In today’s newsletter you will find:

OUR FIRST QUARTER RESULTS

EQUITY MARKET THOUGHTS

CREDIT MARKET THOUGHTS

NEW PORTFOLIO POSITIONS

POTENTIAL NEW TRADES

This week’s equity review will be short in nature as our equities trader is on a holiday.

Equity indices in US and Europe closed the week strong but most notably the DAX is a an inch away from making new 52 week high all the while US equity indices are displaying strength. Now, I am not really an expert in valuation metrics and why this is happening but I do consider and take very seriously the price action of instruments when a negative headline hits the news wires and does not affect the price of the affected instrument as expected. This, by itself, can be used as a trading signal.

We had a regional bank run in the US and a Swiss financial institution collapse in the short span of a week yet the equity markets discarded these events as not significant because they are all trading at levels above the start of the banking crisis in both Europe and the States. The bond markets , as evidenced by the CDS iTraxx and CDS High Yield indices had also discarded the negative news headlines. If you are looking for a market sell off you would have to hope for a brand new risk event hitting the newswires as a regional bank run would no longer do it, it is already in the market. Having said that, my bet going forward for April’23 is for volatility to remain in the current range and likely continue its decline, both across the equity and bond markets. Translated into English, I wouldn’t short the equity markets, unless I have to hedge my portfolio or want to do an intraday trade.

What would change my mind:

Fed Fund Rates futures to return to pre SIVB levels - ~5.75% terminal rate and potentially no cuts or just 1 cut by the end of 2023.

Brand new risk event hitting the news wires, like a CRE ticker going under.

However if I had to put my money where my mouth is, I would be a buyer of the DAX instead of seller at current levels. I believe we see new 52 week highs through April’23.

