CREDIT MARKET REVIEW

Last week was a prime example of what happens to the markets when there is a brand new piece of information that had not been priced in the market. New information that brings uncertainty. The first thing that happens in that environment is to see the VIX moon like one of Elon’s rockets. No one knows how bad things are and everyone prefers to be safe than sorry. It may all be limited to SIVB’s collapse, or this may be just the tip of the iceberg. I am not an insider and certainly don’t have any superior knowledge but one thing is for sure, this is a direct hit to the venture capital and start-up ecosystem. I can’t really comment on how bad things are for SIVB and whether depositors will get back 100c on the dollar for their deposits, remains to be seen. This is also not where my expertise lies but there is one thing that I remember clearly back in the day when I was a in my 2nd year of trading back in 2008. No one expected Bear Stearns to have significant issues, let alone go under in just 1 short week. But JPM came to the rescue and bought them cheap, initially for $2 but then were forced to pay $10. It was about 9 months later when the issue with Lehman Brothers took over and the world was about to collapse. As Jimmy Jude says it is the second one (second round of issues) you have to be careful of. I don’t think the current situation will have a similar effect as the GFC, we are miles away from anything remotely similar but if a second round of issues comes along I would certainly be a lot more worried and hopefully short.

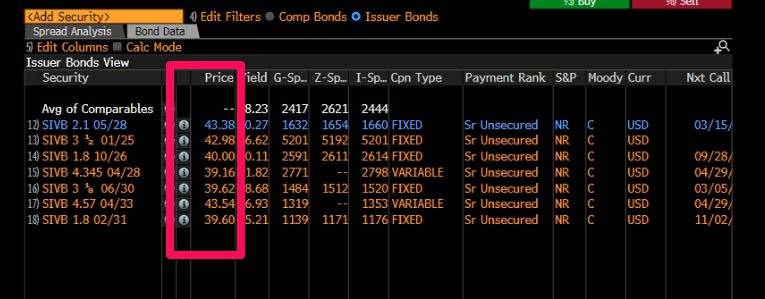

Now let me get to things I know what I am talking about. Have a look at the SIVB OTC perpetuals. Who said credit trading is not fun?

The junior subordinated debt (perps) is trading in the single digits cents on the dollar whereas the Senior unsecured is trading around 40cents on the dollar. Guess this is what the market prices will be the recovery rate for the senior unsecured bonds.

I am personally staying away from this fiasco as non of my trading patterns are flashing a signal here. Only thing I see is a whole lot of uncertainty. I honestly prefer to stay away from all the hype and not pretend like I have any clue what is happening or what is about to happen. I am no macro analyst, no banking analyst nor do I have any superior knowledge on the matter. I am simply a trader who is trying to find a way to profit from short-term price moves. I look at what risk I am taking for what type of potential reward. Through my prism, after the halt of the exchange traded instruments SIVB and SIVBP (the preferred) I no longer see a potential for a trade. On Thursday I was looking for a potential pair trade between SIVBP and any of the PERPs but they were both perfectly priced and did not offer a trading opportunity. If you are really eager to put money at risk and have superior knowledge of what may happen to SIVB and whether they get bailed out or another bank takes control in that case you may simply buy the perps at 3 to 5 cents on the dollar and hope for the best. It is a good yolo bet , but that’s about it. Most yolo bets end up worthless so you should be prepared to lose all of your capital if you go that route.

However the spillover effect brought some opportunities elsewhere. We saw FRC and some of the other regional banks affected. Now lets move onto FRC’s bonds and preferred stocks and check if there are any potential trades coming from this sympathy play.

POTENTIAL TRADES:

FRC’s 46s and 47s are very similar in duration and coupons, with the 46s having a slightly lower coupon. If we believe BBG’s prices the two are currently sitting at a -4.7 points spread, a new record given the very small history we have. This may be a good trading opportunity but not attractive enough to deploy capital. Maybe at a larger spread , around 7-8 points I would be happy to do so, but not at the current moment, despite the fact that the 46s are currently giving you 20bps more in YTM.

