As expected, last week was characterized by the digestion of the large moves we experienced post CPI. This week we have Thanksgiving on Thursday and half day on Friday. My expectations of a wild week are not that high and in fact I personally prefer to call it a week on Wednesday. No need to be a hero when no one is around.

European credit shows way too little fear, in fact reaching the peak dovishness of Aug’22. iTraxx Europe, iTraxx Crossover, iTraxx Snr Financials and iTraxx Sub Financial are all at Aug’22 lows. Although I mentioned it a few times that the EUR market seems very stretched to me at current levels, we have to remain aware of the fact that it is year-end, many credit funds are underwater and will do their best to get as close to possible to their watermark levels. Said in plain English, they will be VERY motivated to window dress their portfolios.

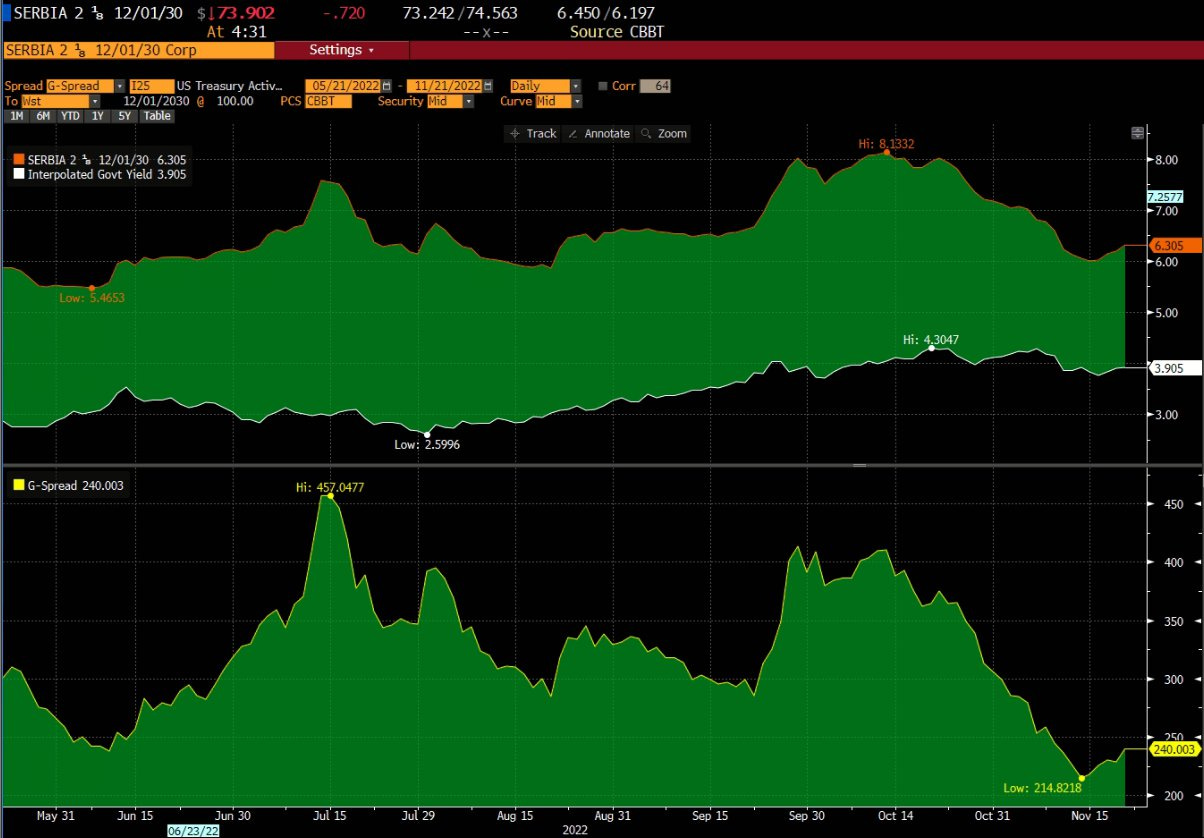

What makes an impression on me is that European credit markets are getting a little too excited, especially the USD denominated issuers. There are a bunch of European sovereigns like Hungary (REPHUN) , Romania (ROMANI) and Serbia (SERBIA) that had their USD debt pushed to the moon (relatively speaking). I can’t fathom why they would trade at these levels, especially given the fact they are USD issues. Either I am missing something about the big picture or these particular issuers are a screaming short. The shorts may not work out this week as most bond traders are either off for the week or will take Friday off meaning the week will basically be over Wednesday.

ADVICE:

If you want to trade the widening G-spread of sovereign cash bonds, instead of buying futures contracts, do it with cash treasuries as you want to collect the coupon on the long bond in order to reduce the carry of the position. That way it would be significantly cheaper to hold the position short. Latest 10Y UST is 4.125%. Pretty hefty for US Government bonds.

RISKS:

FRENCH and GERMAN PMI’s this week.

FOMC minutes.

CURRENT PORTFOLIO:

ALL positions remain the same with the exception of SOAF 52s. We have exited that position and reduced in half the HSBC 28s position after the monster run it had.

NEW POSITIONS:

Last week I shorted the following positions

REPHUN USD 34s 5.5% and bought T 4.125% 32s

ROMANI USD 31s 3% and bought T 4.125% 32s

In fact there are plenty of opportunities if you want to short European sovereign’s USD debt. I love the idea of the trade.

CONCLUSION:

This week will be pretty muted, especially with the World Cup going on. Whenever England plays the EUR/GBP and EM markets will be dead. British traders won’t be bothered with trading. On top of it we have a shortened week in the States due to Thanksgiving. Don’t get your hopes high for an eventful week. I would argue this will be the best week to get some time off the screens. Spend time with your family, travel, do your hobby. It will be cheaper and more soul refreshing than trading the markets.