General overview: Last week was so heavy on data, I did not dare touch a thing as my mind was telling me it is a field filled with landmines. I mean, after a decent 3-4w run to the upside and reaching nice round 4100 level, CPI, retail sales and jobless claims could potentially be a problem, no? Apparently, no. Market chewed through the news like it ain’t nothing. Yes, there were no big surprises to the upside, but I fail to see what is there to cheer upon and get higher at this point. Which, of course, does not mean that there isn’t a lot of factors that are to push the market higher.

All sorts of charm and vanna effects did the slow and steady bid up on Thursday and caught off guard those who thought of Wednesday’s price action as weak. Overall, SPX registered another good week under the belt and the reluctance to show sustained pressure remains lacking. But resistance in the area $4165-$4200 is right above us and should be hard to get through.

I have been saying this for a while, but I see no point in betting to the above here. The place just gives a bad trade, no matter where one sees the market going.

Last week saw rates picking up a little from the solid support they were at. Curve moved up a notch but each point of the curve is still in the very choppy area formed in the aftermath of the banking crisis. They are fighting with technicals but as of now all rates are back above the sma200d and are extending their respective consolidations, meaning they have not broken to the downside.

And why would they? Equities going higher is never the thing to put bonds to rest, one has to keep that always at the back of his/her mind.

On Friday, the SOFR3 futures moved down a bit, as a logical follow up of the strong equity market the last couple of weeks and in line with my thought above. Of all things, with decreasing but sticky inflation and pick up in commodities, rates have little downside here if equities continue marching on.

Before we continue, I would like to give my friend of Credit from Macro to Micro a shoutout. He shares a tremendous amount of charts with a tight focus on the credit markets and in particular Europe. For anyone out there interested in the European debt markets he is a great follow on Twitter - @credit_junk and also publishes a weekly newsletter here on Substack. I am eagerly waiting for his publications every Friday.

THE VIX and the MOVE INDEX aka THE BOND VIX.

The volatility drop continues and the spreads tightening alongside with it. If the earnings season proves to be a non-event I could easily see the MOVE index below 100. There is nothing going on in the credit markets right now that tells me there is imminent risk apart from a potential earnings surprise in any of the large caps but yet again it shouldn’t have as significant impact as the banking crisis in March.

CDX High Yield - With the current VIX levels and further potential drop in the MOVE index all I can see in this chart and the CDX IG chart is further downside (i.e tightening). CDX HY at ~400ish is what I can see happening in the next few weeks.