Lets move onto the preferred stocks. Now that there is volatility it is likely that one can manage to find very decent liquidity to build a position. Going through our scanners I noticed that the only one worth trading is FRC-I vs FRC-N. The borrow fee of FRC-N stands at the reasonable 11% so the trade makes sense, especially if the spread keeps widening.

In terms of relative value the rest are either fairly valued or does not present significant opportunity compared to the risk that must be taken. In such an environment I wouldn’t go as far and do a cross capital structure arbitrage as we saw what happened to SIVB’s junior subordinated debt compared to its senior unsecured. I don’t want to buy the lower tier debt and short the higher tier debt. Here is chart of what the FRC-I, callable from the 30th of Jun’23 vs the FRC 4 5/8 47s looks like. The opportunity is excellent and presents at least 10% potential but the risk is that we see the preferred stocks trading at single digits cents on the dollar compared to the recovery value of the senior unsecured bonds which will certainly be higher. if the preferred falls further I may consider it but currently I am staying away from this ‘opportunity’

Now lets move onto some of the other banks that were affected.

HBAN

A while ago I recommended a list of perpetual preferred stocks about to turn into floaters. The idea was to take advantage of the very high 3M Libor rate which is used as the floating component + a fixed mark up. In the case of HBAN 5.7% that is 3 Month Libor + 2.88% or ~5.1%+2.88% = ~ 8% starting from the 15th of April.

The research I did last week was not in vain because we can use most of these floaters for a trade. You see this one is now considered a risky trade and the likelihood of being called is getting slim. Nevertheless it is the perpetual with the closest call date and will likely show relative strength compared to other perps with higher duration.

Looking at the chart it is obvious that the spread may get more stretched but given the fact that 5.7% perp will float in 1 month at 8% changes the picture a lot. This chart won’t be meaningful. What will happen is that the long will show relative strength on 2 counts:

Significantly higher coupon than the short position

Call date is near which will exhibit relative strength compared to assets with higher duration.

In the unlikely event of HBAN following the path of SIVB (I really don’t think there is even a slim chance) you will get both of the perps at single digit cents on the dollar but in reality you won’t lose any capital as you will make money on your short position.

Given the three factors listed above I think this is a relatively safe trade. Only regret I have is not trading it when HBAN 5.7 was lower in price compared to HBAN 5.625%. This had really been an amazing opportunity.

THE ETFS:

