debt or if you are willing to take on risk and believe we are close to a pause in the hiking cycle, you can really push the envelope in some undervalued debt , potentially with higher convexity to maximize potential returns. I am more inclined to opt for the second option as naturally I am a short-term trade but with the rejection of the lows in SPX and the hint by Daly that the FED won’t go beyond 4.5%-5% I am getting more and more tempted to deploy capital on the long side.