Is it really worth putting capital at risk in the current environment?

Weekly equity and credit reviews 4.10 - 4.14.2023

In today’s newsletter you will find:

Coming back from vacation, we find ourselves in a unique situation where both the equity and credit markets are facing uncertainty. With one of the least volatile weeks for SPY, the market appears to be in a wait-and-see mode, offering little clue as to where it's heading next.

Meanwhile, in the credit world, we've been reducing risk in our portfolio. With NFP, CPI, and Fed minutes on the horizon, there's a sense that some volatility might be coming our way. The rationale is that even without a major risk event, taking on more risk at current levels doesn't seem to offer the best risk-reward balance. If we seedata supporting inflation and a robust economy, we could witness the Fed Fund rates moving back towards the 5.75% terminal rate. This scenario would likely lead to a downturn in equity markets, particularly in the Nasdaq.

On the flip side, weaker CPI figures might also negatively impact the market.With rates and the dollar index at key support levels, it's essential to stay patient and avoid getting caught in trouble. Earnings are just getting started, and we have CPI, PPI jobless claims, Fed minutes and retail sales data coming up this week. Both equity and credit markets are at a crossroads, and it might be best to hold off on taking new positions until we have a clearer picture of where they're headed.

EQUITY MARKET THOUGHTS

I am coming back from my vacation and as stated previously on twitter, I was away for a bit more than a week. That is not a worry by default, but preparing for next week feels like starting on a blank canvas. There is no bias and I lack the feeling that I know the pulse of the market as I had missed the little ins and outs that have happened the last few days. I am unsure whether this is a pro or a con or whether it is worth mentioning at all, given that SPY had one, if not the least, volatile week year to date.

The index finished flat with a bunch of noise around weakening fundamental data that was supposed to be nicely followed up by equally disappointing NFP release on Friday. The latter, however, was in line with expectations and the latest ‘oh, snap’ sentiment of fintwit might be just another nothing burger. At least the market says so. That does not mean one has to be bullish, however. We are right at the 4100 level in a very choppy zone, where little respect to the moving averages has been paid recently.