CDX Investment Grade -

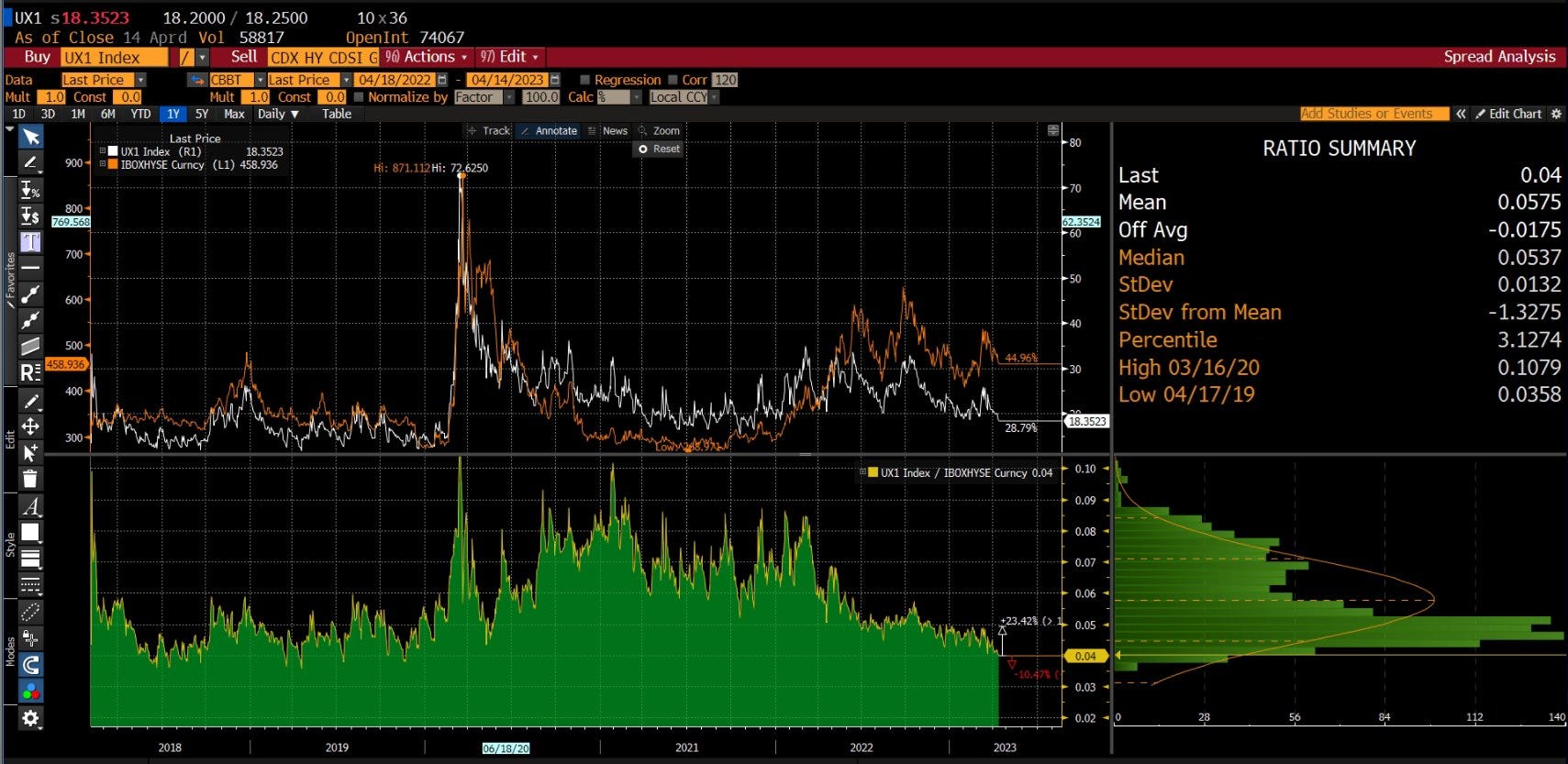

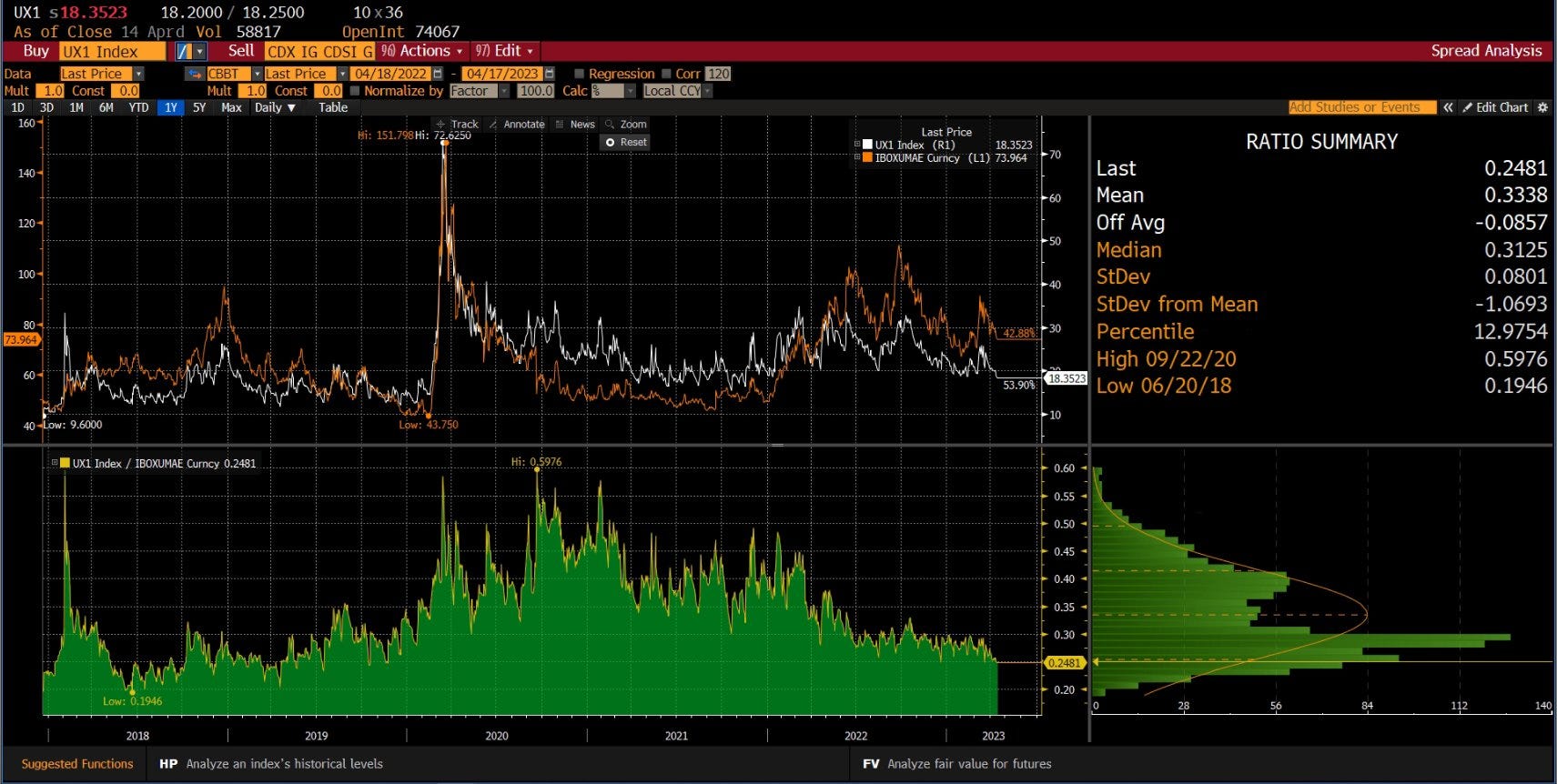

Recently I saw a person on Twitter plotting the VIX chart against the CDS indices (Apologies for forgetting who it was but whoever you are, I am giving you credit!) and it occurred to me that it makes a lot of sense. After all the CDS indices are exactly a proxy of volatility. So let me give you the charts here and discuss what they mean.

When I plot the VIX front month generic contract (UX1 index), the ratio chart shows me that we are at levels last seen in 2019. This move obviously comes from the VIX dropping a lot more than the CDX High Yield index primarily caused by 2022. To get a move higher in this ratio chart we would obviously need either the VIX to jump or CDX High Yield CDS to drop.

Same goes for the VIX front month contract plotted against CDX IG CDS index.

