Now is the best time to learn about relative value (PAIR TRADES)

The best pair trades are born in volatile times

When I started my journey as a trader I was lucky enough to start just prior to the GFC in ‘08 (started in ‘06 as retail, went the professional prop trading route in ‘07). I was baptized by volatility and as a trader I live for those moments. High volatility environments are really not meant to be traded by everyone. Some lose their cool and forget about their risk management, others stare in their screens in disbelief of what is going on. There is this small number of traders that I’ve seen have their eyes fired up and can’t get off their desk from the pre-market session to late after hours session as they don’t want to miss even a second of the action. And who would blame them, this is the time when they make their fortunes. This is the time where I will try to help us much as I can to navigate the markets.

To start with I believe in a few simple rules that need to be followed in this environment:

Avoid leaving large naked directional overnight positions. My exposure is fully hedged at all times or each trade is done via options spreads. Price swings are so large that you can easily get stopped out of any position. Heck, you can even get wiped out.. Imagine the horror holders of SIVB, SI and SBNY are going through. You never know who is next.

You shouldn’t fight anything that doesn’t make sense, especially if you are holding naked long or short positions. In the past few days we saw the short-end make the mother of all squeezes. FFR expectations are now even pricing several rate cuts. I know, that doesn’t make any sense but it may keep on going that way for longer or we can get further squeezed. So expressing a counter trend move with naked exposure to the short side is very dangerous and if you really want to do so you should do it via options in order to limit your risk.

Short-term trading is where the excellent risk adjusted returns are. The key phrase here is risk adjusted. You don’t take any overnight risk and you can exit quickly should things not work out.

BUT THE BEST trades are in the relative valued/pair trading world. This point is where all of my focus is and where I believe the best risk adjusted returns come from. Let me show you what I have in mind by explaining a few trades we did in the past week.

Let me tell you what risks I see and why I think trading directional is a lot harder now.

The CS fiasco may bring down other EU banks. First one that pops in my mind is DB.

Many argue that CS will never be left to die because it is a too big to fail European bank. I absolutely agree with this argument but would like to add that before a bail out happens there can be plenty more volatility to the downside, not just in the case of CS but other EU banks as well. Second the bail out may be conditional and nationalization may be in the cards which would automatically wipe out all equity holders and potentially hybrid holders. If that happens we have monster drop in yields and rate hike expectations in Europe aka the squeeze continues.

Alternatively, if you want to sell CS equity or debt because you are feeling bearish, you may get caught in the cross fire of news headlines. As you are aware SNB (Swiss National Bank) is providing a 50bn Swiss franc lifeline to CS which automatically means a huge squeeze of the shorts, not just in banks but in indices in general. There are so many ways to lose money in the current environment, if you are a directional trader, that I don’t think there are many cases in which it is worth doing it. Worst part of all? With directional risk you will be glued to the monitors day and night and wouldn’t be able to sleep at night.

For that particular reason let me shed some light on what we do on the trading floor and with our private subscribers.

THE TRADES:

WAL-PA vs WAL $25 Apr’23 puts.

There is no chart that I can add to this trade but would try to explain the logic as best as I can.

The idea is simple. I found the preferred cheap at $8 but didn’t want to take the risk of potential insolvency and was looking for a hedge. I was looking at the options chain of WAL and noticed that the $25 puts expiring in Apr’23 were trading at $8.5-$9ish. A quick math shows that if I buy them at $9 and WAL -44.86%↓ goes insolvent I would make $16 in profit. If I lose everything in WAL-A I am going to lose $8.38. Therefore in a worst case scenario I make $16 in the WAL puts and lose $8.38 in the preferred (Also it pays dividend today). So I am nearly flat in the trade should they go bankrupt. I am flat because I got 2x more size in WAL-A as opposed to 1x size in the puts. (to match my risk). If WAL rallies I am limited by the max loss of my puts and happy from the fact that my losing position is with 50% the position size. Additionally, WAL puts will retain some value even if the common rallies to $50 so it won’t be a full loser in the puts. My worst case scenario is significant drop in volatility and the common churning around $20-$30 until expiration. That would mean losing nearly the full premium while I have no clue what may happen to the preferred, although it is likely that a drop in vol would boost the price of the preferred. Given the current situation I am skeptical that volatility will quiet down in a day or two.

2 days ago we sold half of the position. Still holding the other half. Remember, I have 2x the size in WAL-A compared to 1x the size in the puts.

Bought WAL-A at $8.17, sold half of WAL-A at $11.55 average price.

Bought WAL $25 puts Apr’23 at $8.85, sold half of WAL $25 puts Apr’23 at $7.335 avg price.