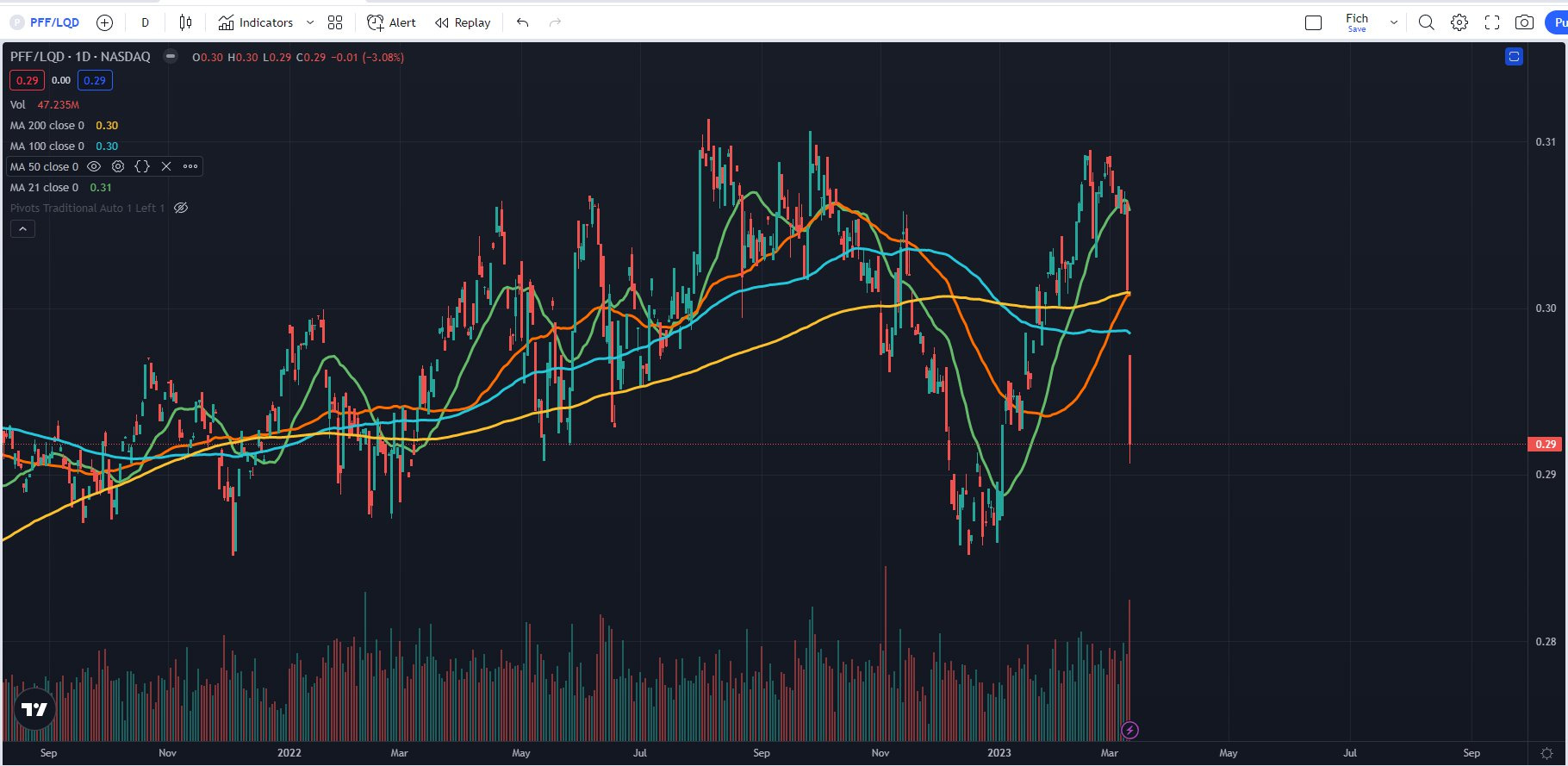

Remember what I told you a few weeks ago about PFF being overvalued compared to LQD and how I couldn’t make sense of it. I was explaining it with the potentially higher dividend yield of PFF compared to LQD. Nature is finally healing. Ironically though, it is the fact that preferreds are lower in the capital structure and in PFF’s case most of the constituents are bank preferred stocks. Higher tier debt instruments were not affected and mostly traded with with rates, albeit not as correlated. So I ended up right in this opportunity but for the wrong reason.

CURRENT TRADES:

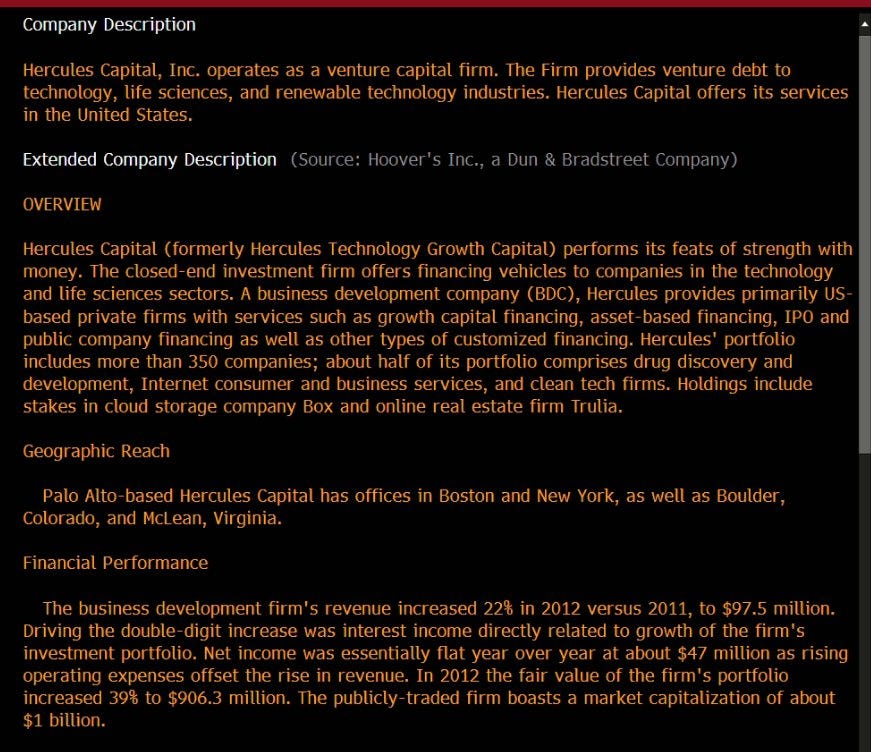

I have shorted HTGC 3.375 27s at 88

HTGC loans money to VCs and starts ups and it is a player in this industry. I wanted to short it as a proxy play of SIVB. Instead of going short the BDC itself I thought it would be wiser to sell short the bond as the risk to reward potential is significantly better. I am shorting very close to the highs.

My view on BDCs is that if there is a contagion in regional banks it will spread over to BDCs due to their similar business model i.e lending to businesses.

HTGC 3.375 27s.

I only managed to get half a position because the bond market is so out of whack when volatility picks up that it is impossible to trade in or out. There are simply no quotes, most dealers go ‘no care’. Sad but true.

You can see the full list of trades we did last week and all the potential trades in this article:

CONCLUSION:

The SIVB fiasco may even trump the CPI report on Tuesday. If anxiety is not cooled off we will see significant volatility on Monday. Relative value will be the name of the game and this is where I intend to focus.

FRIENDS OF HOTF

It is incredible difficult for those who are just starting to filter through the noise in fintwit. Thus, we have decided to include in this section people we follow closely as we believe they are from the few that know what they are doing.

Before moving onto the next part I want to give fx:macro’s newsletter a shout out. He is the very best in summarizing central bank’s activities and the most important macro events in the coming week. There is so much going on in the central banking world at any given moment that getting up to date without his publication will be impossible. Highly recommended.

EQUITY MARKET REVIEW

General overview: What a week. Started rather slow with the market expecting J Powell’s Q&A sessions and finished with a blast that nobody was expecting. I made this point on twitter, but will briefly say it here again.

This sort of events (the SVB blow up and subsequent run on banks) rarely come from a place most of people expect. And while I tend to think that I follow and read a smart bunch of people and research the hot themes I have to say that noone around me (and they are a lot) said that banks will be the first to show cracks. We were all too busy focusing on Europe, commercial real estate, housing and homebuilders, private equity, mega caps and ARKK. And while some say that it is the VC sector that blew up SVB, it is actually the US debt that did so. How ironic. Of course, if we dig long enough we would fine people who sounded the alarm beforehand. And there was little doubt that someone was actually making a bet that regional banks would not do great. After all they are one of the few sectors that trades near 2022 lows and did not meaningfully participate on the rally to 4200. But I heard more arguments why banks should do okay than why they are going to go bust.

By Friday, I already had the feeling that good news about the situations are around the corner. It is my view that despite the FED wanting to ‘kill’ the animal spirits, they do not want that to shatter the banking system while doing so in any way. It is important, in those market instances where something big is happening to look a bit outside the chart and think bigger picture. Who are the game masters, what do they want to achieve and how and adjust what you do accordingly.

Alright, let’s cut to the chase and see what happened in my favourite love triangle: stocks - bonds - the dollar.

SPX fell c. 4.5% without stopping for a breather at the 100 and 200 day moving averages and is now firmly below those. While this is not the ugliest chart I have seen it does look like the next leg is to the downside no matter how the things with KRE are resolved. Next stop is 3800 but here is too late to short if not already in. Backtesting the sma200d will give a good opportunity to do so as proved on Friday, when the market ticked up exactly there before plunging in the second part of the session.

The big turbulence actually happened in the bond market, where the short end initially, but the long end too, fell in a dramatic fashion.

