General market overview: Hell broke loose on Friday, no doubt about it. What started as a natural pullback from overbought conditions was about to end in an ordinary manner before Powell gave his speech on Friday morning for the closing of the Jackson Hole symposium. Since the last FOMC speech, market participants were very divided on what his actual intentions was, but I believe Powell had this ambiguity the right way, acknowledging the slowdown of some parts of the economy and buying time for the planned continuous rate hikes. Time is all the Fed needs, and large market swings to the upside (from ambiguous speeches) give him the necessary room for addressing inflation firmly with narrative, just like he did on Friday. Right before the speech, the expectations were for a very cautious (and ambiguous on the dovish/hawkish specter) talk given his understanding of the lag the monetary policy has on the economy and the data driven approach started in July and the worsening housing, personal income, PMI data since then. However, there was nothing, absolutely nothing for the dovish heads to get a grip on, and thus the market nosedived in an extraordinary manner. Those bits from the speech summarize it well for me:

We are moving our policy stance purposefully to a level that will be sufficiently restrictive

estimates of longer-run neutral are not a place to stop or pause

The historical record cautions strongly against prematurely loosening policy

Reducing inflation is likely to require a sustained period of below-trend growth

What I get from this is that not only interest rates have to rise, but that also growth and margins are to suffer too.

The selling than ensued following his speech got through the May consolidation and the daily sma100 like a hot knife through butter and next logical support comes at the 4000 level, where the round number and the sma50 on the daily should provide support to what would be then oversold conditions.

For those who follow the equity overview, it will come as no surprise that I always tend to look for clues also at what the rates and the dollar are doing, when forming my general outlook at the market. Despite his hawkish speech, rates and the dollar did not react nearly as strong as equities with the front end of the yield curve was sold while the long end got bought. When rates are still and the market is down 4%, the move comes from multiple contraction/growth revisions. And while the former (rates) are to blame for the SPX YTD return, what could now follow would most likely be coming from the latter.

Sector review: The comeback of the inflation scare brought along two favorite market sectors that were the huge runners in the beginning of 2022 - energy and metals & mining.

The energy sector in all its shape and form continued marching higher for another week.

The strength of this sector is remarkable as even on Friday when correlations turned to 1, it was still hard to have a sensible pullback in those. And all of this strength is happening with oil consolidating around its sma50 on the weekly.

One can only imagine what a run of oil to the test the 100-110 area would do the equities in the sector. I believe that this sector is one of the few to have long exposure in and have been an advocate of this when I first saw the divergence in price between oil and oil related stocks. While stocks were going higher with oil, they were flat and accumulated on a bad oil day. This asymmetrical relationship has so far continued.

XME - the metals and mining sector - has also shown very strong price action, although nothing close to what the energy sector is doing. Despite the rough week in equities, it managed to close the week with a c 3.5% gain. Prior to Friday’s speech, it had a neat breakout from the sma100 on the daily with what looked like a bull flag continuation. Now that the inflation is back in the narrative I just want to remind you what the sector did as part of that play earlier in 2022 when it topped at c.49% gain in mid April. While not all sub-sectors in the XME would perform well (gold miners testing the bottom and would likely go below) there is some stubbornness in copper to go lower despite a strong dollar and bad economic outlook. What is more, steel producers are looking decent on chart as they have formed higher lows and the market loved the news of increasing prices of some steel products, coming from CLF on Wednesday. What gives me confidence that this sector will perform well if inflation scares continues, is the hugely positive reaction the it had in the beginning of 2022, meaning that investors recognized it as one of the few places to run to. If one has missed XLE, he/she might just go for the second best thing. I know metals are much more price sensitive/elastic currently compared to other commodities like oil and gas, but that’s a topic for another time.

Uranium - Big news coming from Japan, where there was a very loud return to nuclear energy. Not only would they restart reactors but actually go forward with the construction of new plants. What was deemed a total U-turn in energy policy has been , in my opinion, the first and most clear acknowledgement that the stated goal of fighting climate change through substitution of fossil fuels has to happen by returning to nuclear. Some remember that Japan was close to suffering a power blackout earlier this year and they are waiting for EU to follow suit after Tokyo has moved the needle on the topic given the similarity in the energy shock. The defendants of nuclear are so many and so loud that they have their ‘uranium eyes’ on twitter. Even Elon Musk had something to say about it.

