We all eagerly awaited the FED’s press conference last week. The 75bps hike was exactly as expected but the presser turned the market into a horror show. As soon as Powell said “Let me say this, it is very premature to be thinking about pausing. So people, when they hear lags, they think about a pause. It's very premature in my view to think about or be talking about pausing our rate hike.” I knew I was in trouble. My immediate action was to get my hedges on.

But I make hedging look easier than it actually is. There are so many factors to consider whether it is appropriate to initiate hedges or not. Let me walk you through how I hedge and when I think is appropriate to do so:

Is the event going to be a market mover? - With FED press conferences this year, this is obviously a no-brainer. They’ve been the biggest market movers.

What type of hedges - In the case of Investment Grade Corporate bond exposure I am going for Treasury bond futures (similar maturity to my corporate bond exposure) instead of cash treasuries for the following 4 reasons:

The liquidity - You can basically go for institutional style orders without moving the market at all.

Ultra tight spreads - There is no slippage for getting in and out. Believe me, it compounds once you start doing size.

If you short cash treasuries , you are liable to pay the interest to the long holder on a daily basis. This adds to the cost of your hedge.

Ultra cheap commissions.

Combining all of the above reasons add up to substantial cost savings, cutting your costs by thousands of dollars on a monthly basis. If you do size, the costs savings are significantly greater.

How much size - Generally speaking, if the event is not considered to be significant, I will go for an amount corresponding to being perfectly duration hedged. This week’s event was a substantial game changer in my expectations and I decided to effectively turn from net long to net short by shorting 2x my notional long exposure. That is 2x times my duration adjusted hedge.

On the other side of the pond, European equity indices and CDS indices are performing relatively stable with the iTraxx Crossover trading around its 2 month lows. The DAX is showing relative strength compared to SPX which is surprising given all of the negativity that was directed towards Europe in August’22 and Septemeber’22. Quite the turn of events.

ADVICE:

Hedging with futures, instead of cash bonds will save you so much money that you can pay the college tuition fees for your kids.

Available futures contracts for USD denominated corporate debt: CBOT Treasury Futures Contract Details - (https://www.cmegroup.com/trading/interest-rates/basics-of-us-treasury-futures.html)

ZT_F (SHY)- 2 year treasuries

ZF_F (IEI)- 5 year treasuries

ZN_F (IEF)- 7-10 year treasuries

TN_F (Ultras) - 10 year treasuries

ZB_F (TLT)- 15-25 year treasuries

UB_F (Ultras) - 25 -30 year treasuries.

IBIG (LQD) futures - Investment grade bonds ( LQD)

IBHY (HYG) futures - High yield bonds (HYG)

Available futures contracts for EUR denominated corporate debt:

(https://www.eurex.com/ex-en/markets/int/fix/government-bonds/Euro-OAT-Futures-137416)

GERMAN bond futures

FGBS (Schatz) - 2 year German bond futures

FGBM (Bobl) - 5 year German bond futures

FGBL (Bund) - 10 year German bond futures

FBGX (Buxl) - 30 year German bond futures

FEHY - European High Yield futures

FECX - Euro Corporate SRI futures

FGGI - Euro Green bond futures

ITALIAN bond futures:

FBTS - 2-3 year Italian bond futures

FBTM - 5 year Italian bond futures

FBTP - 10 year Italian bond futures

FRENCH bond futures:

FOAM - 5 year French bond futures

FOAT - 10 year French bond futures

SPANISH bond futures

FBON - 9 year Spanish bond futures

SWISS bond futures

CONF - 8-13 year Swiss bond futures.

WHAT ARE THE CHARTS TELLING US?

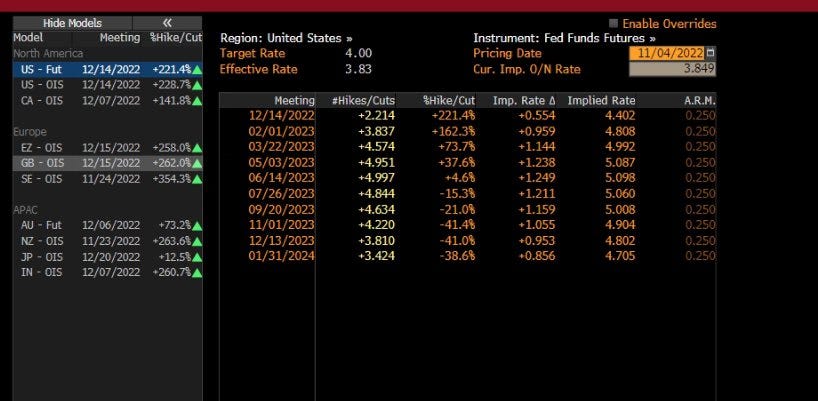

According to the Fed Fund Futures, the terminal rate is still trading around 5% in May’23/Jun’23. This shows the market didn’t believe Powell will go higher than what is currently priced in. Mr. Market says Powell is bluffing.

MOVE index trading lower again, closing the week with a big red candle . This was unexpected as I thought the long end volatility might affect it.

CDX High Yield index finished the week relatively calm given the long-end’s reaction and equity indices reaction.

VVIX and VIX are showing us we are in a period of fear is not present in the market.

POTENTIAL TRADES:

1. We found this week a good pair trades in USM 5.5% 2070s (long) - CUSIP: 911684884 (callable in 2026) baby bond vs the USM 6.7% 2033s (short) - CUSIP 911684AD0.

Must be noted the USM 5.5% 2070s bond is illiquid and not suitable for large accounts. However I think the opportunity is fantastic and if one is eager can work out to get reasonable size. On the bright side, there is another USM 5.5% 2070s bond with a different CUSIP - 911684801. Splitting the size in each of the bonds can make the illiquidity issue slightly better.

CURRENT TRADES:

We are still holders of the same trades. Only difference is the adding/removing of hedges whenever we are close to a risk event. We like the yield at these levels.

Long HSBC 7.39 28s bond

ENIIM 7.3% 27s bond

SOAF 7.3% 52s bond

All of our holdings ended the week flat or close to flat despite the down move in bonds. This is a adding further confidence to my bullish view.

RISKS:

Mid-term elections on Tuesday - I am not sure to what extend can fixed income products be affected by the elections and will not be employing hedging for that event BUT still want to note it as potential market mover.

CPI data on Thursday. This will be the big one as Powell mentioned several times that the FED will be data dependent. He moves the pressure away from the FED to economic releases therefore the market will be trading from one release to another and we would need to be very flexible on the hedging.

ECB President Lagarde and FOMC’s Mester speaking on Monday followed by more FOMC speakers right after the CPI data. These events had served as market movers lately.

CONCLUSION:

I am still leaning bullish in fixed income. I am taking note of what the MOVE index and the OIS Fed Fund Futures are telling us and will keep my long only exposure. Should a risk event occur I will keep on adding hedges, at times 2x the size. I prefer being very active on the hedging side instead of working on getting out of our corporate bond exposure as I don’t want to pay the slippage to get out. If I want to buy again I will have pay the offer to do so further adding to my costs. Right now we are earning 7%+ on our investment grade holdings. I like that yield.

One very important thing to note is the price action of the long-end bonds after Powell’s comments. Despite the hawkish comment, we have not seen new highs in yields. The CPI print on Thursday will be a big tell on the future of the bond market. If we get a higher than expected CPI print but no new highs in yields then we have received an important message from the market. Yields have reached a peak. Until then, I am on a wait and see mode.