Weekly Credit Review - 19.09 -23.09

The CPI print on Tuesday really moved things around. The fun bulls had was quickly spoiled by a storm of selling. 4% drop in equity indices in a single day is not something we see every day. I have to admit, I was leaning bullish before the CPI print and for the first 2 days after the print I didn’t see many signs of credit deteriorating but on Thursday and Friday I began seeing cracks. Let me start with what made me lean bullish even after the CPI:

The Fed Funds futures curve was pricing ONLY an additional .25bps to the curve. I took that as a sign that the market is not expecting as aggressive move as Twitter was expecting. I believe Twitter to be a great source of sentiment BUT I always cross check that sentiment with what the charts and price action are telling me.

SPX was still above the important 3900 level. This evidence was giving weight to my argument that we are above important levels even when considering an important CPI print to be significantly worse than expected for the equity markets.

Investment Grade CDS and High Yield CDS indices did not make a monthly high despite the large move, especially given the severity of the news. I would have expected a huge move above the August highs of 550 and a retest of the 600 level in CDX HY. 1

The combination of these three factors made me hesitant to flip to short as the major levels I was watching were not breached despite the large intraday moves. However, as we neared the end of the week things began changing dramatically for the worse.

FDX warned of lowered earnings and withdrew its yearly guidance. We had been discussing this theme on our trading floor during our morning meetings and mutually agreed that the upcoming earnings season will be the Grim Reaper for stocks. We expect FDX’s warnings to be preview of what is about to come.

CDX HY index crossed the Aug’22 highs of 540-550 during the day on Friday which I took as a sign of fear building in the credit markets.

FDX’s unexpected news brought SPX down below the 3900 level

FED Fund Futures now pricing 4.5% in Feb’23 and Mar’23, that is additional .50bps priced in only 2 days after the CPI report.

These changing factors affected my judgement and I am now leaning more and more bearish. This is in complete contrast of what I was thinking last week and the way I was positioned. I will explain in details how my current spread positions were adjusted to account for my change in perceptions.

One important thing to note, you may ask why do I follow SPX levels when trading credit. The answer is very simple. I view credit spreads as a proxy of SPX’s implied volatility or basically as the VIX rises, credit spreads rise too. So if I want to trade widening credit spreads I would be watching for the important SPX levels and CDS levels in combination, instead of the 2Y yield or 30Y yield.

FIXED INCOME ETFS:

HYG - There is still no re-test of the $73 lows from Jun’22. We are close but not there yet. This level will be very important and can be traded off against. Depending on price action one can use it as a potential launching pad for a long position, I would go long ONLY in case sentiment improves. As I see this as a key level I want to be as flexible as possible and would even consider shorting if SPX decides to go for the June’22 lows around 3650. In all cases options will be required as vanilla trading (shorting the underlying without limiting your loss) of the ETF is not advisable due to the possibility for larger than anticipated gaps.

PFF - Traders are putting a lot of weight on the $32.60 level. Using the HYG analog, one could use this level as a launching pad IF sentiment improves or short the ETF from this level. The difference with HYG is that there is the $32 level below which can hold temporarily while in the HYG analog there is no level below to hold the ETF.

CURRENT TRADES:

MET-F long vs MET 3.85% short2. I had been trading this pair with a 1:1 notional exposure but given the change in my perception of the future I decided to increase the short exposure in this position twice. I am now holding a 1:2 notional exposure in this position. The reason I added to the MET 3.85% position instead of reducing the long exposure is due to the significantly better liquidity in MET 3.85%. The OTC perpetual has better liquidity than the exchange traded preferred stock.

PGX long vs WFC 5.875 short. I had again skewed the exposure to the short side and sold 1/2 of the long position in PGX leaving me with a 1:2 exposure. In this case PGX has the better liquidity than the OTC perpetual hence the choice to reduce exposure in that product.

Short REM via Oct’22 27-24 put spread for $0.75

I am taking advantage of the flexibility in pairs trading and playing along with the size depending on my views. Usually I don’t like changing the composition of pairs trades but in this case my views had dramatically changed. Should anything happen to change my perception again (God knows I would dread that) I can easily reduce the extra exposure in MET 3.85% and add back what I sold in PGX. Keep in mind that there will be additional slippage, additional commissions expenses and very likely worse prices involved if I had to do that. These are the primary reasons I don’t like making changing the composition of my pair trades but at volatile times this is necessary.