This was obviously a reaction to the risk of the banking crisis unfolding as investors were betting that that tightening was enough and ran for the safe haven in the long bonds. In no time, the ED futures ran up. I am writing this on Monday morning, and the Dec 23 contract has erased 90bps hikes for the last three days. That is nearly unheard of. To the point of me cursing not taking a long 2y note momentum trade I had on my mind on Thursday (not the only missed trade but that is another story).

So far so good - drop in equities, rise in bonds. That’s very ordinary in a risk-off environment. What is most surprising though is how the dollar has reacted. Usually, it tends to gain strength during market stress. This time, however, it is weak.

Not being able to fly with the wind blowing in your tail is a thing to note. I have received questions about why is the dollar doing what it is. The only thing I can think of is rate differentials with other currencies (dollar not being as attractive anymore due to decreased future interest rate expectations) and a potential sell on the US economy vs other economies. I am definitely no expert in this area and it is not my place to tell why. It is, however, my job to think of what this would lead to and how to potentially profit from it. Let’s see.

Sector performance and potential trades: Now that we get a weak dollar on top of less hikes and risk-off narrative there is one asset whose price should rocket higher - gold. Logically, it did (I missed a momentum trade here too).

For those that have been in the market for a while, it comes as no surprise that often in mass deleveraging moments, even gold and related tickers are not spared. This time is different (famous last words) but GLD went straight up without selling. However, gold equities did not do so well, especially on a relative basis.

Usually when gold is up, the miners are just a higher beta play on it but the last couple of days were different as the miners lagged due to the broad sell-off in equities. I have little doubt that if the gold strength is to continue, GDX will quickly get back to pace.

In a similar fashion, SLV often acts as a higher beta product with the same driver as GLD and is currently at a good level (not the best, but decent).

And to finish off with the related charts, amongst the miners, it is not that rare to see the big miners doing better than the juniors in the beginning of the runs (and during the deleveraging) so I am eying the relationship between the two in case there is too much of an advancement there to get long the juniors and short the big miners. However, I think we are not too close to such point yet.

I will omit talking to the obvious sector, but wanted to share my experience around it. On Thursday, I assumed that XLF is getting hit in a pure sympathy way with the situation being uncertain but with the FED paying close attention to it. As written above, it is my opinion that they will not fool around before sorting out the situation. I had an inner countertrend calling and I wanted to pair it with something that is liquid, has somewhat similar volatility and is not considered a different animal in the value-momentum specter. I landed on XLB and the ratio relationship seemed decent and the pair was trading on a good level.

I did not pull the trigger only because I could not risk manage the trade properly, given the uncertainty around the root of volatility - KRE. I looked at the options for the long side to protect my downside but did not like them. It hindsight it was a good decision as the market opened with XLF down c. 1.5% more than XLB which I guess would have been enough to make me want to close the position at the worst time as it ended being slightly up for the day. Point here is do not fool around with the underlying too much and concentrate somewhere else.

This week I will gladly look at some KRE options to see where I could find value.

Current positions: I am short NVDA (full risk), short TSLA (half risk).

I took half of TSLA long put fly 190-150-130 for 31 March on Wednesday at 181$ to take profit. I am keeping the rest as I am now at the sweet spot - comfortably in the money with market experiencing stress. Time works for me as of now.

On Thursday I realized I want to increase my short and quickly turned to NVDA. No one believes NVDA is fairly valued, including me. I was tempted to play it as I saw the market making the initial push to the downside and allowing it to experience relative weakness further down the line with a 330-320 put spread for April 6. I acknowledge so far it has not experienced it but I am definitely keeping it for now. Risking 2$-2.3$ points of the 3.3$ premium or will take it off on a new high.

Conclusion: Equities are down and bonds get a safe haven bid with the Eurodollar futures pricing cuts as soon as September. However, the dollar has been weak. No matter the reason, gold is the go to asset in this scenario and I am following closely the relationships between the various tickers in the space. In addition, the short term options in the hot sectors - XLF, KRE allow a lot of opportunities in the volatile phase.

Great reviews as always! Appreciate the effort that goes into them!

I thought I read somewhere about a re-balancing in KRE on Friday