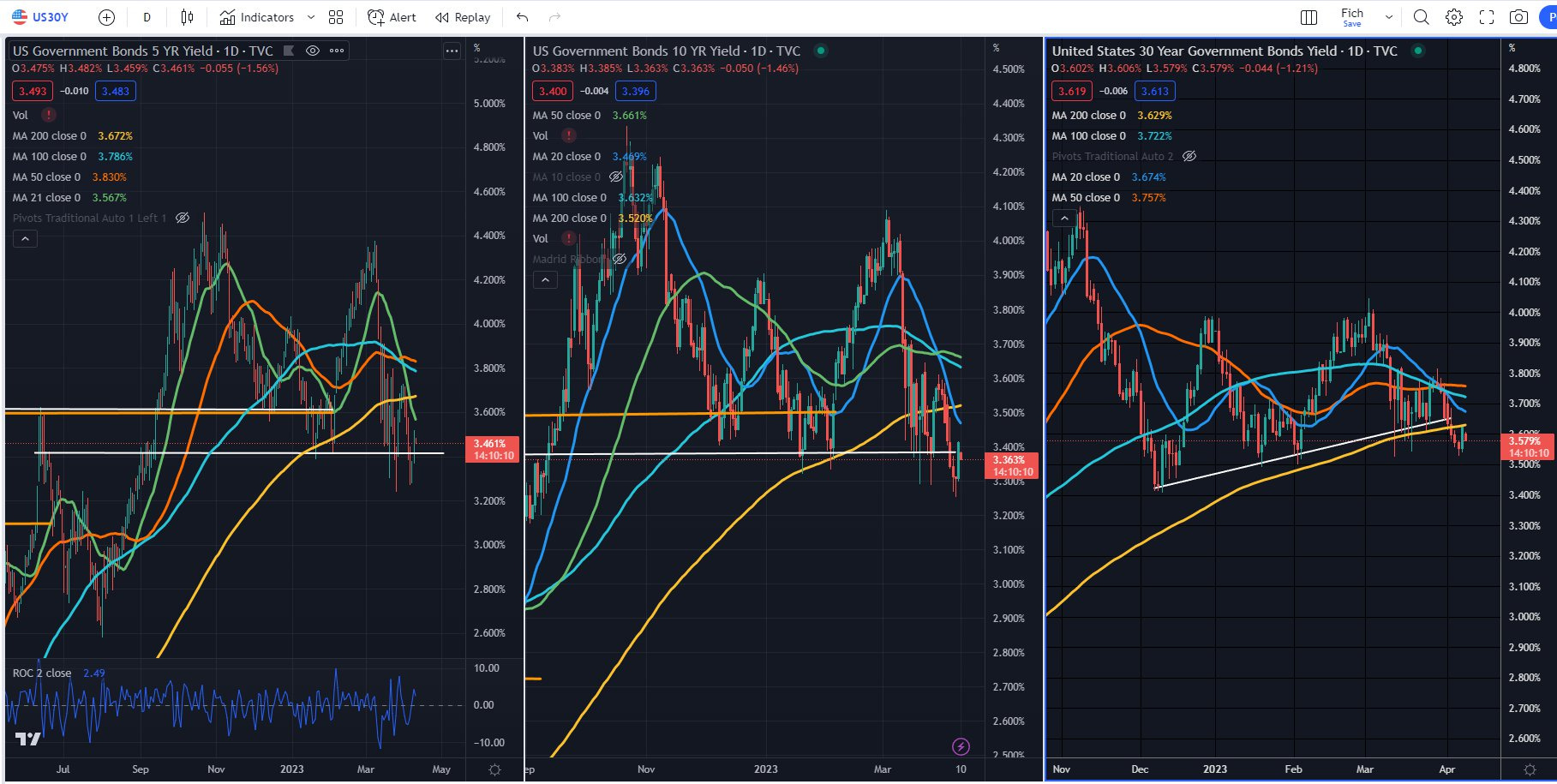

It would be a huge lie to say that the setup favours a good risk-reward to the upside, especially if one looks where the rates currently are. Almost all rates across the curve are at key support levels that appear to be falsely breaking to the downside.

Again, I am unsure of where they are going next as I have no crystal ball. It appears to me that the worries about the economy finally showing weakness might be more right than wrong which should give rates some pressure. Nevertheless, technicals are to be respected.

The dollar has also been in the centre of a heated discussion around its demise as a global currency but not to the point of me deciding I have had enough of it and putting a contrarian trade even though I believe using this as an argument for the recent DXY selling is ridiculous. Facts are, however, that besides a very mediocre bounce to 105, the dollar index has been pounded like few other assets during the last 4 month.

I would lie if I say that I am tempted to take a trade here. CPI is coming on Wednesday, earnings are just getting started with a blackout window for buybacks, jobless claims and retail sales await on Thursday and Friday, respectively. All the while SPX is in the middle of nowhere but trades rather rich on multiples with DXY and rates at support levels. Classic setup for putting anyone not patient enough in trouble.

CREDIT MARKET THOUGHTS

Last week I worked only on cutting down the risk in the portfolio as I was reluctant to take any risk even in the existing fixed income portfolio. It was not only the NFP risk on Friday,

