Social media is usually filled with positive outcomes on all sorts of trades. We are all happy to share when we are doing well but everyone goes quite when things do not exactly line up as intended.

Funny enough, in the trading world the type of mistakes made by experienced and retail traders are very similar, it is the frequency that separates them. Well, and the magnitude of losses. What is not usually talked about is that mistakes are not always translated into direct losses, sometimes they are missed opportunities. This is what happened to me last week when I was so eagerly anticipating the perfect level to short long-end treasuries. I’ve been mentioning the levels several times, I got the clustered support levels I outlines on Twitter, and I was so eager to short them that when the time came I didn’t act on it. I kept saying to myself they can keep squeezing until Friday or Monday afternoon, just before the CPI release. The upcoming eventful week made me want to wait until the very last moment before shorting. I was waiting for the ‘perfect trade’. The precautious approach cost me the trade and now I am sitting on the sidelines waiting for another opportunity.

What I am trying to say is, that it is never the trading idea that generates the ALPHA for you, it is the trade management. In this case, there was no trade management as there was no trade. These seemingly unimportant moments are the small nuances that make a big difference to our trading on a yearly basis.

There is no big lesson in here, just pointing the obvious that experienced traders are mortals too and make mistakes. On trading floors we get to see this on a daily basis and we are familiar with how the nature of trading goes but many traders do have access to what is happening on trading floors on a daily basis.

Lets move to the credit world.

WHAT ARE THE CHARTS TELLING US:

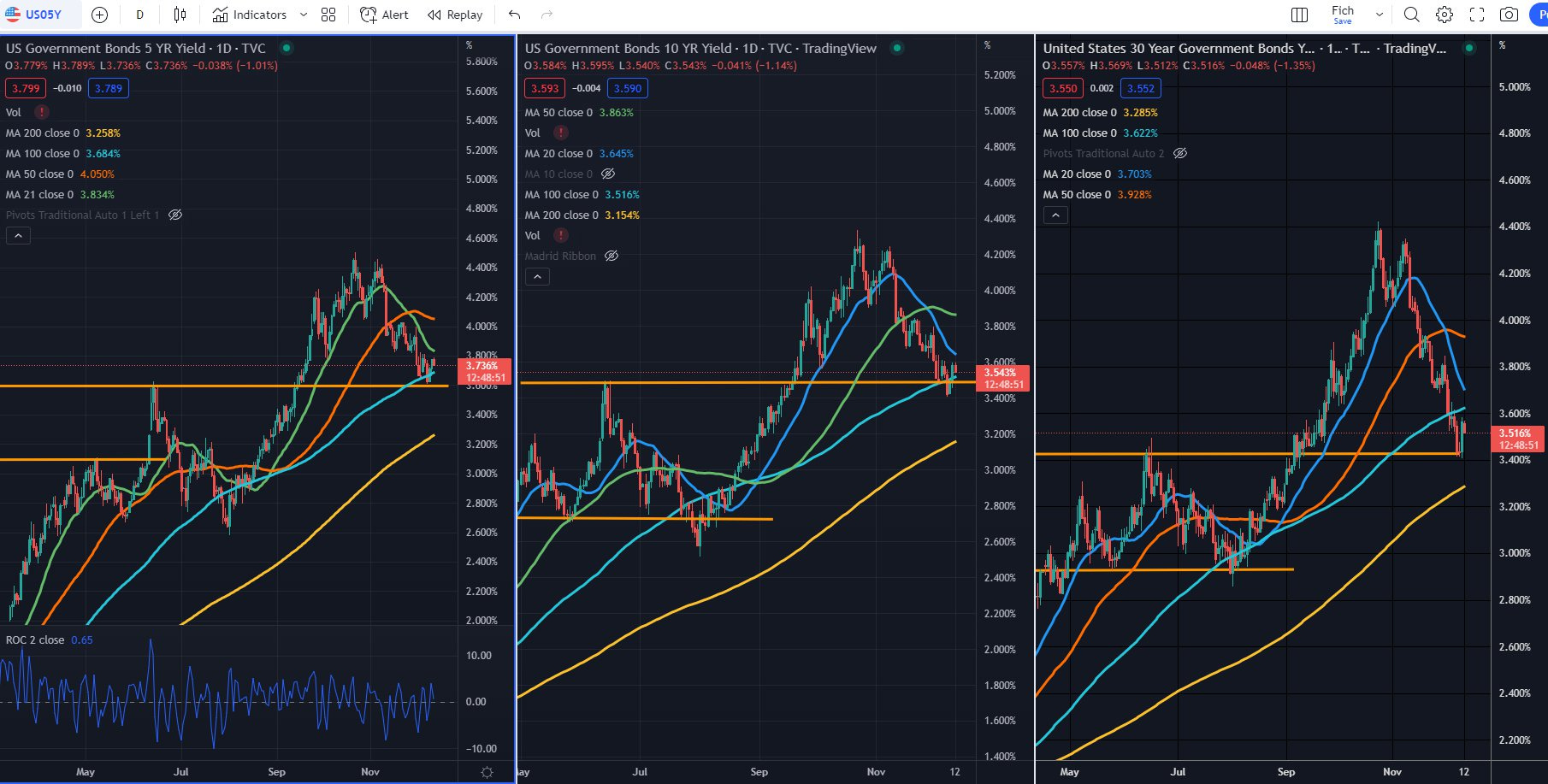

As expected we bounced from the Jun’22 highs level. Deep down I hope on CPI or FOMC day we get another go at the levels where I will have a trade this time.

MUB - National Muni Bond ETF. When we get an initial tag on the 200d SMA for the first time we usually get a reaction of the level. I think this trade will be a good fade this week.

MBB - MBS ETF - Currently sitting on the 100d SMA and 2022 downward sloping trendline. Another one I see good enough for fading.

THE RISKS:

This week we need to be conscious of the CPI release on Tuesday, FOMC announcement on Wednesday and ECB’s rate decision on Thursday

CURRENT POSITIONS:

Long G-spread REPHUN 34

Long G-spread ROMANI 31

Long GP 7.25% 28s at 110.08 (US373298BP28) vs IBIGG3 at $127.25 (LQD) futures. Duration adjusted.

POTENTIAL POSITIONS:

I would still go for the same trade idea as last week since nothing significant changed. If this week turns out to be less volatile than expected I will opt for buying USD perpetuals that are finding it hard to rally. The idea is very simple, I want to play the potential window dressing at the end of the year + collect juicy coupons along the way. Even if the capital appreciation does not materialize I will end up collecting the coupon. Sounds like a win/win to me.

CONCLUSION:

My plan for the week is to short the long-end if we get a squeeze post FOMC. I think the levels will hold into year end and present us with wondering risk to reward opportunity. I still believe the cash market will be very slow with the potential for a slow grind to the upside. Therefore the shorts I have in REPHUN and ROMANI will be exited this week, with 1/2 of them even prior to FOMC.

What we’ve seen this year is that volatility picks up significantly during big economic releases and FOMC meetings. I don’t expect this week to be any different. That is why I don’t believe in being very brave prior to these releases. If you don’t have positions wait for the anxiety to cool off BUT be prepared with a list of potential long and short candidates. Preparation is key.