Market reaction immediate with everything uranium related jumping like a penny stock after promotion. I can only imagine that a lot of folks that were waiting for a catalyst are going in the trade now, and those who are not, are patiently waiting on the sidelines for a better entry. One can play the theme either through a stock such as CCJ, UUUU, SMR, KAP (LSE), an ETF such as URA or through a physical trust as a bet on the commodity itself - U.UN and YCA (LSE). For now, I am on the sidelines until I see a price formation that would suit my swing style. However, I do like how SMR has a hyped technology (0 view on the topic), has options, a low float and decent short interest all the while trading near its all time highs.

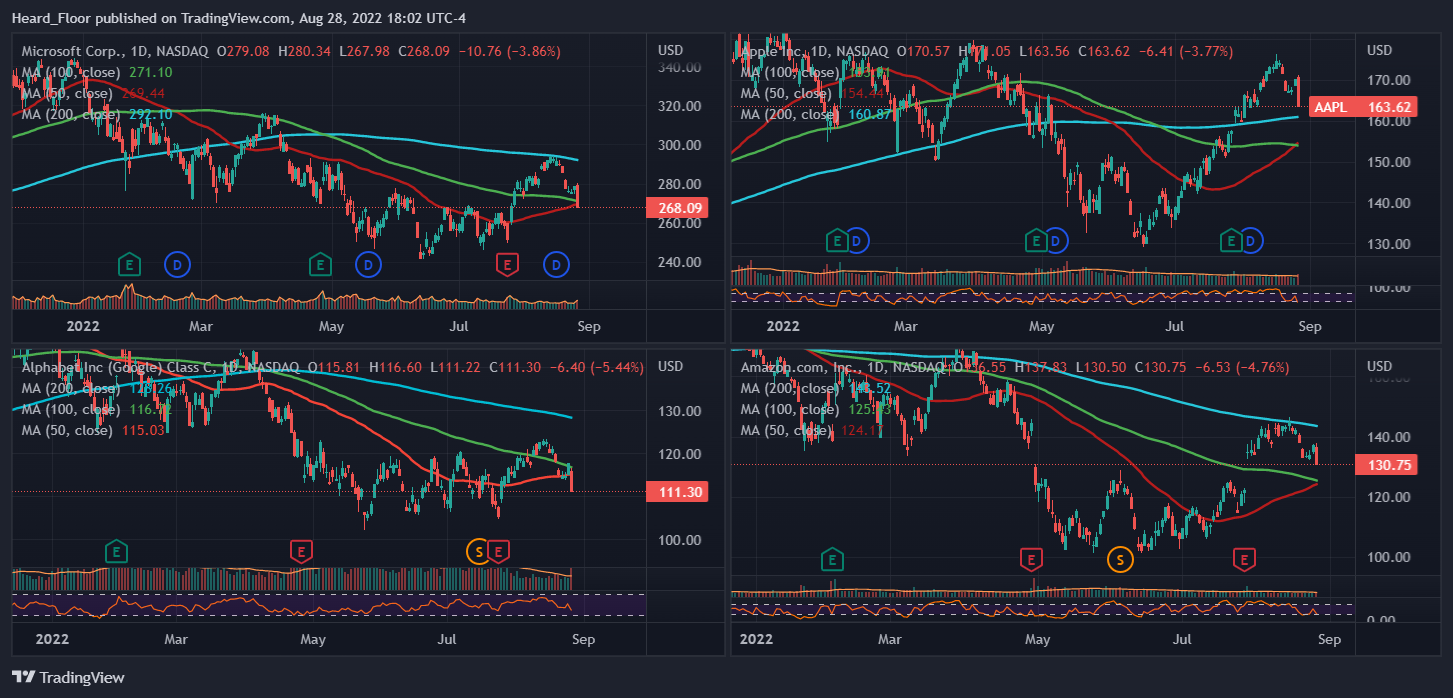

XLK - What brought down the indices on Friday was actually the fire sell in mega caps. All the generals - AAPL, MSFT, NVDA, AMZN, GOOG fell mid single percentages. If rates are relatively still and the dollar steady, all the move has come from multiples contraction. Given how overvalued the mega caps are, I believe we are about to see some pain ahead in the indices and the mega caps would most likely be the culprits

MSOS - I guess I sound like a broken record with this niche sub-sector, but again the marijuana names did pop up with volume and the MSOS ETF has finally tagged an important technical indicator - the sma100 on the daily timeframe. As you can see, this has not happened very often in the last year.

Potential trades: If one is not already short the market, entering here would be tough for those that want good entries and a free-of-FOMO feel.

TLT - I got long the 20y treasury ETF as ‘sustained period of below-trend growth’ resonated with me. The US20y rates are at a good technical levels for a swing short and the risk-off mode should channel investors into the safe haven the long end is known for. Furthermore, we are now closing the month of Aug, which will drive flows into the market and we have a holiday period with good seasonality around Labour day. I have played this with a long call ratio call spread where I got long the 116$ calls and shorted 2x the amount in the 119$. Expiration is Sep 9 but one might chose a bit of a longer option structure.

XLE, XME - Hopefully, those will provide a decent entry if the risk-off continues. Price action has been too strong to ignore and their performance during the inflation scare at the beginning 2022 tell me they will be used for a hideout once again. Unfortunately, XLE has run a bit too far for me to get really comfortable going with it, but XME provides a decent shot. One might narrow it down to steel or copper equities as the gold miners are likely to find new lows. Copper, surprisingly, has been fighting its way higher despite a strong dollar prior to Friday at least.

Current positions

We are short AMD, TSLA, QQQ, BBBY, long TLT and CL (USO).

AMD - I have discussed previously about the combination of weak price action and fundamental news coming from the sector which led me to take a short in AMD. I am short through a Sep 30 put spread $90-80. Unfortunately, only we know how much damage I have done to the trade by micromanaging it. NVDA had horrible earnings on Thursday and gapped lower pre-market only to be bought with force during the session. I certainly did not like that as it speaks for positioning in the sector while also being the classic sell the rumor buy the news event (NVDA had an earnings warning before the actual earnings). SPX also got bid from good support closing strongly on Thursday evening. All of this made me decrease my size in the trade (and not for the first time). Some profit was taken on Friday and a small portion was left.

QQQ - still in the Sep 30 $310-295-280 long put fly that I got several weeks ago. Got some hope for this one as we are entering within the strikes on what was a very OTM option structure with a nearing expiration. I certainly do hope that the megacaps continue the price action from Friday.

TSLA - so far so good with the event driven trade. Since the split the stock is down c. 3%. On Thursday it showed relative weakness which I liked a lot but Friday it got some bidding at what appears to be support near the 285 - 288 area. Despite the mediocre move I did took off a third of the trade as the Sep 9 put spead $283 - 275 has some theta burn given its close expiration.

BBBY - When entering this one on the short side, we definitely did not expect that it will take only 3 days for it to drop from 30$ back to $10. We chose a much longer trade structure with a Nov long put ratio spread $11 - 7. And now that we are within the strikes with so much time left, best course of action is to wait as time is on our side.

CL - the Feb 23 long call fly $130 - 160 - 180 is an expression of the view of what might happen to oil following what we saw happening in natural gas. Just when everyone thought the nat gas trade is over it came back with full force. No need to discuss fundamentals in oil, production constraints have been chewed in length many times by experts on the field in twitter. The chart looks decent consolidating on the sma50 on the weekly timeframe. It is to be noted that gasoline did very poorly on Friday. Hope oil does not follow suit.

Conclusion

We have experienced in my opinion a substantial change in sentiment following a firmer than expected hawkish speech by Powell on Friday. Fridays that end on the close with such a catalyst do not come with good expectations for Monday morning to say the least. If not already short, one might look at long dated treasuries to catch a safe haven bid.