Our latest Options trading idea

After yesterday’s hawkish comments by Powell the bond market started selling off again. This created an opportunity in REM (Mortgage Real Estate ETF).

Here is our trade idea:

$22 Dec’16 puts at mid-point are trading around $1.25. They may open higher today if REM is lower at the open.

The trade can be aggressive by risking 50% of the premium, effectively 2x-ing your size. It can be done less aggressively by risking 75% or 100% of the premium

If the trade turns out to be a winner and moves lower to $21 one can start shorting $20 or $19 Nov’18 put premium. This move lowers your risk, increases your risk-to-reward and opens you to shorting more (if previous short had expired worthless) premium if REM holds the lows.

Personally I prefer having more choices when it comes to selling premium. Therefore I looked at REM’s holdings to pick up a constituent with more options expiration dates. This will only add flexibility to my trading. I can go for my favorite short dated expiries where the theta burn is the highest.

Here is the list of the top 10 REM holdings.

Going through the options chains of the top 4 holdings, which comprise 40% of the ETF I found that NLY and AGNC have weekly expirations. If any of the top 4 moves, the ETF will move, so you are in effect trading the ETF via common stock.

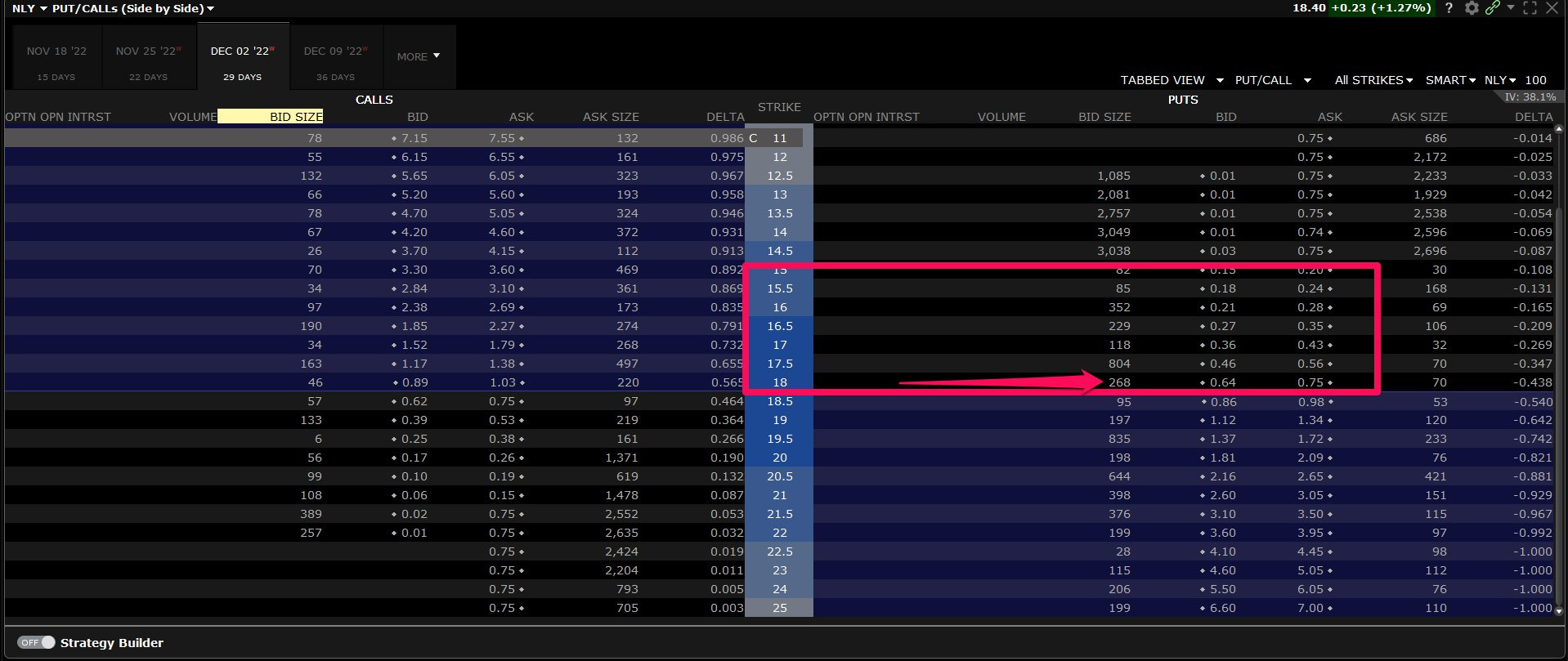

Following the example of the REM trade I checked the puts of AGNC and NLY. I like best Dec’02 $18 puts at $0.70 mid.

Buying the Dec’02 put at $0.7mid (hopefully). One can choose to risk 50% of the premium , 75% of the premium or 100% of the premium, depending on how confident they feel about the trade.

If correct one can short put premium on the shorter expirations at $15 or $16, depending on how quick the move down happens. Short premium position sizing = long premium position size

CONCLUSION:

The REM trade idea is identical but in the case of NLY you have the flexibility to pick weekly expirations. If you get the direction correct, you are in a position to short premium every week. This quickly adds up and makes THE BIG difference. As I have emphasized numerous times, it is not the idea that matters but how you manage your trade.