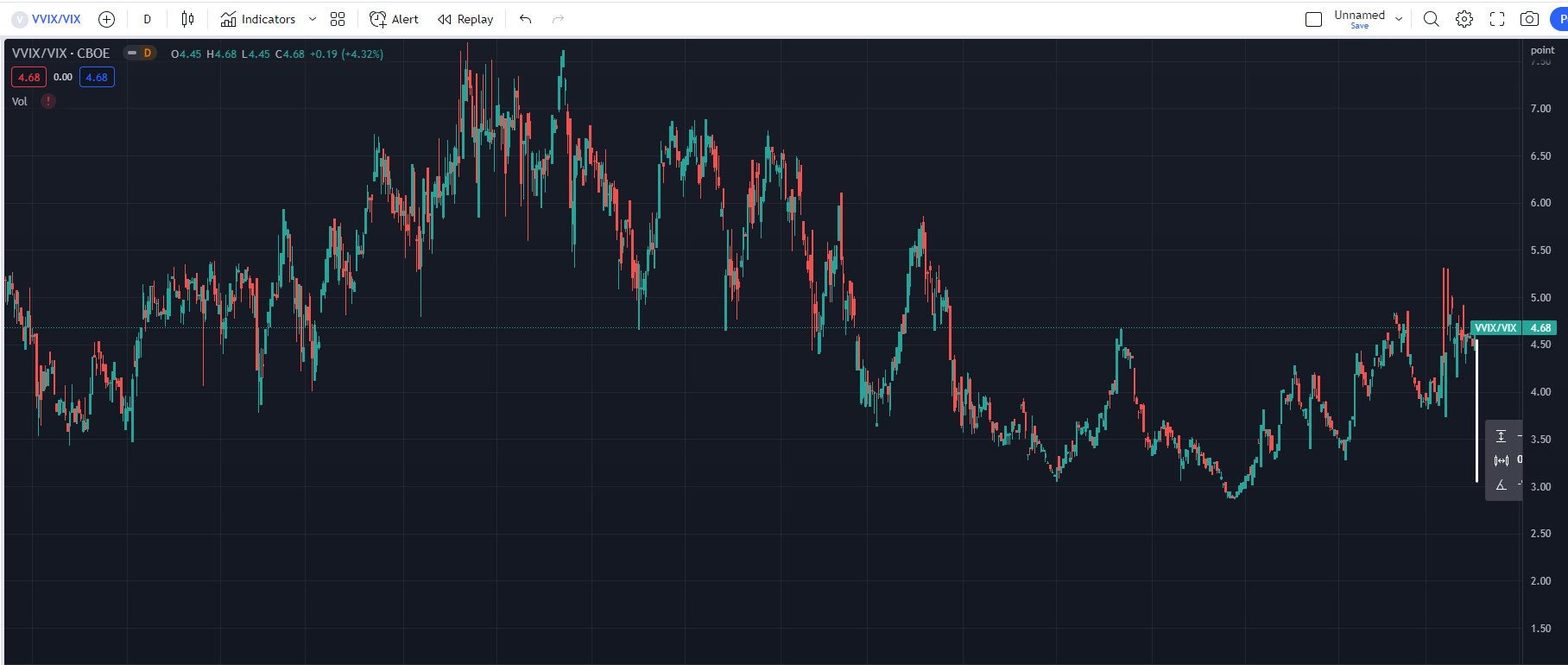

in the US, the VIX and VVIX (vol of vol) is sitting near the 2023 lows but I believe there is further downside , at least in the VVIX as the VVIX/VIX ratio had not retraced back to its lows. In addition, the seasonality stats of VIXY (VIX front month contracts ETF) shows consistent drop in volatility throughout the month of April.

I personally view the markets in 2 regimes. Risk on or low volatility (contracting volatility) regime and risk off regime which is obviously associated with the expansion of volatility. Whenever we are in a risk on regime (we are currently in such a regime) I buy undervalued instruments and when we are in a risk off environment I am a buyer of the VIX or looking for relative value/pair trades.

CREDIT MARKETS THOUGHTS:

Who would have expected to see such a quarter end rally, especially after having a surprise banking run in the US and a collapse of a trade mark financial institution in Switzerland. I certainly wouldn’t have guessed it. The volatility drop was quite spectacular, especially in the bond markets. The MOVE 0.00%↑ index dropped from the yearly highs of ~200 to 135.

The CDX High yield CDS index dropped to 463 , almost wiping out all the fear that was created during the SIVB 0.00%↑ surprise collapse.

and the iTraxx Crossover almost forgetting what happened to Credit Suisse.

I have been thinking lately how different the markets had turned since I started trading back in 2006. The speed at which events unfold and are digested has significantly increased since 2006. This could be attributed to the influence of social media and the ability of analysts and traders to quickly assess situations or the culprit might be hiding in Central bankers like Powell and Lagarde now closely monitoring market reactions, reacting instantly if a situation gets out of control.

Let me give you an example:

On Thursday the 8th of March the markets caught up onto SIVB’s issue and hammered the stock. Trading was halted. On Friday the FDIC were already in SIVB’s offices trying to figure out the situation and find a solution.

On Wednesday the 15th of March there were rumors of Credit Suisse needing a lifeline to survive and on the following day the Swiss National Bank delivered. A few days later insiders knew this would not be enough and gathered during the weekend to find a solution for CS. There was a forced merger between UBS and CS by Sunday afternoon. Again , a lightning fast reaction by the authorities to stave off a financial crisis.

Both the US and Swiss authorities acted swiftly in addressing the banking issues at SIVB and Credit Suisse, averting a larger crisis. While there may be other unknown risks lurking, it is important to note that only unknown and uncertain events tend to rattle markets, as known risks are already discounted. It is not the expectation of high interest rates that brought the stress as this risk was widely known.

