Starting this week, we have decided to combine the Equity and Credit market reviews in one piece.

We have done so in order to decrease the amount of e-mails you receive from us as we understand how spammy the world of Substack has gotten. Plus, we hope those of you who have been strictly focused on reading one of the reviews to accidentally find value in the other as well.

We are constantly trying to improve the way we write and lay out our thoughts in markets. Hope you like it and don’t hesitate to tell us what you think.

WEEKLY CREDIT REVIEW

Bond markets are playing catch up and imitate the rally in the equity markets. Fixed income ETFs trade like equity ETFs. I really don’t know the reason as not much has changed since December. Maybe it was the aggressive tax loss selling that was holding the ball underwater until the 30th of December. All of a sudden the ball was released and popped, reaching the sky. Traders are simply repricing now. Alternatively, it could be fresh money deployed that waited patiently for the new year. I can never be sure as I don’t have the data. I would argue we don’t need the data as catching the full extend of such moves is only possible for the buy and hold investors. Short-term traders like ourselves never catch the full move. We are always the first to get in , often too early, and the first to get out. At least this has been my story.

The big question we are facing now is whether we see another leg lower or a shallow dip which would be used as a launching pad for a new leg higher. No one knows for sure, except Powell. To me it is too early to tell and that is the reason I am not taking any directional trades at the moment. What I have done is focus on pair trades in extended pairs. I will show you what I have in mind below.

Lets go through the most important charts of the week:

WHAT ARE THE CHARTS TELLING US:

CDX High Yield and iTraxx XO -

CDS indices are saying only 1 thing. NO FEAR. Credit spreads are tightening because of it, fixed income ETFs rallying. However, I am thinking that the 400 level, both in iTraxx XO and CDX HY will hold and we see a bounce from there.

Terminal rate expectations in USA:

In the US, terminal expectations didn’t change much, suggesting that the ‘pause’ communicated previously by multiple FED members is what the market now believes. The ‘pause’, as the market suggest, will be in the 4.75% to 5% range. If inflation data turns aggressive, maybe we spike to 5.25%. However, what has changed in the past 10 days is the obvious dismissal by the market that higher for longer will be a thing. We are again down to another 25bps cut in Jan’24 or 4.25%. That will be full 75bps cut from the 5% terminal peak, which is priced as of now.

The key take away here is that the market is now more or less inline with the 5% terminal rate set by the FED. The unknown variable no one is sure about is whether we really see higher for longer as FED members are publicly communicating. The market says no, the FED says yes. I would add that this part will really be data dependent and we will have a more concrete answer possibly in Apr’23-May’23.

PFF looks extended and is right at the declining trendline. On top of it the 9 day ROC is at the highest level since the COVID rally. I think a correction is due but whether it is a deep or shallow correction remains to be seen. I just know that I want to be short PFF at this price. The better risk to reward is certainly on the short side

POTENTIAL TRADES

High yield energy sector is trading closest to the tightest level since 2021. Maybe as of today there is no particular reason to trade wider spread in the HY Energy sector but we are quickly reaching levels that would present an excellent risk to reward potential. We would just need a catalyst. As a next step one would need to go a bit further and dig into the constituents of the index and check out the weakest links, i.e the ones that have not yet participate in the rally. Usually these participants are the first to drop when the environment deteriorates.

CURRENT TRADES:

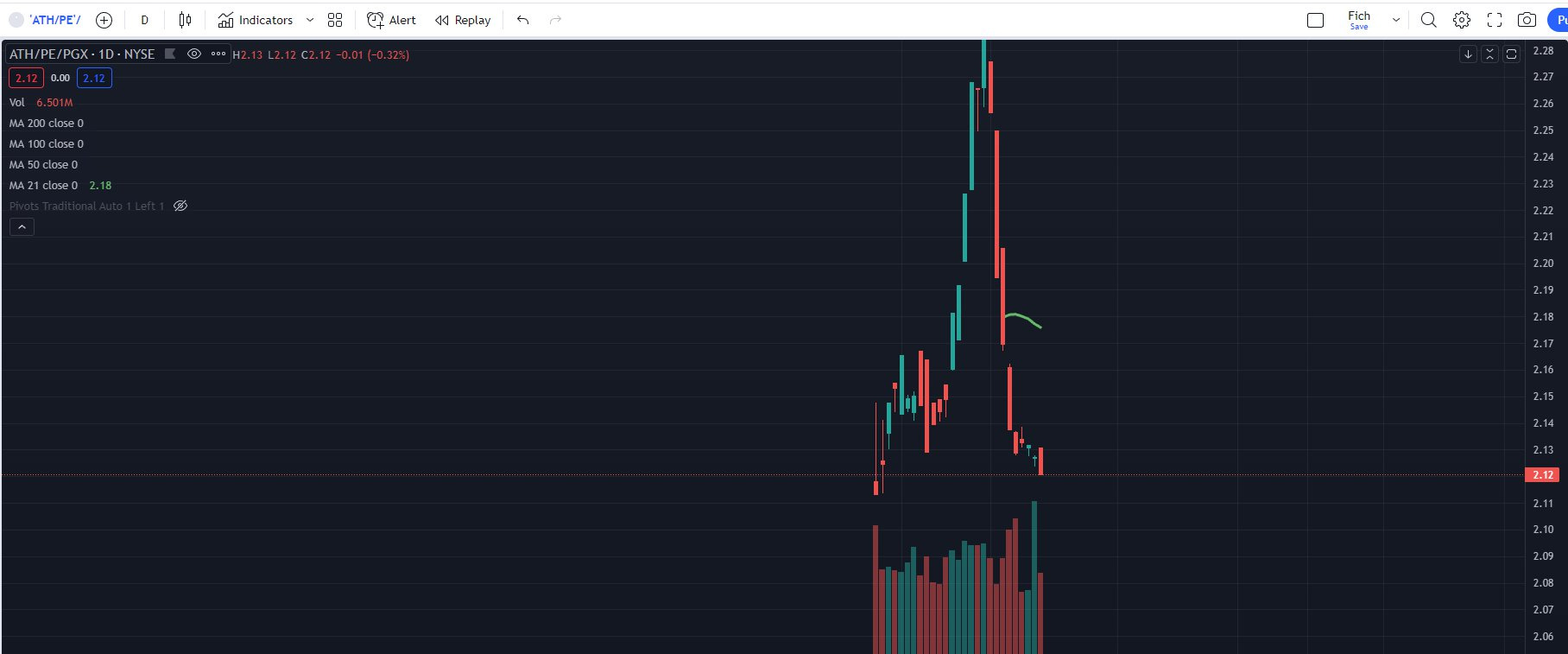

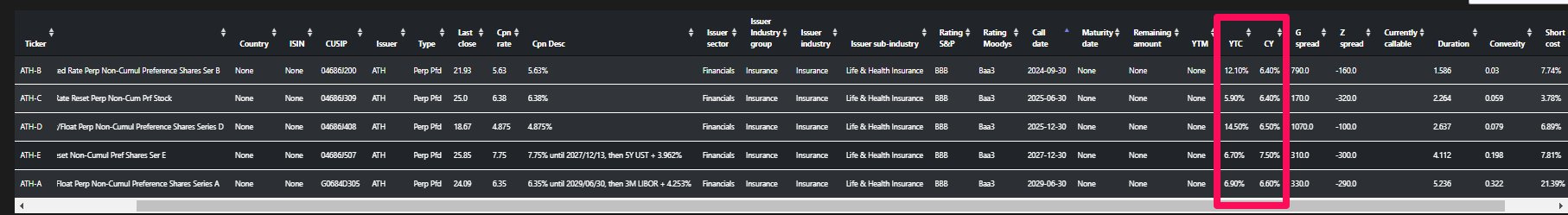

ATH-PE vs PGX - I am of the opinion that ATH-PE is currently lagging PFF and PGX’s move. ATH-PE is also undervalued relative to the rest of ATH’s preferred stocks on a current yield basis. I am not convinced, in the current environment, that comparing preferred stocks on a YTC basis is correct as the low coupons will trade below par until the FED lowers FFR. Since they trade below par their YTC will always be higher than the ones which trade above par. Additionally, until rates are at current or similar levels any of the issuers who managed to sell preferred stocks with coupons lower than 4.5% would not be very motivated to call them. Chances are slim. Therefore a CY metric seems more appropriate until rates start dropping.

On a trade management note, the trade could be expressed by going long ATH-PE and short ATH-PC but I would avoid that due to the unknown nature of borrow fees and the lack of liquidity on the short leg. You put yourself in a position where you are vulnerable to factors beyond your control. This is why I prefer to hedge with ETFs when it comes to preferred stocks. You know that the borrow will be very cheap due to the immense liquidity and that particular factor also adds to the optionality that ETFs give you when pair trading. For example, If I feel bearish I can overweight my short (PGX) x2 or even x3 if I wish. If the short doesn’t work out I can quickly reduce the pair to 1:1 notional exposure. If I feel bullish (which I am not), I can even get out of the short position and move to long only in the preferred stock. Approaching the pair trade that way I have put the control in my hands.

- Turkey 9.375% 33s (long) vs Turkey 8% 34s (short)

CONCLUSION:

As of this writing (Monday 16.1.23) I am feeling bearish equities and fixed income but it is worth pointing out that I am not in a doom and gloom mood but rather thinking that we see a technical pullback. Even if one is not bearish, it is a bit far fetched to believe that we can sustain this momentum to the upside. Buying right now is a fool’s errand and should be avoided. Things happened too quick, while nothing really changed. Did the narrative change, is the worst behind us or are we about to see another leg lower, are questions to ponder and better be left to the macro professionals. My job as a trader is to be aware of the current risks and position my portfolio to be less vulnerable and exposed to potential negative outcomes.

