Let us not pretend anyone knows where the market is headed

Weekly Credit and Equity reviews - May 1st-5th

Another week of the market ending nowhere despite the price swings. These types of price action really gets everyone off guard. One day the bears are rejoicing only to see their fortunes fully wiped out on the following day. This is the toughest part of the life of the swing trader. Waiting for the market to set up in a direction and actually follow that direction.

What has made an impression on me is the disregard of the market regarding the FRC situation. This time I would say rightly so as the FRC risk had been long in the market and participants are fully aware of the possibility of them going under or even better, being bought by a competitor. So I would say this is a good for the overall market’s health. We are finally past the story and can now look for another catalyst that may bring the market up or down.

If I have to look for cues I would certainly have a look at the volatility indicators. The VIX , VVIX , MOVE index and HY CDX index. The VIX making new lows while VVIX dropping like a stone, MOVE index registering another flat week with the very likely continuation to the downside. All I can see is further volatility compression. And volatility compression is supportive of a drift higher in the equity and credit markets. Not that there aren’t reasons for the market to move down but given their known nature to all market participants, I would argue that it will have to be a new market catalyst that brings the market down, it won’t be anything than is already known like regional banks, the potential for rate hikes or anything else.

US Sep’23 OIS is at 5% about 2 potential hikes below the Feb’23 top. It remains to be seen if we reach the highs again and most importantly whether this will have an impact on the equity markets. In Feb’23 the response to the 5.75% projected terminal rate was very muted.

EUR Oct’23 OIS , about two hikes below the Feb’23 highs.

GBP OIS Nov’23 back at the pre-regional bank crisis.

Australia is also about 2 hikes away from its Feb’23 highs.

Rate hike expectations are slowly but surely moving back to their Feb’23 highs. What remains the important part is whether reaching the respective highs will have a material or marginal effect on the indices.

Basically nothing has changed in the span of this week and very likely nothing of significance will come to light until Wednesday when we have a FED meeting. The meeting may bring temporary volatility but generally I don’t foresee anything significant coming out of it. Additionally, Monday is a bank holiday across Europe.

We are now in the wait and see mode and will look for more clues from the FED’s decision and subsequent presser. As I am still of the opinion that the upside seems limited here but at the same time the downside is exhausting to play. I am still positioned 100% in pair trades (relative value). At least that way I don’t have to pretend like I know where the market will head next. I simply wait for the mispricing to be arbitraged away.

One chart that you may find interesting is VLY. (Valley National Bancorp)