Of course, there is further potential for this ratio chart to drop to the lows of ~0.20ish. Additionally, I would primarily use this chart to figure out how compressed volatility in both the equity and credit markets is and try to identify levels at which a jump in volatility is likely to occur. This chart does not serve as a trigger for volatility but rather a guideline of how compressed we are. The above charts also tell me that the CDX IG and HY indices are the ones that generally exhibit lower volatility levels levels and do not match for the moves in the VIX whereas in the past 2 years the moves in CDX IG and CDX HY from the lows had been more severe than the moves in the VIX index as evidenced by the chart. The CDS indices generally trade in line or below VIX levels.

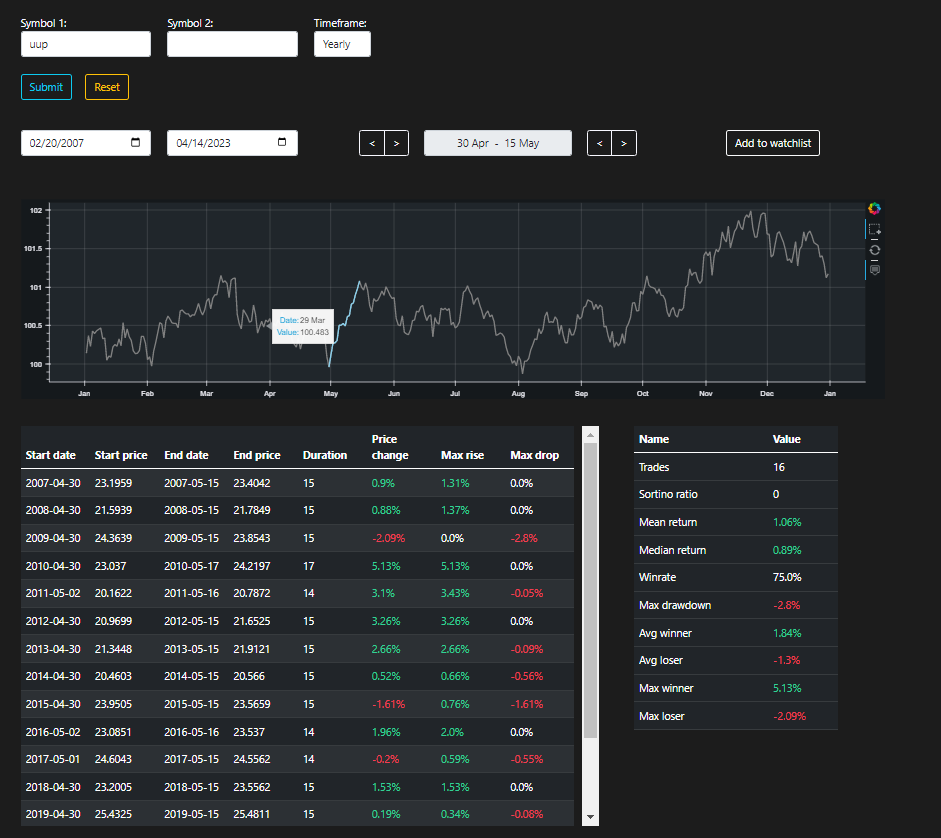

THE DOLLAR - $DXY

The dollar showed some muscles on Friday, but everything there remains the same. Tape is weak and bidders are missing even at solid support. Help from seasonal factors might be just around the corner though, with beginning of May being a very nice period usually that lasts about 2 weeks.

