Lately, we have been bombarded with so much pessimism about the future of Europe that makes you think if we will survive this winter. But as with most cases we should take the opinions of random people on social media with a pinch of salt and focus on what the market is telling us. After all, media outlets feed themselves with pessimism. You can not expect inflation and energy issues to continue into perpetuity. Peak media frenzy is usually the time to look around for a contrarian trade as the masses are the last ones to get into it. Selling fear and pessimism is good business for newspapers and newsletters but not profitable for traders. Selling the lows in the equity or bond markets is not a profitable endeavor and does not present a trader with a good risk to reward ratio. In fact, being contrarian to consensus beliefs is what makes you the money but only if you can read the signs pointing to a possible turn around. Below I will outline the signs that made an impression to me in the last couple of days.

We can clearly see the iTraxx Crossover failing to make new highs despite the Nord Stream 1 cut off. In addition European Natural Gas futures contracts and German 1 year forward baseload electricity contracts failed to make new highs on this important day. It felt like the market had already priced in a worst case scenario of NS1 shutdown and it was expected.

Elevated ECB rate hike expectations. The EZ-OIS market is now pricing 50bps in October and another 50bps in December. As a reference, just a month ago the market was pricing 50bps in September, 25bps in October and another 25bps in December. We have added additional 75bps in hikes from what was expected just a month ago and the European equity markets still didn’t crash.

1 year forward inflation expectations in the US and Europe keep dropping further, reinforcing the market’s beliefs that we have seen the worse in terms of inflation.

Throughout the storm of negativity and pessimism in Europe the market was telling us that it had enough and it is ready for what is coming. I used this information to flip my views from short-term bearish to short-term and buy some proxy FI positions. It goes without saying that this is not a risk free trade and a ‘sure thing’. I was simply thinking that I have the timing and the risk to reward on my side which was enough for me.

COUNTER ARGUMENTS:

Let us not be one-sided and point out a few counter arguments supporting the opposite views. I see a few charts that have me on the edge of my chair:

The German 2 year yield broke out out of its range and is currently trading above the resistance level of 1.25%. Given the repricing of the ECB’s expected hikes, this is to be expected. There is a strong argument for inflation to not calm down in Europe as the energy and inflation subsidies announced across the continent will keep demand going while the supply issues are not fully addressed, not to mention solved.

US2 and US30 year yields are on the verge of breaking out of their respective ranges. The reason for the US02 year yield breaking out to the upside is identical to what is happening in Europe but right now I have no clue why the 30Y is attempting a breakout. Might be QT but that is nothing more than a guess.

FIXED INCOME ETFS:

PGX - If the positive momentum in the equity markets keeps going we can expect a short-term rally in the preferred stocks ETFs at least testing the 100d SMA and the 50% Fibonacci level. Risking around .10c to make 30c is a reasonable trade. I am surprised by the fact that none of the fixed income ETFs tested their lows.

HYMB - The High yield municipal bond ETF is trying to consolidate at the $50 level. I like HYMB at the current level due to several reasons:

It is trading at a 0.30c discount to NAV.

It is consolidating at the $50 round number level.

There is a relief rally in the equity markets which I expect, in the short-term, to spill over to the bond markets.

My stop is in the range of $0.10c to $0.15c, which compared to the very reasonable target of $51-$51.50 presents a fantastic risk to reward ratio.

POTENTIAL TRADES:

Long European (Yankee banks) AT1 (Perpetuals). Most of them are at the June’22 lows (considering screen prices are representative of real cash prices) while FPE (EU and US perpetuals) is forming a higher low. I would bet on the ones with the highest rating and short FPE as a hedge. As this trade has the obvious dangers of new lows in the European bond and equity markets I would certainly hedge myself with FPE and at the first sign of trouble arises I would want to short more size in FPE to compensate for the potential increased volatility. Such a trade would require a lot of active management but presents and excellent risk to reward opportunity.

Our filters caught a decent amount of extended AT1 pairs versus FPE but keep in mind that a handful of these are inclusive of Credit Suisse AT1s which I would avoid due to the idiosyncratic risk of further volatility in that name.

My suggestion is USB 4 3.75% long vs FPE.

CURRENT POSITIONS:

MET-F (long) vs MET 3.85% perpetual - I have written a more extensive educational article on this trade. You can find it here:

PGX (long) vs WFC 5 7/8 perpetual - The widening in this spread comes solely from the extended fall in PGX and most likely this trade will work out if PGX rallies back 3-4%, which I believe is achievable in the near-term. The primary risk in this trade is PGX’s movement to continue to the downside while the perpetual will likely lag and be slow to reflect the moves of the ETF. This could happen if there was further stress in the equity markets and a potential attempt for the lows in SPX. By using this chart I am in essence using the ratio’s levels to identify extremes. When these extremes are present in multiple perpetual preferred stocks pairs with various benchmark ETFS (like PGX, PFF, VRP and FPE) I know we are at a good support level for PGX or close to one. Some can argue that this trade is essentially just long PGX, and I would agree, but I would add that even if PGX uses the current level as a magnet the perpetual can also drop and bring back the ratio chart higher. I am simply improving my chances to turn this position into a winner by allowing myself an additional scenario to help with my position. The scenarios in which this position makes money are:

PGX goes up more than WFC perpetual

PGX stays flat while WFC perpetual drops,

PGX goes up which WFC perpetual drops at the same time.

