What I wish I knew when I started pair trading

Watch out for the borrow fees and spreads

WHAT IS HOTF’s BACK TO SCHOOL?

This is the educational arm of Heard on the Trading Floor’s newsletter. In this section we explore in detail concepts that we talk about in our weekly newsletter. This part is useful not only to traders trying to learn new concepts in trading but also for experienced traders who are interested in figuring out our approach.

Pair trading is the approach where you buy a presumably undervalued security and sell short an overvalued security from the same family. Ideally, both securities must have high correlation and/or cointegration. In the credit world things are usually simpler. You look for major discrepancies in YTM/YTC, Coupon, CY and maturities and try to figure out if the spread between the two products is at extremes or not.

For a more detailed explanation of how pair trading works and what the pros and cons of this approach are:

Today I am going to focus on Pair trading credit instruments with ETFs (works with Futures). To illustrate my point better I will go through a trade I did two days ago.

HOW DID I FIND THE OPPORTUNITY?

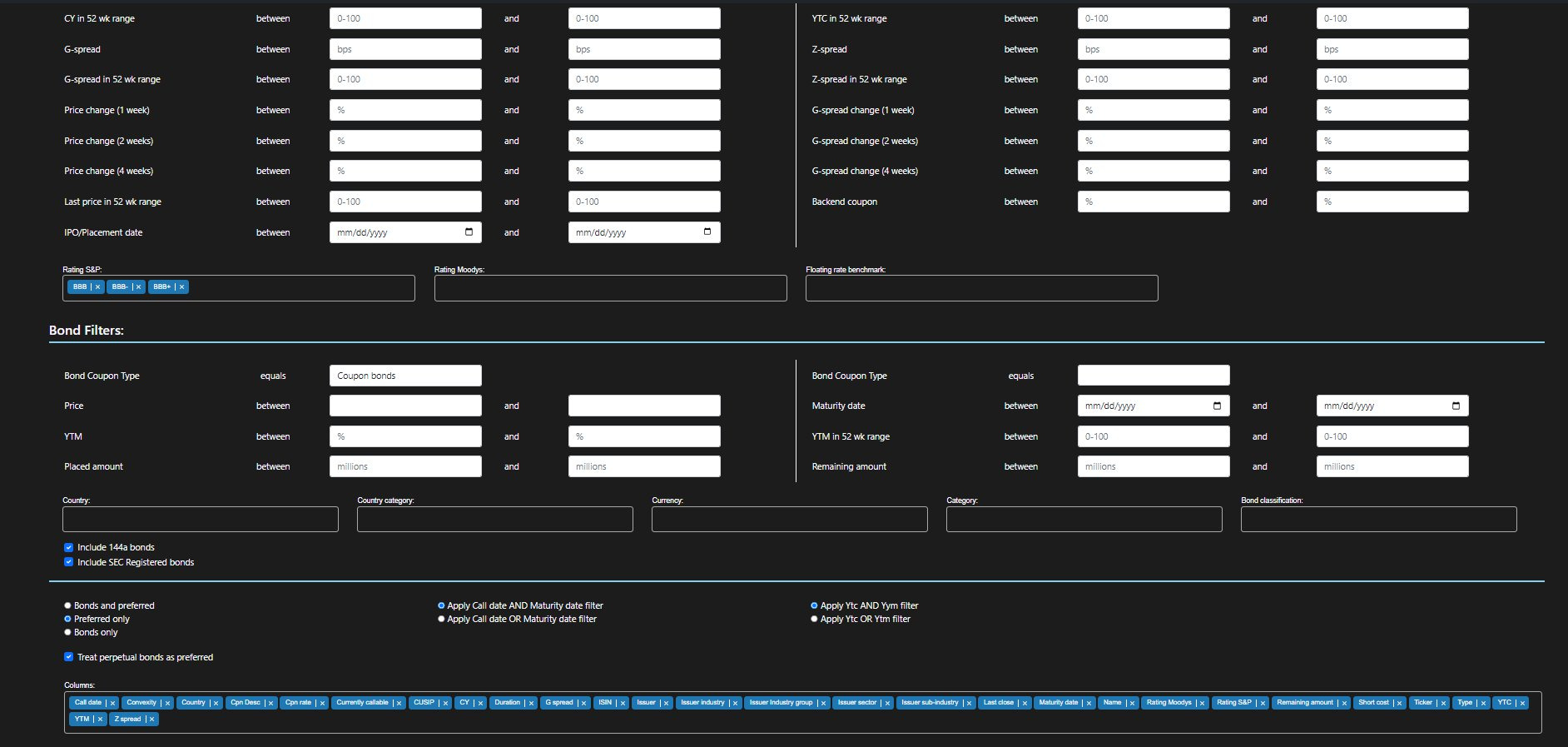

As I was looking for ways to combine price appreciation + positive carry I decided to look for a list of the highest coupon payers in the preferred stock world. I chose to do so as I know that PFF and PGX , two of the largest preferred stock indices are extended. So I thought, lets check if these high coupon payers are lagging the move in the benchmark ETFs. I jumped over to our screening tool and selected all preferred stocks with a coupon higher than 7.5% and a BBB+, BBB or BBB- rating. I was looking for an issuer that is relatively safe and pays a hefty coupon.