The way I positioned myself is via pair trades with the short legs being ETFs, where ever possible. That way I have more flexibility to overweight the short leg should I see weakening of the market internals. If I am wrong on the short side, then I can easily, with very little slippage, get rid of the extra weight on my short leg.

Start your day on the front foot with one of the top daily macro briefings on Substack. In under 10 minutes each morning, you’ll get:

Overnight price action across asset classes

Previews / reviews of key macro events

Upcoming data releases & CB speakers

Published every weekday around 8 am (UK). Subscribe for FREE 👇

WEEKLY EQUITY REVIEW

General market overview: Last week turned out to be solid for equities, no doubt about it. The market just grinded 2%+ higher and spend some time resting on the sma200d, without being rejected as one might have expected. I know you are probably sick of hearing, seeing and fearing it, but not only it is at the technical level everyone in finance (incl. Jim Cramer) speaks about, it is also at the descending trend line from 2022 that has served as a dream buster to all bulls.

Nothing really interesting has happened in land of the dollar, which keeps being as weak on the downside as it was strong on the upside. There is little doubt among shrewd traders/ investors that it has peaked. Rate differentials are only about to get tighter between US and non-US countries, as central banks among the world catch up with raising rates. This is no news, however, and I have been waiting for a dead cat bounce but am increasingly getting tired of doing so. This is how you know the move is near.

Bond land is a bit more exciting. The curve has moved down with shorter rates finding new recent lows. In contrast, long rates appear to have made higher lows and could be indicative to which bonds are to be weakest. After all, rates down and stock market up with FED’s promise of not making cuts after getting to 5% does not sit well with me. Something has to give.

The move since the beginning of 2023 is not that impressive in terms of gains if you look solely at the broad indices. It is decent for sure, but pales in comparison to some individual equities or EM ETFs, which I will mention lately. Most of them have jumped because they were sold due to tax loss harvesting. More importantly, some have also met inflows from newly allocated risk to PMs. Usually those inflows pause sometime mid January and serve as ground for mean reversion and profit taking of the big gains in the beginning of the year.

Sector overview and potential trades: Defensive sectors were the weakest link last week. Of all sectors and industries, only XLP (consumer staples) and XLV (healthcare) managed to close red with the latter being more flat than red. At this point, to me it is much more interesting to talk about some excessiveness that is hard just to pass by.

One has to look no further than airlines to spot it. Jets had a monster c. 10% week with earnings coming both from AAL and DAL. I know it is a bunch of tax-loss selling meeting good numbers but to me strong travel is such an old story it surprises me that it comes as a ‘surprise’ to anyone in markets.

DAL earnings’ gap was bid up so hard that the ETF closed at its highs. BA is equally stretched. If it was not for the earnings I would have heavily leaned on the short side here. Short term, things have gotten off the wheels.

Copper - Copper is another theme that has been pumped like there will be no tomorrow. Yes, we all heard that China is opening up. Yes, inventories are low. But please, 10% up from the 1st of Jan when the opening theme was I-do-not-know-how many days long. Now copper is at a key 4.25 level, gold is up too and the XME (metals and mining is up in the sky. FCX has already shown signs of being tired and sits a nice resistance, whereas SCCO leaves me speechless. This one is ripe for some mean reversion too. Earnings are once again my main issue here.

Current positions: We are long NG_F, short Z and short DIS

Natgas - Natty has been beaten down like no other due to warm weather across US and EU and historically high inventory because of it. We have clearly priced that in my opinion and the levels deserve some bottom picking.

Z - Housing had a strong start in 2023. Z was one of the worst performers in 2022. Fundaments in the housing sector have not gotten much better as far as I am updated. Some nice pump from this tax loss seller have made it possible for me to short it through a 42-39 long put spread expiring Feb 03. Risking half the premium.

DIS - I am short DIS with a 97-94 long put spread. I really like the level 100$ and stop at sma100d, making it easy to base a good RR on it. Earnings are not too close, even though it might be affected by NFLX ER this week. The good old mega caps being short theme is still very much on point and the company is having some stakeholder issues lately, which I guess are not of much help.

Conclusion: I am unsure of whether the market will go up or down from here. However, it makes little sense to bet on it going higher right at the resistance that has been putting a lid on price throughout the whole 2022. I would much rather play it short on some much extended names near good price and technical levels. I expect the New Year inflows to decrease in force and for some mean reversion and profit taking to take place soon.

If you are looking for a great way to start your day with a summary of overnight price action and key forward events you should check out Harkster’s daily newsletter. 👇

Start your day on the front foot with one of the top daily macro briefings on Substack. In under 10 minutes each morning, you’ll get:

Overnight price action across asset classes

Previews / reviews of key macro events

Upcoming data releases & CB speakers

Published every weekday around 8 am (UK). Subscribe for FREE 👇

Great review as always!

current mood well captured