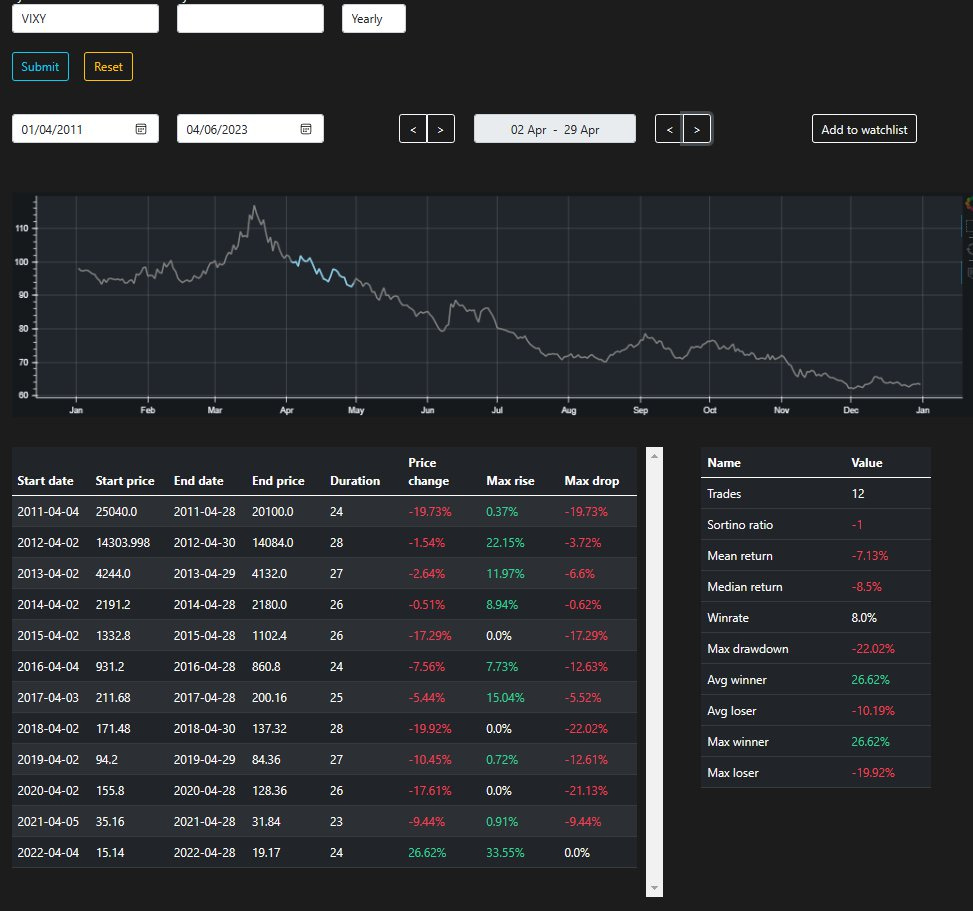

but CPI and FED minutes are upon us on Wednesday. Not only that, but I have a feeling we will see upcoming volatility in either one of these events and even decided to protect the remaining exposure in our portfolio by buying VIXY 0.00%↑ on Thursday, just prior to the close.

My logic mostly lies on the assumption that even if there is no risk event, I don’t see the reason to take the risk at current levels as the risk to reward is simply not skewed in my favor. If we get data supportive of inflation and a strong economy, we will immediately see the Fed Fund rates moving back towards the 5.75% terminal rate which we had in February. This should bring the equity markets down as the primary reason to have a rally from the lows is the wipe out of projected hikes and the assumption that there will be three cuts by Jan’24. This was very extreme by the market and the slightest hint of inflation returning to the market will immediately bring us by on the path to 5.75%. Maybe we don’t get there but the path will be in that direction. This should immediately lead to repricing in the equity markets, most notably in Nasdaq ($QQQ). As the recession narrative is already in the public domain, I assume that weaker CPI will impact the market negatively. And in case I got this all wrong I won’t regret it as I don’t feel like I have the odds and the risk to reward in my favor. Maybe at 3800 SPX, maybe if credit spreads were wider.

Let me show you the most important charts in my opinion:

The US Curve. We briefly broke below the support levels and now the 10y and 30y are testing them from below. It is a bit too early to tell if we had broken the support levels, but a single negative news hitting the news wires will certainly do the job. But why do I see this support level as important? In my mind the bond markets are pricing in a recession and a deteriorating economy. Many traders also use the long end as a hedge to a deteriorating economy. The further yields drop, the worse the situation is. This immediately translates into widening credit spreads. If you are a long only credit portfolio manager, it would be much more profitable to just get off any benchmark hedges that you may have, as the widening process will hurt you significantly more due to the fact that treasuries will run further than corporate bonds and, in many cases, the corporate bonds may suffer by price depreciation if they hit rough few quarters along the way.

Personally, I would hedge with ETFs or Futures of the IG index or HYG index, namely LQD and HYG. As their constituents are only corporate bonds, they will better serve as hedges.

THE Regional Bank and related companies CDSs:

Lately, the European bank CDSs had become popular again after what happened to Credit Suisse. On the following week everyone started posting CDSs of DB and the other EU banks, however I decided to do the same for the most affected regional banks in the US and any of the most affected symbols from the big run on banks in the beginning of March. I have cherry picked the ones that are most problematic and are still hovering close to the highs. If the CDSs of these tickers keep grinding higher the likely of the sell offs in these symbols grows significantly, which may bring significant volatility in the markets.

LNC 5YR Senior CDS

VNO 5YR Senior CDS:

Some of the rest I found were not as worrying but none the less should be tracked.

MET 5YR Senior CDS

Unfortunately not many symbols have tradable CDSs, especially on the regional banks. I have found the following CDS that are worth your attention so far - LNC and VNO seem like the worst of the pack with LNC most notable making new highs last week. This is on my watchlist as LNC has 2 preferred stocks that are relatively liquid and can present a good short opportunity. No position yet but it is on my watchlist.