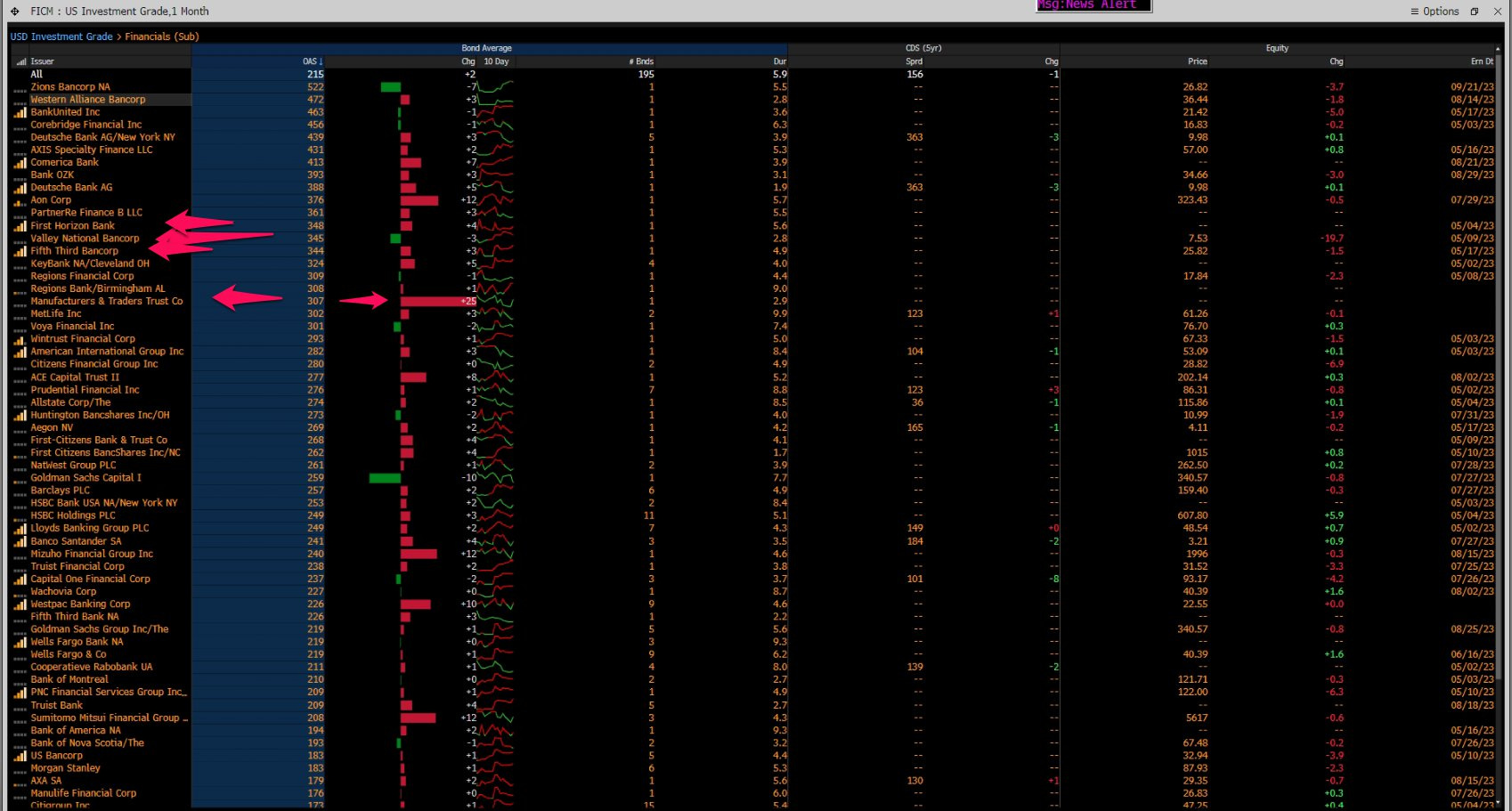

The stock was heavily offered yesterday. The market is hinting that they may be the next victim. I would add KEY, FHN, MTB. RF, FITB and HBAN to that watchlist as their preferred stocks seem to show weakness, likely derived from the another disappointing development in the preferreds in FRC. People start thinking whether it is worth holding preferred stocks in general after what happened to Credit Suisse and First Republic. This question is especially important for the preferred stock holders of regional banks. I know I wouldn’t be an investor in such a product, given the risks. HBAN in particular has several preferred stocks that I think are trading rich relative to the risks.

Here is a screenshot of where the widest moves happened yesterday in the Financials (Sub) IG. Who knows, this may give you a few ideas.

In the equities world:

General overview: The past week was a bit emotional. News regarding the FRC drama drove some volatility in the market. What I had been saying for several weeks already was that a move above 4200 on the SPX seemed like a sure thing given no new NEWS or exogenous events. And when the market went down due to continuing stress on FRC I was getting FOMO. When waiting for the downside for too long you do not wanna miss it.

However, this confirmation of the stress was nothing new to me and the market, which left me a bit perplexed how SPX decided to do the most obvious thing - back off the resistance where it was consolidating. I am happy to say that I was not sucked in on the short side and subsequently squeezed. Actually, this is exactly what I had envisioned the weeks before. Can’t say it was easy to stand still through this but here we are, just about to kiss 4200 like nothing happened.

I have got to a give it to the market - every dip has been bought and every jump in volatility has been sold with boldness.

This has been facilitated by the numbness of bonds and the dollar. Rates for another consecutive week keep consolidating. I have to say that Friday was market by a relatively big down day in rates just when equities were exploding higher.

I know that the squeeze is of a technical/structural nature and one must not read too much in it, but it is weird to see rates down in such a risk-on environment. Where does the bullishness comes from if it is not attached with higher growth/inflation?

The SOFR3 futures are equally stubborn to make a significant move.

A thing that I am writing to our private subscribers about it DXY. Stanely Druckenmiller gave a speech recently about his one big conviction trade - short the dollar. But the dollar seems to be finding solid support here going into FOMC this week. Can there be something for a surprise, surprise? I do not know, but does not seem impossible for sure.

The USDJPY pair has already made a move up and USDAUD (&USDNZD) have done so too. Something tells me that is as interesting as it gets these days - where is the DXY headed next.

CURRENT PORTFOLIO:

In the current portfolio section we will occasionally shed light to our trade ideas by unlocking older paid posts. This week I will unlock a portfolio update we did for our paid subscribers on the 30th of March.

INTRA WEEK PORTFOLIO UPDATES AND A TRADE WALK THROUGH

It is time for the intra-week portfolio update. It is a busy week for us with several trades under our belt already. I am a believer of the quarter end window dressing in particular assets. Most time…

POTENTIAL TRADES:

For this week’s list of potential trades and portfolio updates you can consider becoming a paid subscriber.

CONCLUSION:

Yet another week in which we need time to figure out which way the market will go. It is of utmost importance to not push yourself in either direction and obviously become very selective in regards to what trades you do. My personal preference is to read a lot of research or test hypothesis that I have regarding specific trading patterns. Additionally I try to talk to other professional traders and get their point of view and what trades they are currently looking at. This gives me perspective. If others are struggling it gives me perspective to also take it easy, while if they are performing I get the message that the issue is with me, rather than the market.

"But the dollar seems to be finding solid support here going into FOMC this week. Can there be something for a surprise, surprise?" Yes, there are a couple of things the Fed could do from here on that would be dollar bearish. A) They can omit to raise rates tomorrow given that it is not clear where the whack-a-mole banking turmoil is headed, and what else could be lurking in the tails of risk. They may opt to simply hold rates but threaten to raise rates. The problem is that this could be grossly misinterpreted by the market leading to a rally though B) They could raise rates, and signal a pause i.e. That any further hikes will depend on if the data becomes significantly worse. C) They could fail to do A and B, but if there are some dissenters it will come off as dollar bearish. To me it seems as if the Fed are in a bit of a corner. Will be really interesting to see what he says tomorrow. If they pause it will be epic given that the market is about 94% sure they will hike XD