The weeks was characterized by slow and steady bleeding in both the bond and equity markets ending with a culmination on Friday with a wild reversal bar. Credit spreads and CDS indices widened in Europe and the States, clearly displaying the fear building up in the markets. In Europe the iTraxx Crossover index is attempting to break the June’22 highs and barely holding the levels. A single stress day in the markets and we will be targeting the COVID highs. I find it particularly difficult to find a reasonable trade in this environment as I can feel it in my blood that stress is building and the resistance levels in the CDS indices along side with the major resistance levels in the German and US 2 year yields are on the verge of a breakout. We can all feel the negativity building up on Twitter, however one thing that it is not mentioned as often is the dropping 1 year forward inflation swaps in the United States, United Kingdom and the Eurozone countries. It seems that the repricing of the expected rate hikes in the United States and Europe played a role and now traders are expecting lower inflation levels. If that will affect the upcoming rate decisions is yet to be seen.

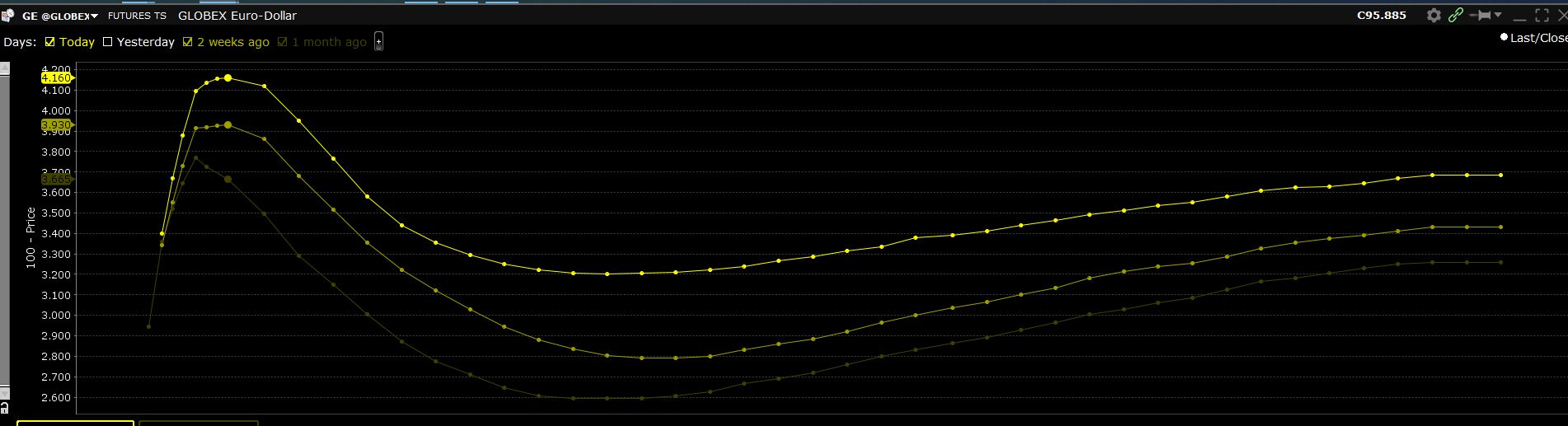

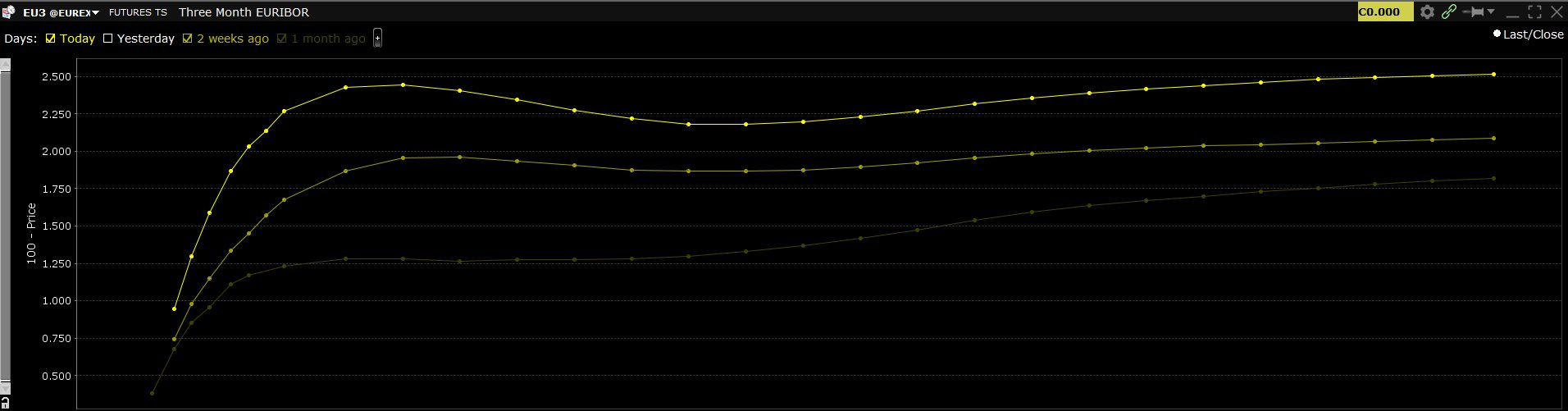

The main reason we saw short-term bonds reaching support levels and yields resistance levels is the repricing of the expected rate hikes in Europe and the United States. In the past 15 days we saw the Fed Fund Rates expectations reprice from 50bps to 75bps hike in September and from 25bps to 50bps hike in October. That is another 50bps of hikes in a 2 month window. Mr. market expects the same action by the ECB. You can see how the market’s perception of what the FED and the ECB may do changed aggressively in such a short-period of time and how that affected both the equity markets and bond markets simultaneously.

For the time being I don’t expect further aggressive repricing of the forward curves as the 1 year inflation swaps are already dropping and accounting for the additional price hikes. Additionally a lot of hawkishness had been priced in and in order to see further evidence of aggressive FED/ECB we will need to see further strong economic prints. I honestly have no idea if this will happen.