Onto the next position:

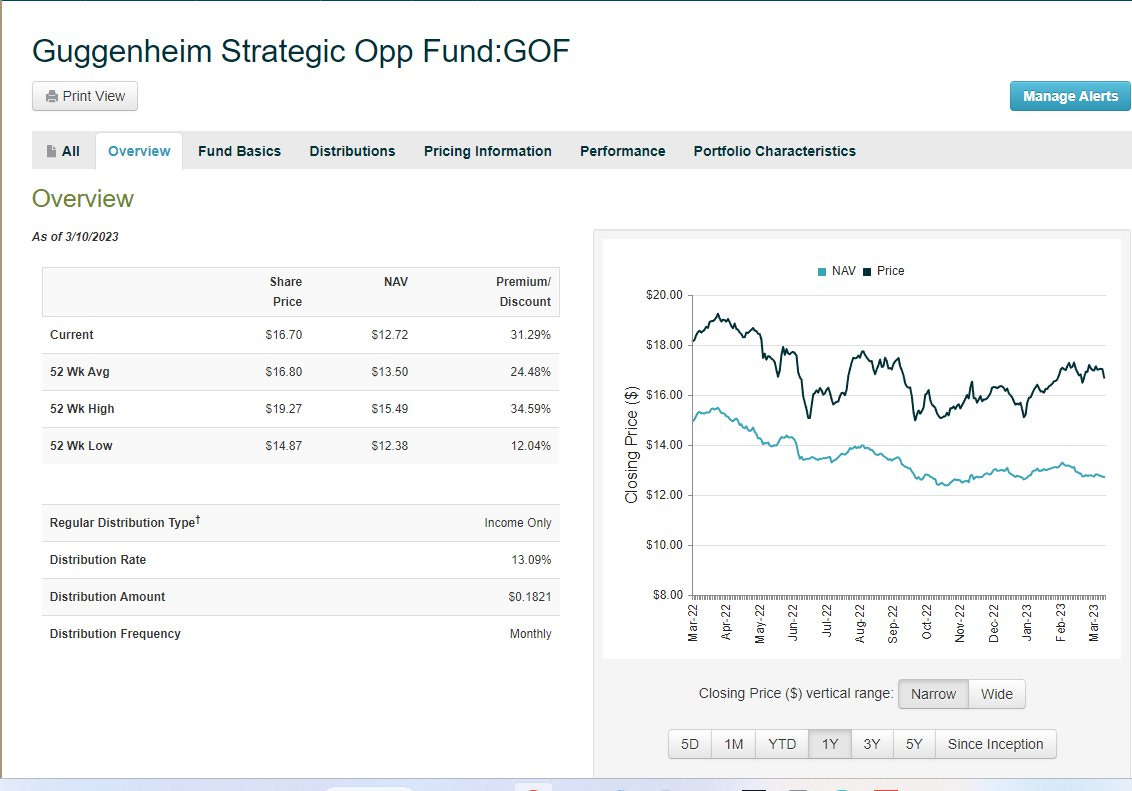

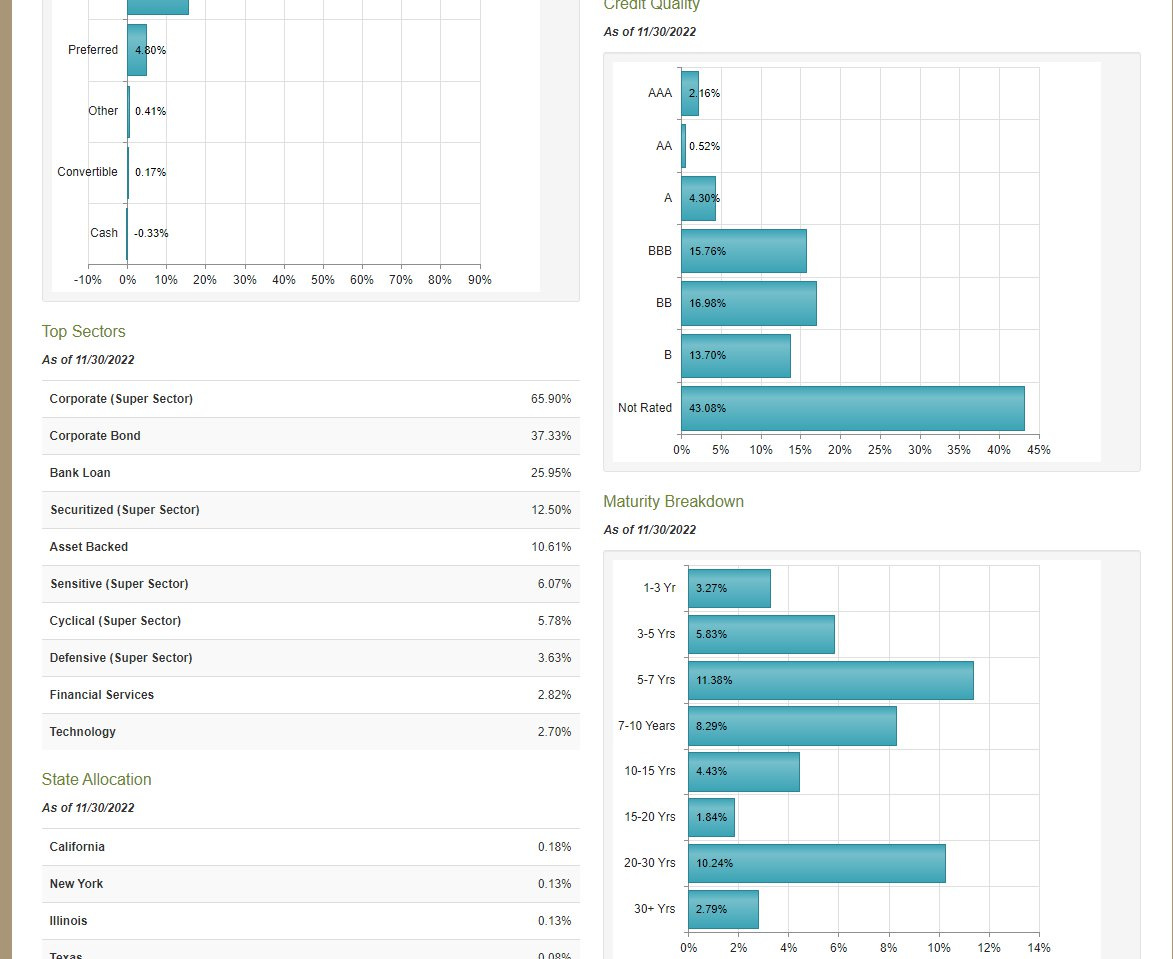

HYG vs GOF

We are short GOF from $16.92 vs long HYG from $73.45. The purpose of the trade is to take advantage of GOF’s mispricing as it is currently trading at a significant premium. (Screenshots below are from the time I initiated the trade)

Let me explain why I like the trade:

It is trading at one of the largest premiums it has traded in the last 52 weeks.