NOW LETS MOVE ONTO OUR FIRST QUARTER RESULTS:

Key points to consider:

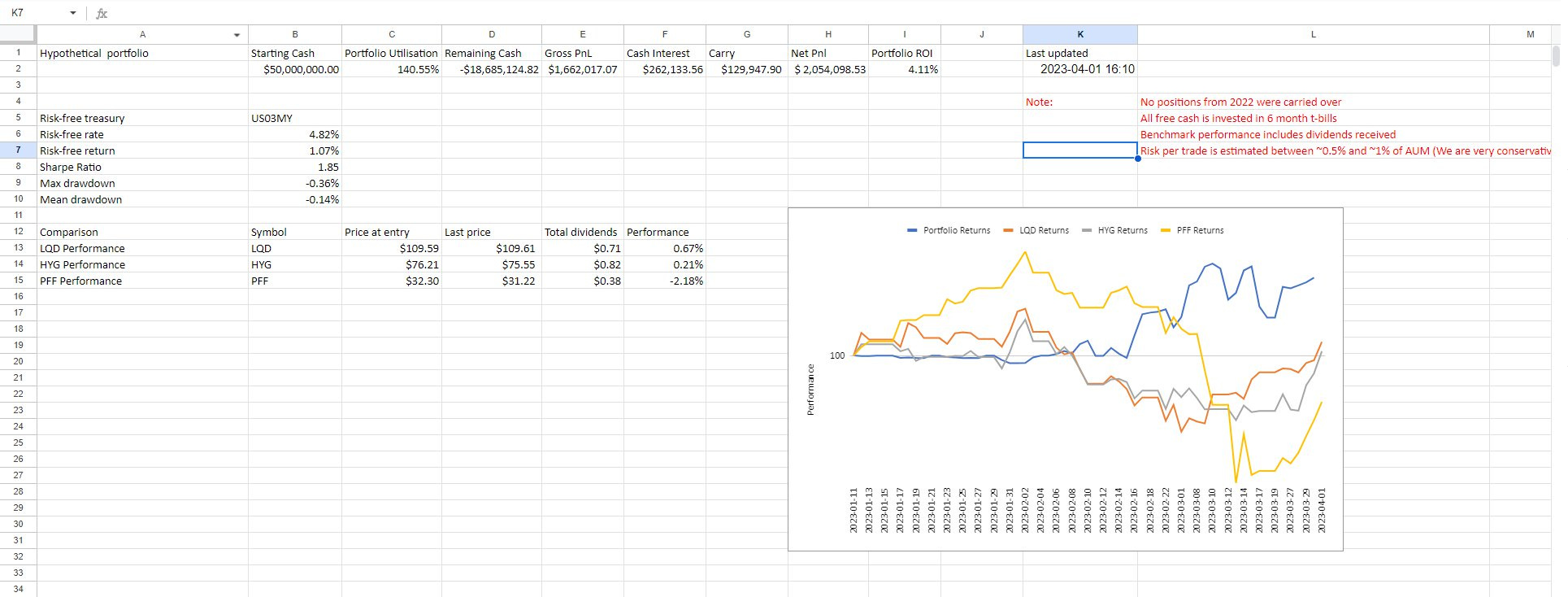

The first position was initiated on January 11, 2023, marking the beginning of benchmark comparisons.

Risk per trade is typically set at ~0.5%, but starting in Q2, it will increase to ~0.75% to ~1% per trade.

The majority of trades involve fixed income (credit) relative value (pair trading), making the returns comparable to major credit ETFs such as LQD, HYG, and PFF.

In response to popular demand, options and futures trades were added to the portfolio in March.

Portfolio Returns Summary:

In Q1, our portfolio outperformed all benchmarks, demonstrating the efficacy of our strategies and timing in surpassing risk-free returns, even amidst the challenging environment of high interest rates. This accomplishment was achieved with a minimal drawdown of 0.36%

NOW ONTO THE IMPORTANT PART OF WHAT TO EXPECT IN THE COMING WEEK AND WHAT TRADES AND PORTFOLIO CHANGES I PLAN TO DO:

Starting with the premise that interest rates may rise again due to unresolved inflation concerns, the US yield curve's support levels are likely to hold firm. My portfolio positioning in the coming weeks will reflect this view, and the key question is why I believe we will hold this cluster of important levels.