I would lie if I say I am not keeping my eyes on the dollar with all the comments on its demise and the destruction of bulls that happened the last couple of months.

All of the above really puts me into a volatility compression mindset going forward. We breezed through the sensitive data while the market kept its composure. I can’t believe I am really saying that but given the above factors I think the odds are to the upside. What happened last week really showed us what the market is made out of. Having said that I think we should at least make some effort to prepare for a potentially slow market.

WHAT I USUALLY DO IN SLOW PERIODS:

Proprietary traders thrive in volatile periods. Whenever volatility starts compressing we have to find additional patterns that make for decent risk adjusted returns. Here is what I spend my time on:

Focus on the primary market. Slow and steady markets are great for primary market trading as the tightening prevails and most issues play out well.

Focus on dividend plays in pfd (preferred) stocks and CEFs.

Focus on overextended (overbought) instruments to short with the hope of having a limited loss to the upside (due to the over extension) but hedging with an undervalued pfd ETF or potentially undervalued bond/perp/exchange traded pref.

Go through as many charts as possible to find a potential gem.

Look for potential signs of volatility picking up.

TALK TO MY PROPRIETARY TRADING FRIENDS - This part is key as many of us look at different things in the markets to give us clues. We never have the full picture. I am personally subscribed to multiple paid newsletters and private Twitter feeds to get better grasp of what the pros out there are thinking and doing. Best of all, I get to ask them questions and have conversations on specific trades. I think this is a tremendous cheat code for traders and few take advantage of what social media has to offer. (You should of course figure out which traders are suitable for your style and most importantly you should figure out which ones are worth your time and money)

POTENTIAL TRADES:

This week we had identified 4 relative value opportunities in the preferred stocks space, 2 in the ETF relative value space and 1 brand new potential put spread for the bears out there.

PFF vs JPM-M

The general trade idea within the preferred stocks is to be long PFF vs an overvalued preferred stock. PFF is currently undervalued solely because of its exposure to the regional banks’ pfd stocks. Should volatility calm down this trade will work out easily. And as we’ve seen volatility is really going that way lately. There are a few very good examples out there at the moment but I want to focus on this one in particular.

JPM-M has one of the lowest CYs ~5.2% and a coupon of 4.2% for a BBB- banking preferred. Compared to the rest it certainly is overvalued. The below screener is for all banking pfds rated BBB- and below with a current yield below 5.8%. The rest of the pack is around the ~5.6% CY metric whereas JPM is at ~5.2%. The YTC metric I would not comment as I see it largely irrelevant in the current moment due to the very unlikely possibility of banks refinancing their pfd stocks at coupons even remotely close as the sub 4.5% coupons they managed to get in 2021. Therefore they will likely be left to float until interest rates hit rock bottom again. Having that in mind I believe the CY metric is currently more appropriate. At least for pfds that have very low chance of being called.

If you are interested in all of the traders we found this week you may consider becoming a paid subscriber.

CURRENT PORTFOLIO:

Have made multiple exits in the past week to account for the risk events of last week. Luckily we got out from most of them prior to Wednesday’s CPI. We would have made more profit if we had decided to go through the potentially volatile events with the full portfolio but I was reluctant to do that. I prefer to have a stable PnL and control over the VaR in the portfolio. I can always get back in or find new trades. If I have to chose between making a bit extra profit at the expense of my trading confidence I would always prefer to keep my confidence for times when I have better conviction of the market’s next move.

As we have identified a few new opportunities in the credit space I am going to focus on building positions there and ramping up the portfolio exposure now that volatility is compressing. To read the full list of trading ideas and to get access to our portfolio you may consider become a paid subscriber.

CONCLUSION:

If you are still feeling reluctant to take risk there is this option on the table that may not be available in the near future, especially if we see a hard landing. You can still get paid ~5% per annum to hold cash. (put them into 6M or 1Y bills) This approach will be more appropriate for people with large portfolios that find it hard to invest all available assets at hand. For us, proprietary traders, this is rarely an option for a prolonged period of time. It may be useful for a week or two until we figure things out but it is our job to find the best risk adjusted opportunities the market is currently giving us.