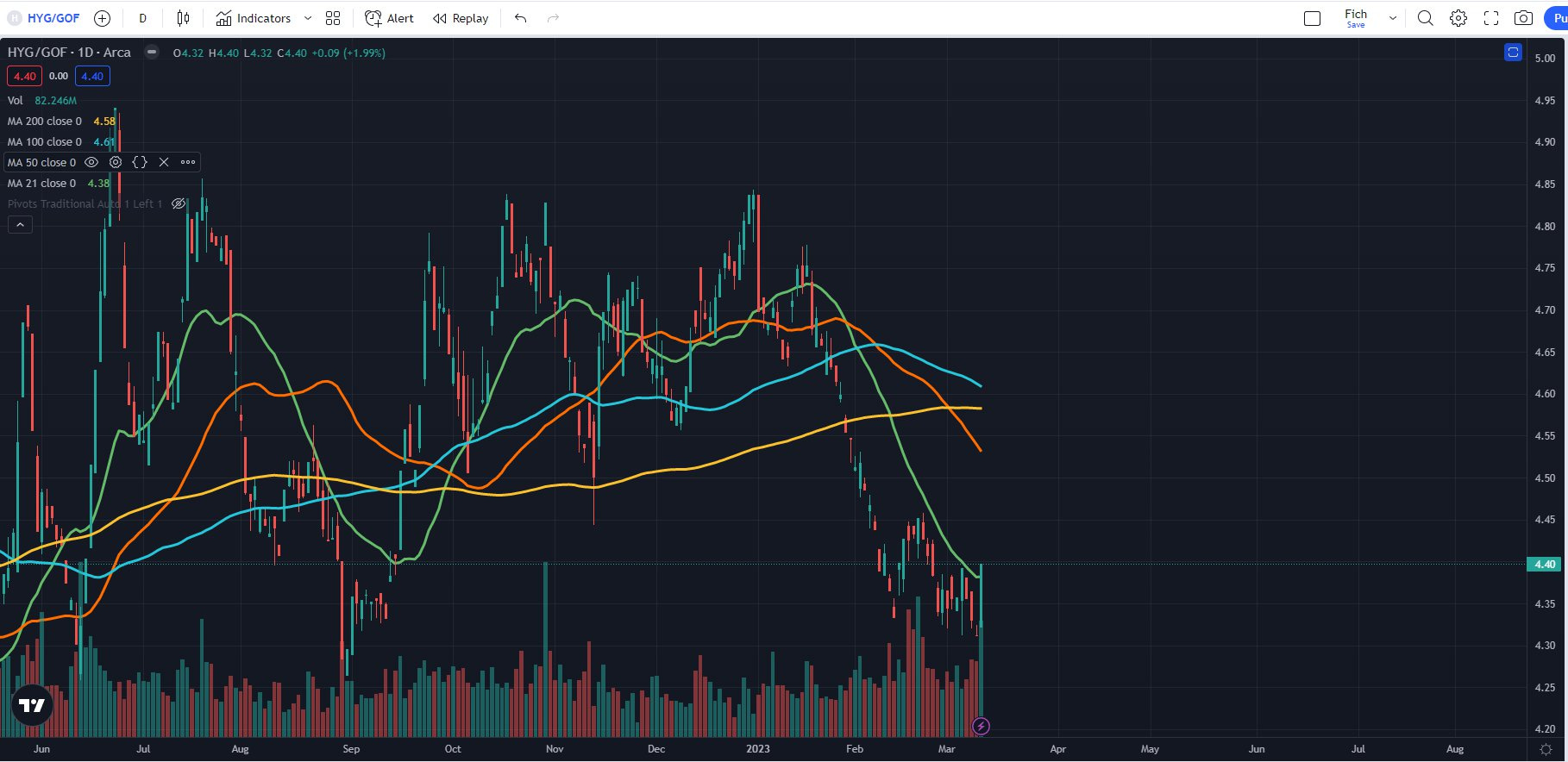

The ratio chart against HYG , HYG/GOF if you use tradingivew.com as charting software is at an excellent support level.

I chose HYG because the majority of the portfolio is in bonds , mostly below BBB (HY)

There are certain headwinds though.

The 17% borrow fee is quite steep, therefore I don’t expect to hold this one very long. To make the trade worthwhile we should be relatively confident that it should work out in a month or so.

Ex-dividend date is on Tuesday. We will pay the dividend which would mean higher costs. Nevertheless my anticipation is for GOF to reach at least the 52 Week Average premium/discount.

This is the current chart of the trade. HYG outperformed GOF by about ~6% in about 4 trading days and we already sold 50% of the position for a handsome profit. It goes without saying that the current volatility helped GOF get a bit more ‘fairly valued’ but this is where my major point lies. By doing relative value trades, you position yourself on the right side for when volatility picks up. Overvalued products very quickly become fairly valued. That is why I am not afraid to hold such trades overnight and why I am proactively looking for them. If there is no volatility they need time to work out.

What I am trying to show with today’s trades is that with volatility comes the opportunities. The WAL-A trade wouldn’t have worked out if there was no volatility in both the common stock and preferred. These opportunities are usually lying around for a day or two at most and then tend to get priced in correctly. Most importantly, each of these trades allows you to sleep well at night and take reasonable risk, especially if you use leverage in your trading.

Occasionally we also take directional trades. We just did a few in the past few days. Some of them are in ZB_F and SOFR Jun’23 options but expressed each trade via put spreads with about a month’s time to expiration.

I am a believer that we likely won’t see cuts, at least not as fast as the market is pricing but at the same time I didn’t want to hold naked short positions as the squeeze could continue for longer. Actually I rarely like to hold naked exposure to either side.

Whenever we do a trade we also try to figure out what the risk is first before implementing the trade. As I was aware that the squeeze may continue if the banking crisis spread over to more and more banks I wanted to make sure that I have a limited loss. I am sizing my position accordingly to whatever amount I am willing to lose in the trade and sleep tight at night.

As usual, if you are finding value in the trades we share or want to learn a lot more about them and our approach in general, you would find it beneficial to subscribe to our private Substack. Here is the link to a very detailed article about my thoughts about risk management and how I applied it to one of our positions and several relative value/pair trade ideas I discovered.

All the best!

Day Trading vs. Swing Trading: Which is Right for You?

On listed exchanges, in almost all cases, they don’t. There is industry chatter if it’s a particularly large trade, but even then not everyone hears about it. There’s a phenomenon called ‘shopping flow’ where a very good hedge fund customer might hear from their broker that they’re seeing other volume in the name - it’s one of the ways brokers, who provide a largely commoditized service for hedge funds - differentiate themselves from one another.