Scenarios in which I lose money:

PGX drops more than WFC perpetual

WFC perpetual goes up more than PGX (highly unlikely)

Structuring the trade in that way allows me to increase my odds of winning.

RISKS:

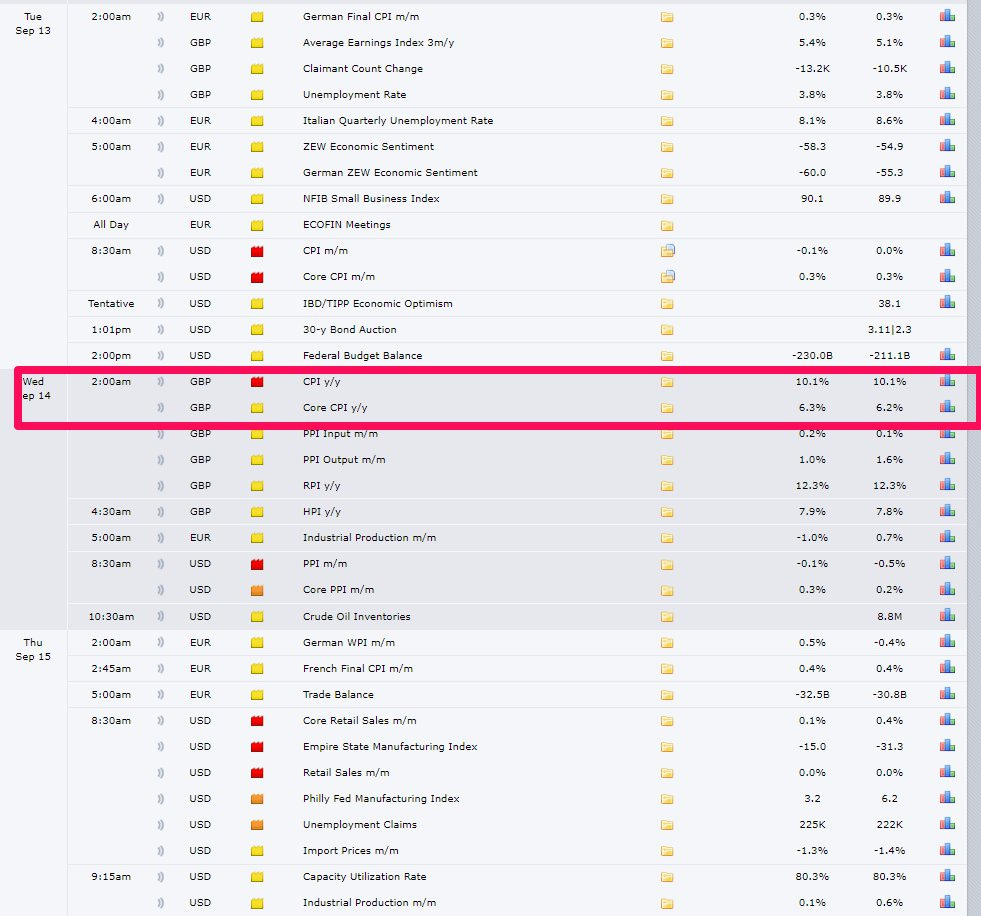

By far the biggest risk this week is the US CPI print on Tuesday. God knows how traders will react to this event. On top of it there is a UK GDP m/m and core CPI y/y, French and German m/m CPI. I am clueless how we play out as short term US and German bonds are above resistance levels. We may squeeze higher or go back inside the range. What the actual prints will be and most importantly how traders will react to them is a big unknown which I don’t intend to guess. Would be best to wait out the the potential volatility and see how Mr. Market reacts.

CONCLUSION:

One of the key takeaways from this week’s post is to ignore the noise in Twitter and other media channels and focus on price action. Although negativity and pessimism in social media attract an audience, trading on them is a poor strategy. Keeping track of the important levels and how the market reacts to negative news at these said levels is key to identifying potential turning points. Of course, I can be dead wrong in my assessment and get stopped out of my positions on Monday or Tuesday but my entry points are excellent and offer exceptional risk to reward. If I am right I will make $3 for every $1 I risk. This is the way I want to position myself. Shorting at the bottom of the range in equities or bonds is not my cup of tea. I like to remind myself George Soros’s quote every once in a while: “It is not whether you’re right or wrong that is important, but how much money you make when you are right and how much you lose when you are wrong” - This, in my opinion, is the essence of successful trading. If you don’t realize that you will have a hard time staying in this business.