In 2022 we’ve seen volatility in the bond markets comparable only to Covid and GFC. I have a sense traders will not be willing to take any unnecessary risk in the final weeks of 2022. For that reason I don’t expect anything meaningful to occur. Maybe we get a slight move up in rates but it will be nothing compared to what we’ve seen in September and October.

The cash bond market typically dries up in December, dealers leave the desks early and bid-ask quotes widen. Primary deals dry up after the second week of December. Therefore our portfolio changes will consist of exiting our long G-spread trades and moving to coupon collection with the potential of capital gains. This will likely happen in the few perpetual preferred stocks that had not yet moved and a few high yield bonds.

Let us first see what are the charts telling us:

US and EUR terminal rates still steady at 5% and 3% respectively.

iTraxx Crossover and CDX High Yield are sitting comfortably around the Aug’22 lows.

3. EMB tagging the 200d SMA.

The charts are telling we’ve reached the peak for 2022 and a consolidation at current levels is the likely outcome until year-end. Even if we move to the downside in EMB or up in CDX High yield, my expectations are for muted movements.

CURRENT TRADES:

Long G-spreads in REPHUN 5.5% 34s - Underwater

Long G-spread in ROMANI 3% 31s - Underwater

Long PFF vs WRB-G, WRB-F, WRB-H, KEY-J - I am trading the obscene valuations of these 4 preferred stocks compared to PFF. I have shorted 4 of them instead of one to compensate for the lack of adequate liquidity in preferred stocks. This trade is suitable only for accounts not going wild with the size. Keep in mind, the borrow fees are quite hefty, if the trade doesn’t work out in a week or two, it should be scratched.

POTENTIAL TRADES:

The below trades are picked up based on the following 2 criteria:

Potential for capital appreciation

Relatively high coupon which should allow for collecting handsome coupon during the slow periods

.

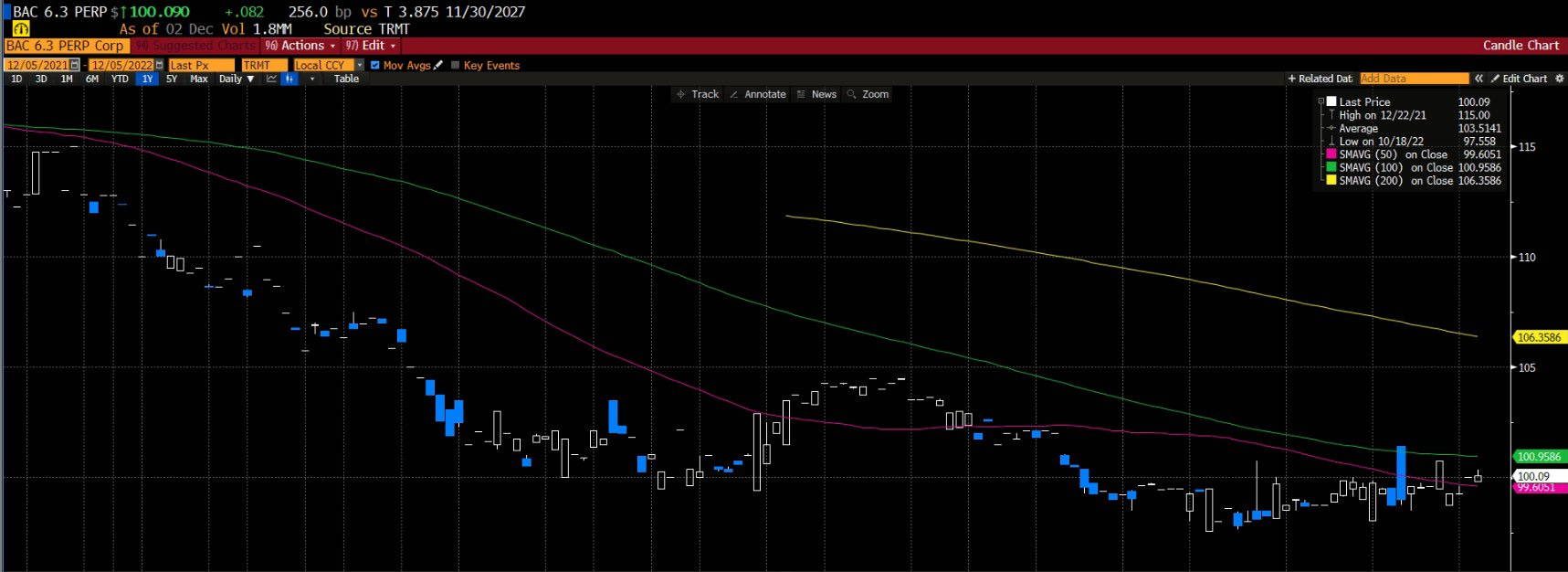

1. BAC 6.3% perp - US060505EU46

C 6.25% perp - US172967KM26

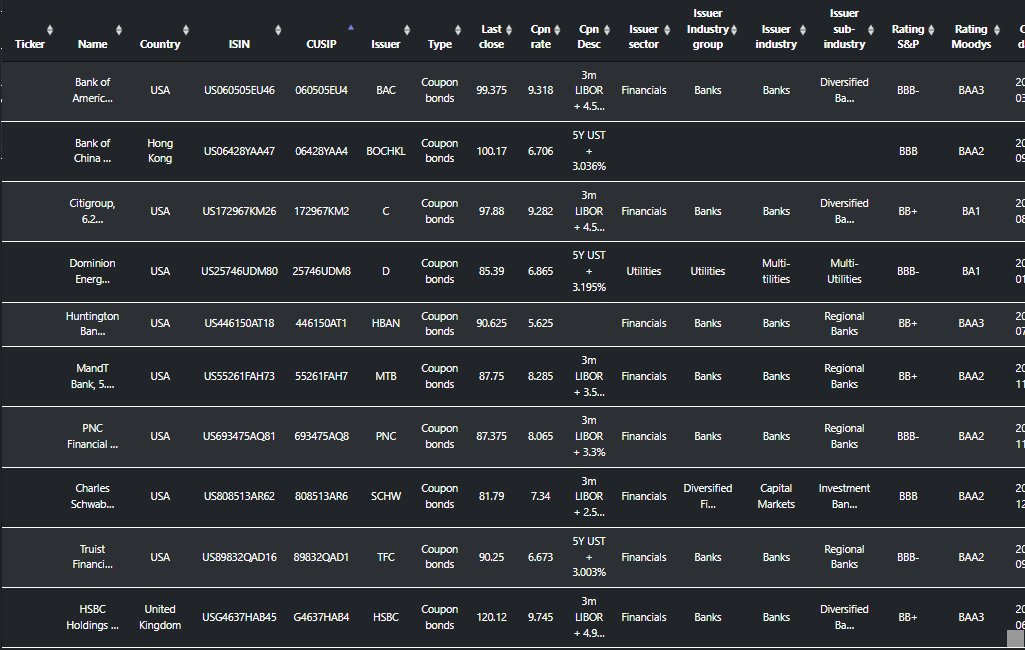

3. List of remaining perpetuals our scanners found, which fit my criteria

CONCLUSION:

My current plan for December:

Hold the shorts (long G-spreads) until the end of this week. If they turn into profit I will wait until next Tuesday to exit. If the trades are still at a loss by this Friday I exit the trades

Buy OTC perpetual preferred stocks this week. Next Wednesday, just before the announcement I will hedge with VRP. Hold them until the first Friday of Jan’23.

Enjoy the holidays with my family.