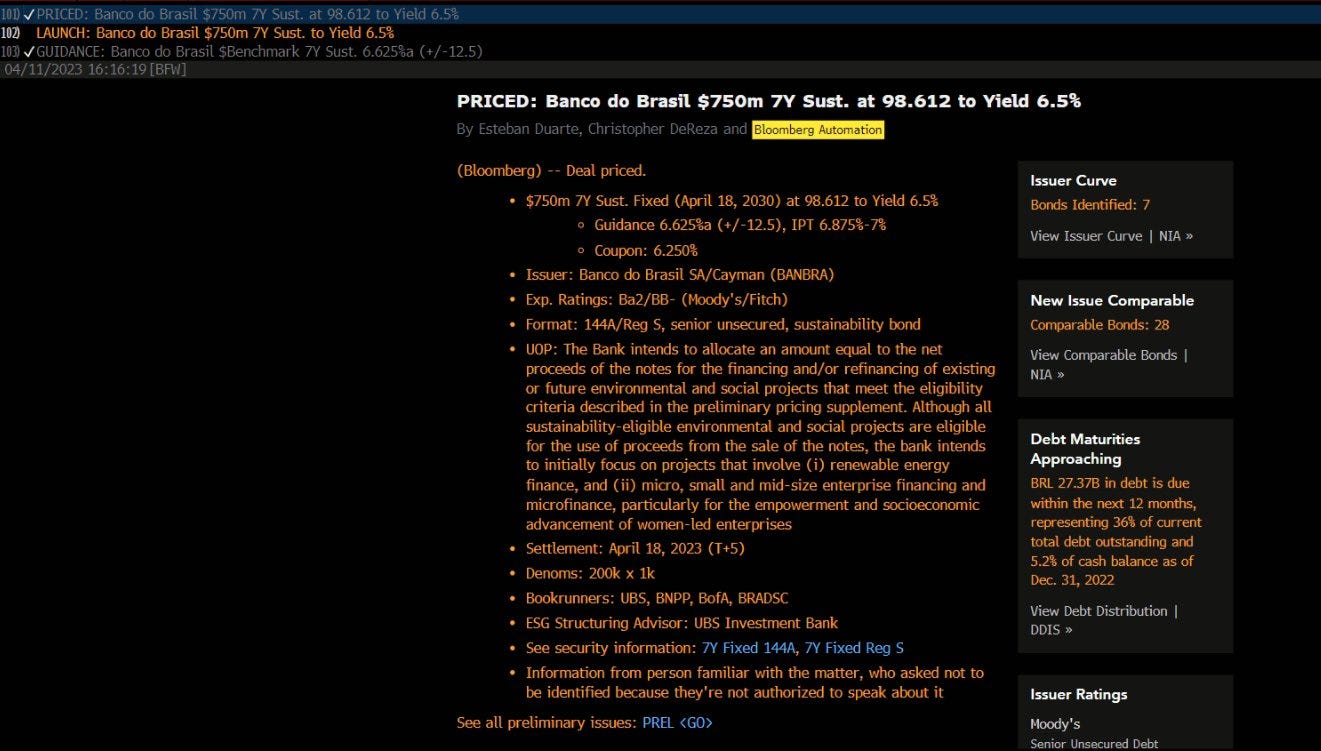

Recently, there was a new issue by BANBRA (Banco do Brasil)

It was issued at 6.5% while the secondary curve , with a similar maturity was trading around ~6%.

It seems as there is a decent upside for anyone who gets allocated but just exactly how good this trade is. Below I will explain how I approached this trade and whether I decided to trade it. But before that, let me share a few pros and cons of doing primary market trades:

Now, contrary to what many people believe, I am of the opinion that doing the math is the most basic aspect of trading the primaries. Everyone knows how to value a new issue and this is certainly not the reason why some people are better than others at this strategy.

The biggest and most important factor dominating the profitability of this strategy is…..

Having an excellent relationship with the leads , maybe if you are on a first name basis also helps. This will really help you get extra allocation.

Let me tell you why a good relationship with the leads is important:

The allocation process is non-linear. Sometimes you get allocated 10% on your order, another time you don’t get allocated at all and sometimes, if the issue is not priced well (i.e too tight) you may get your full order allocated. This variety in allocations brings a lot of uncertainty on your PnL as you always end up with the MOST size in the LEAST performing issues and the LEAST size in the BEST performing issues. Such is the life of the primary market trader.

But if you are like myself, a mere mortal, who does not have a particularly close relationship with the leads, you would need to think of other ways to make this pattern work for you.

Here is what I learned in primary market trading and what I use on a daily basis to improve my process:

New issues are also affected by risk on/risk off days. You should be aware of potential risk events in the next few days.

Hedging is not always easy. Some people hedge with treasuries if the bond is IG rated but HY bonds are difficult to hedge as you have a lot of idiosyncratic risk there. If you can’t find an appropriate hedge, is the new issue worth taking on the directional risk, if traded as a standalone instrument?

Hedging IG bonds with treasuries is a VERY bad idea on a risk off day. Treasuries get bought while the cash market is either flat or offer only for the day. Also getting someone to provide decent quotes is a very difficult job.

In risk off days, the liquidity is ALWAYS at very bad prices, IF you find any liquidity in the first place. This is where the hedging part becomes very important. You need to know what can protect you well, so that you can weather the storm, until volatility calms down and liquidity comes back to the market.

In order to make the pattern more consistent you need to be better at making the following discretionary decision.

Picking your best hedges based on your expectation of volatility in the coming days. Sometimes it may be better to just buy the bond and hold it, other times it would be better to hedge with thematic ETFs like LQD or HYG and sometimes doing the old fashion G-spread trade would be sufficient. The decision would depend on what your expectations are for the next few days. If you expect:

Credit spreads tightening you will be better off with a G-spread trade

Volatility you will be better off with hedging via thematic ETFs

If you expect a calm market you will be best served trading the issue outright

Some bonds, usually those of lower ratings, can be paired traded with their respective secondary curve providing a very safe trade, whenever there is no appropriate liquid hedge. However, if you like this approach you should take into account a few factors:

There is large slippage when you get in and out of such a trade, diminishing your returns

You pay the carry and borrow fee on your short position, often leading to negative carry on the position or you have to pay to hold the position.

You should make sure there is sufficient room for profit when you account for the above mentioned set backs.

Some bonds are so good that you don’t need to hedge them but take the directional risk. This is my least preferred method.

Lets move to the BANBRA bond (Banco de Brasil)

Let us start with what category the bond falls into. To me this is a EM bond that can generally be hedged with EMB (the ETF), however I like to check if EMB had other issues from the same issuer already added to the same bond but in this case it didn’t have. So I shrugged the idea to hedge this bond with EMB.

Then I looked at the rating. a BB- (by S&P) falls into the high yield category. Since this is not an IG bond I am not going to hedge it with treasuries as this type of hedge is not appropriate. I am also reluctant to hedge with the the US High Yield ETF (HYG) as the constituents of that ETF are VERY different and would not essentially serve as hedges.

Now that I figured out I don’t have an appropriate hedge with any of the liquid instruments that I have access to I turned to the secondary curve. I noticed the YTM difference is around ~.40bps but at the same time they have around a year and a quarter between them. Accounting for the maturity difference should equal to 10-15 bps possibly therefore the realistic potential profit shouldn’t be more than ~20-25bps? When you account for the slippage of getting in and out of 2 different bonds at the same time , you quickly realize that this is a worthless endeavor and the capital used for this trade is not going to bring the returns you would want to see.

Therefore I figured out that I would not want to pair trade this bond based on the above factors.

Then I moved to figuring out if I want to trade the bond outright long. The bond was issued on the 11th of April, a day before the CPI report and FOMC minutes. This generally makes me hesitant to participate in any new issues, let alone buying them without hedge.

After exhausting all possible ways to trade the bond I figured out that I am not going to participate in this new issue and quickly shrugged it off. There was no trade for me.

CONCLUSION:

It is the discretionary decisions that make us good or bad traders. The general idea that something is a buy or sell is the easiest thing to come up with. Ideas are abundant, it is the execution that is the tough part. I have been saying for ages that it is not the trade idea per se what separates the good traders from the very best. It has always been the trade management of the trade. That includes how to structure the trade, how much risk to take (in the context of your portfolio or account size), when to exit the trade if it does not perform as expected or whether to enter the trade in the first place. A straight forward trading pattern like buying new credit issues on the primary corporate market may sound pretty easy but in truth it is the way you construct the trade that makes the big difference. This is what we do on our trading floor at all times. Discuss ideas but most importantly we try to figure out the best way to trade them. If you like what you read and want to see how we approach our trading and what trades we add to our portfolio you may consider subscribing to our private Substack.

Great comment & very helpful! „Everyone knows how to value a new issue“ > tbh, i wd love to know your best strategy, thanks!