POTENTIAL TRADES:

For the QIB’s (Qualified Institutional Buyers a.k.a >+100m in AUM) out there I am thinking ARI 4.625 29s at between 80 and 80.50 is an excellent SHORT opportunity given my view of upcoming deterioration of the Real Estate market. Carry is low at 4.625%, borrow is also cheap in the range of 1%-2% and your worse case scenario stop is just above 85. I don’t think we go there. My main thesis is that the longer rates stay high, the more mortgage demand will drop until there is an equilibrium in the price at which buyers and sellers are willing to transact. Somehow I am not convinced with current mortgage rates buyers to be happy paying for 2021 prices, even if we are already seeing signs of price cuts. I think it is still too early for buyers to jump in the markets at +6% mortgage rates. I know if I was in the market for a home I wouldn’t be paying current prices. This is one of the very few long-term trades I allow myself to entertain but I feel very confident that house prices will not be at current level in 1 year. They will be lower.

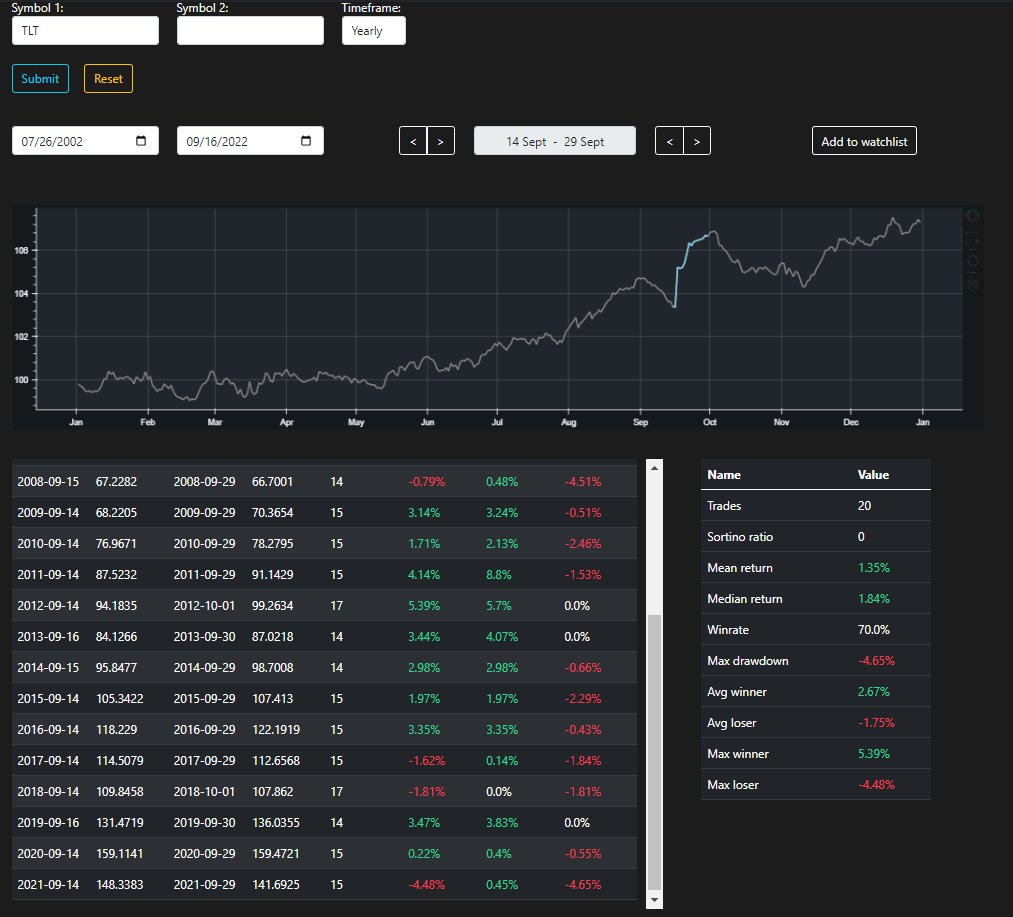

I am thinking that we may have seen a short-term bottom in the 30Y bonds. My main reasons are gravitating around the fact we have made relatively big moves in the short-end of the yield curve to reflect the new FFR expectations, while we are seeing volatility pick up. If you are in the camp volatility may go up, the long-end will likely be bid. We also have the added benefit of a reasonably bullish seasonality period in TLT. The way I like to play this is by going long the 30Y bonds via TLT or ZB_F. My preferred method is buying the underlying (TLT) and buying long puts to limit the loss of my trade, while keeping the flexibility to add short calls to the position at a future time, IF the position turns out to be a winner. I can essentially lower the risk of the position that way. Here is my proposed trade idea:

Long TLT at 107, long Sep’30 $107 puts at $1.6

With this structure we benefit from:

Higher delta if the trade works out sooner than expected

Limited loss of $1.6. No matter what happens, you cannot lose more than $1.6

Potential to limit the losses earlier ,if TLT moves higher , by shorting 111 calls for the same cost as our puts. If this happens we have a free trade which can make $4 dollars if it closes at or above 111 for nor risk. If it closes below $111 we make the difference from $107 to $111. If it drops below $107 the position is scratched. (0$ profit/loss)

My view is that we either have a few really strong days of outperformance in the long-end or all things are lost and the 2013 lows at $102ish will be the next target. @iv_technicals, an account that I respect, is also bottom fishing here. Keep in mind, both of us are representing the same idea slightly different, his preferred method is via call spreads, BUT the key takeaway here is that options are involved in both cases in order to limit the risk. LIMITING THE RISK is the underlying motivation for both of us. There is no vanilla buying of the underlying. That is too much risk in my opinion.

RISKS:

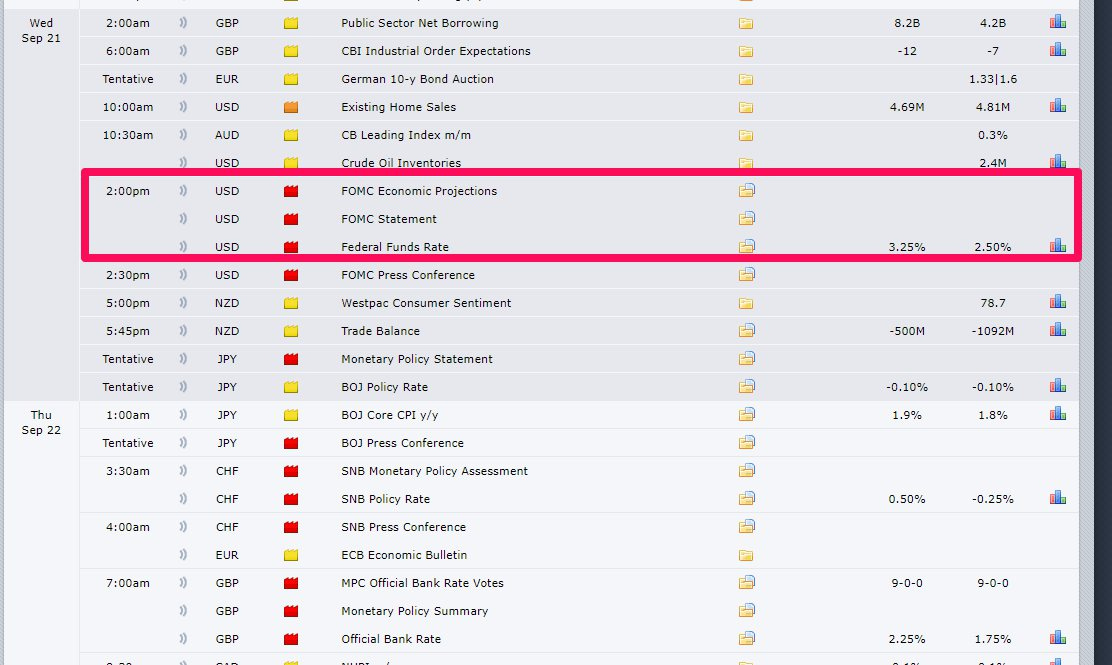

The elephant in the room is the FFR decision next week. Will it be 75bps or 100bps? Markets are leaning 75bps at the moment but you never know, maybe the FED will set an example with a 100bps and show to all market participants how serious it is about fighting inflation? Potentially they may choose to do 100bps in this meeting and offset any potential surprises in the October CPI print in advance? I am convinced they will not be willing to show a strong hand just before the mid-term elections. 100bps now and 50bps in November doesn’t sound like something out of a SCI-FI novel.

Another fear of mine is the upcoming earnings season. It seems reasonable to expect lower forward guidance and lower profit margins by the vast majority of companies, especially the ones affected by increasing labor and material costs. This October will be the time to find out how much demand destruction there has been, IF ANY, and how much inflation has creeped into the profits of companies.

CONCLUSION:

Next week will be filled with Central Bank activity which will likely pave the way forward until the earnings season begins. Seasonally speaking we have entered a bad period, which is already playing out. Credit spreads are still tight, given the current clouds gathering around the equity markets and this may be one of the potential trades one could take going forward. I believe the longer we stay below 3900 in SPX the higher the chances for a retest of the 3650 lows. Friday’s close didn’t provide much hints as to next week’s direction but I am leaning short for the time being as we are still below 3900. I am closely tracking the performance of the CDX HY and Europe’s iTraxx Crossover to gauge the amount of fear building in the credit markets.

Let us end this week’s review with a famous quote by Ed Seykota:

High Yield CDS -