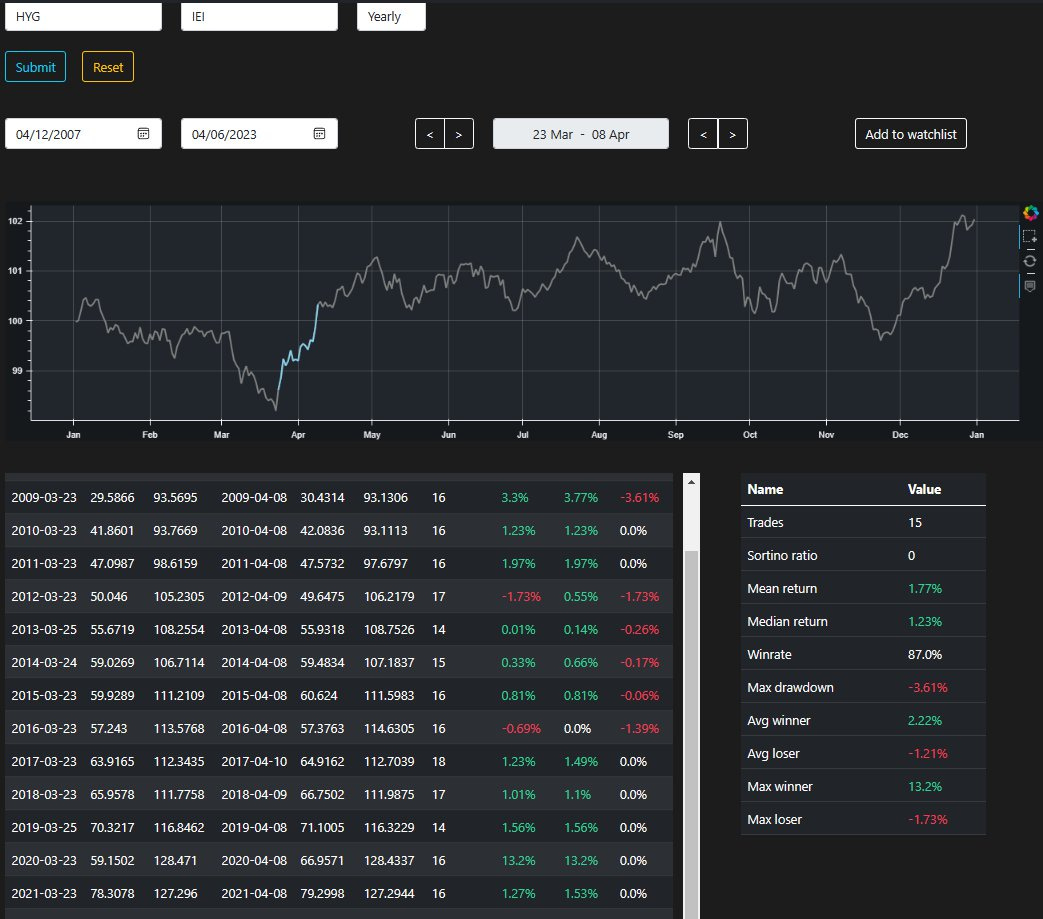

HYGH and VIXY seasonality.

If you remember, in the previous issues and Twitter posts, I had dug up two very strong seasonal tendencies, both pointing to lower volatility.

HYGH or HYG vs IEF (a trade expressing tightening credit spreads in the high yield cash market) - April seems to be a month for tightening credit spreads, especially in the high yield space. We all know that high yield is not benchmarked to treasuries but still taking this information helps us figure out that high yield cash bonds are outperforming US government bonds. That is enough to tell you that April is a month in which traders are seeking yield and capital appreciation. As to why this is I will leave it to you as this discussion is open to many variables which are difficult to quantify but one that has merit in my opinion is the receipt of yearly taxes that are re-directed to 401k plans.

VIXY - This chart further emphasizes the potential lack of volatility, and it is in direct contraction to my long trade in VIXY. But as you can see from the Max Rise column (shows you that VIXY also goes up in April, it is not only downhill) there is the possibility for an up move. And given the risk events I am seeing, I wanted to be hedged. Should there be no volatility past CPI day and Fed Minutes, I will remove the hedge, likely at a loss.

Both of these seasonality patterns pointed me in the direction of taking risk in the credit spreads tightening department. Now that we are past the 10th of April and past the Christian Easter holidays, I am not so certain anymore about the strong seasonality. Most notably in the high yield credit spreads tightening trade. There is evidence that it may continue but I won’t take the chances.