I am watching like a hawk the US02Y yield and DE02Y yield (German 2 year) charts. They do represent quite well the FED/ECB’s intentions and currently are sitting at very convenient resistance levels. Trouble is that should we see an upward surprise in an economic indicator used to forecast inflation then we break to the upside decisively. This is where thinking about a good trade construction comes into play and makes the big difference. There are several ways of expressing a short yield trade (long bonds). This is a short-term potential idea with a clear stop. The main thesis is to short the upper range of the yield chart (long bonds) at a time when large part of the additional rate hikes are being priced in. I am of the opinion that the risk to reward and timing is good for a trade.

Options 1: Buying the bonds outright. This is my LEAST favorite option as outright buying is subject to a lot of whipsaw action around the key levels and traders can easily get discouraged holding such a trade as it is difficult to sit out a sharp down move or prolonged whipsaw action as stops may get triggered. It gets increasingly frustrating should the price of bonds retrace after being stopped out. I can recall more than one keyboards falling victim to similar price action.

Options 2: Buying via options or an options structure. A few examples might be buying an outright call or a simple call spread. Currently bond futures’ implied volatility is quite high given where the MOVE index is (ICE BOFAML Bond market options volatility estimate index) and a bit more creativity is required which takes form in the active trade management of a position. I usually opt for risking 50% to 75% of the premium I had paid and calculate my risk to reward by taking into account the premium I intend to risk. There may be cases where I am unable to honor the exact stop level but at least I get a peace of mind by knowing that no matter what happens in the markets I have a limited loss at any given moment. This fact by itself helps with three very important aspects in MY trading:

Having a peace of mind which helps with sleeping well.

Ability to calculate my max loss and hence size up my positions accordingly. This approach significantly improves the process of managing a larger portfolio.