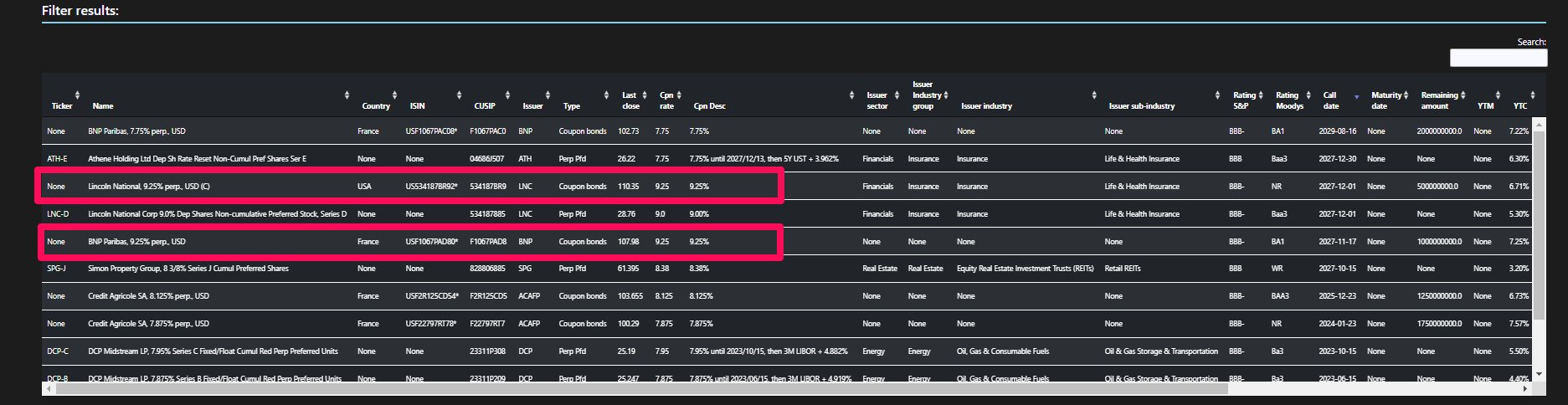

This is what came back, sorted by call date:

I checked out both of the highest OTC perpetuals payers BNP 9.25% and LNC 9.25%. Chart wise BNP has some room to catch up LNC.

Then I cross checked each vs PGX. Before I go on, you may wonder why I chose PGX. There are a few reasons, but the most heavily weighted are:

Very liquid

Very cheap borrow

In the short-term , it outperformed versus VRP and FPE (The perpetual preferred stock ETFs) - This gives me the potential for a larger move to the downside in the ETF, IF it happens.

PGX just paid a dividend a few days ago. I don’t need to worry about paying the dividend on my short position for a month.

There are also downsides to choosing PGX.

It is not a direct proxy of perpetual preferred stocks but, if the trade is held for a longer period, the large borrow fee of VRP of FPE (compared to PGX) will eat away a big portion of the profits. God, I wish there were futures on PFF or PGX.

The ratio chart ( Long BNP 9.25% vs PGX) is showing that we are at levels close to when the perpetual (BNP 9.25%) was issued. A lot of things happened from Nov’22. The most important one is that rates and credit spreads dropped. That means the BNP 9.25% should be well outperforming PGX or in fact any of the benchmark ETFs. In reality, exchange traded instruments are very quick with exacerbating the moves to either direction and luckily for us this creates opportunities. (My favorite type of opportunities - OTC instrument vs exchange traded instrument)

The best part - this trade has a hefty positive carry. If you are not using margin, you will receive 9.25% coupon on a daily basis from the perpetual while paying a borrow in the range of .50% - 1% on PGX. Not a bad positive carry for a position that is also supposed to appreciate. You could also easily afford some downside as the hefty coupon will help you offset any potential temporary losses.

Now, onto the reason why I chose to hedge with an ETF , instead of another perpetual from the same issuer or a competitor from the same sector.

ETFs are very liquid

ETFs are cheap and easy to borrow

ETFs and (Futures) give you the flexibility to decide for yourself if you want to increase or decrease the exposure in your hedge. You may ask yourself, what is this man talking about. As a short-term trader I often have an opinion of where the market may go. In today’s market I am confident that the odds are we first see a technical pullback, rather than a continuation of the move we’ve seen from the beginning of January. That means I want to be more short the ETFs, essentially skewing the trade to be effectively short the ETFs.

Compared to pair trading with another preferred stock from the same family you AVOID:

Paying the slippage in getting in and out of the short leg , if you have to short a less liquid product. This by itself is very detrimental to the performance of the pair

Paying substantially higher borrow fee on the short leg, if it is a less liquid instrument. Again , a bit performance killer

In some cases, borrow fee can increase dramatically, if locates become scarce and your borrow cost may become prohibitively high, making the trade obsolete. This will result in an urgent buy back from you in order to save on the borrow costs. In addition you will have to sacrifice the spread which will balloon the losses.

Now you know what makes me inclined to short ETFs and Futures instead of the exchange traded or OTC preferred stocks.

Curious about the bond & preferred screening tool you're using in this article. It looks a good deal nicer than any other screener I've used. Can you share the name/vendor of it? Thanks.

thx for such close insights - they are what's really needed, bc they really clear things! incredibly great idea, great write, and great thxs from any reader, certainly.