Construct each trade with reward 2 to 3 times larger than the risk taken (in some lucky cases even more). Looking to achieve 2-3 times my risk does NOT mean I achieve it every time but this is what I aim for in every trade.

As you can guess I focus solely on option 2 on the vast majority of my trades.

FIXED INCOME ETFS:

HYG - We have broken decisively the $76 level I shared last week. I am happy to not even attempt buying it. Waiting on the sidelines for the whole week had been my best trading decision for the year. My eyes are on the $73 level now. Odds are we go there soon.

PGX - Chart looks almost identical to HYG and to be fair most fixed-income ETFs share the same looking chart. My thesis for PGX is the same as it is for HYG. waiting for the lower support line , in this case $12. On Friday I had entered a pair trade by going long PGX and shorting WFC 5.875% perpetual. This is a different trade from going long PGX outright and that is why I have no problem taking this risk.

EMB - To be fair , Emerging Markets debt had been relatively stronger compared to HYG and LQD, which is surprising given where the US Dollar is trading (DXY) and the sky high inflation rocking EM markets, but pricing action never lies so there must be a reason for that. Fundamental analysis is not my strong suit and I don’t know the exact reason for the outperformance but I live by the rule that price acts first and fundamentals come second. I focus on the technical analysis, identification of important levels, timing and trade construction. The prior support line, which now serves as resistance on the ratio chart looks like a good spot to try to short EMB and buy HYG , especially with the 100d SMA sitting exactly on the resistance line. This makes sense if you think EMB is short but don’t want to short it at the current level.

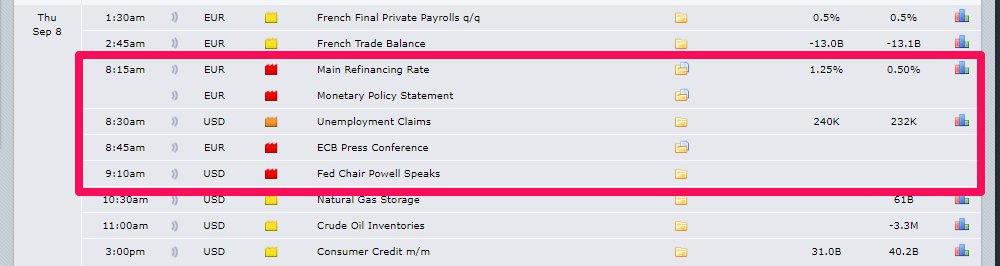

THE WEEK AHEAD:

Next week we have the ECB’s rates decision which will be watched by the whole world. Expectations are for 75bps in Sept and 50bps in Oct. (at least this is what the market prices at the moment). Given the short-week and the importance of the decision the market will likely be muted until the actual decision is out. One thing to note, muted in this environment means $10 point move in SPY. Daily ranges are still quite high.

CURRENT POSITIONS:

Yet again I have no confidence in any new trades and do not suggest getting over exposed in the credit markets. The market is volatile, as we clearly saw on Friday and getting stopped out of a position is easier than ever. Cash is also a position and staying on the sidelines while using the time to research potential trades is the best investment one can do at the moment. My goal is to be prepared when the right time comes.

Long PGX vs Short WFC 5.875% perpetual from 0.1242 ratio price.

POTENTIAL TRADES:

HYG vs EMB

Long US02Y bonds and/or DE02Y bonds for a short-term trade, however I am not long yet and am waiting for the ECB decision.

CONCLUSION:

Last week I was a lot more clueless than this week. With the approaching of major levels at least I have a base on which I can form trades and look at options prices. Nevertheless I still remain clueless as to the next direction of the credit markets and do not have the same confidence in the direction as I had in the end of June and beginning of August. This is one of these periods where you have to wait patiently on the sidelines until the market tells you what it intends to do. I think the alpha right now is in doing nothing. Never forget Paul Tudor Jones’s quote: